Auto Insights Newsletter | April 2023

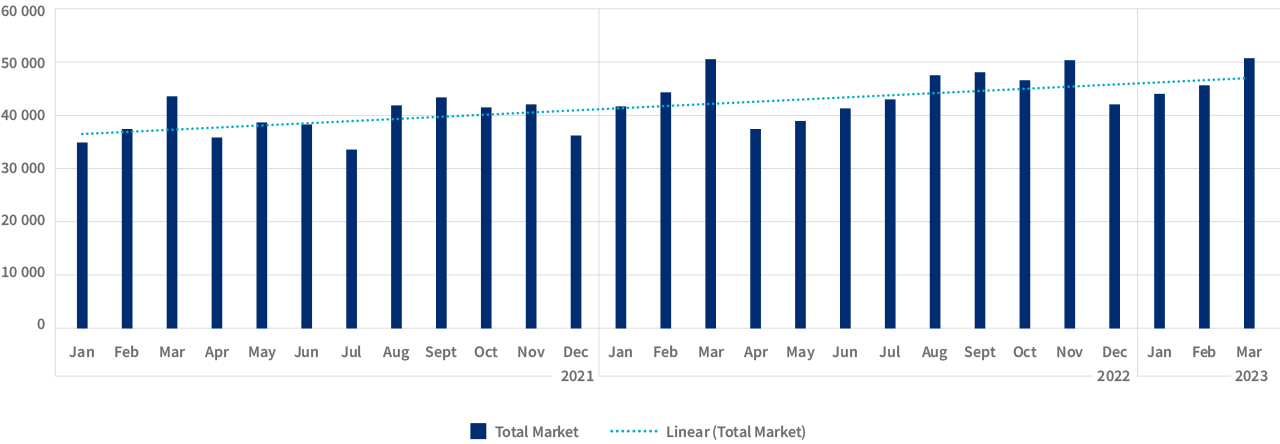

New vehicle sales inch upwards in the first quarter

Q1-2023 1.7% up on comparable period in 2022

New vehicle sales in March 2023 (50 114 units) were 0.7% down on March 2022, according to naamsa, but 11% up on February 2023.

Passenger vehicle sales fell 6.5% year-on-year in March to 31 601 units, but Light Commercial Vehicles sales increased by 11.2%, reaching 15 542 units, when compared with March 2022.

New vehicle sales

Overall sales for the first quarter of 2023 were 1.7% higher than for the comparable period in 2022, and 20% above sales for the same window in 2021. Probably more significantly, new vehicle sales are, so far in 2023, 3.1% ahead of the Q1-2019 volume, a sign that the market has essentially recovered to pre-Covid levels.

Dealer sales represented 83.9% of the 138 571 units sold between January and March, while Passenger vehicle sales were down 1.4% year-on-year for the three months and sales of LCVs grew 9.1% compared to 2022.

The car rental industry accounted for an estimated 12.7% of new Passenger car sales in Q1-2023, slightly behind the 13.9% share recorded in 2022’s window and 14.5% in 2021.

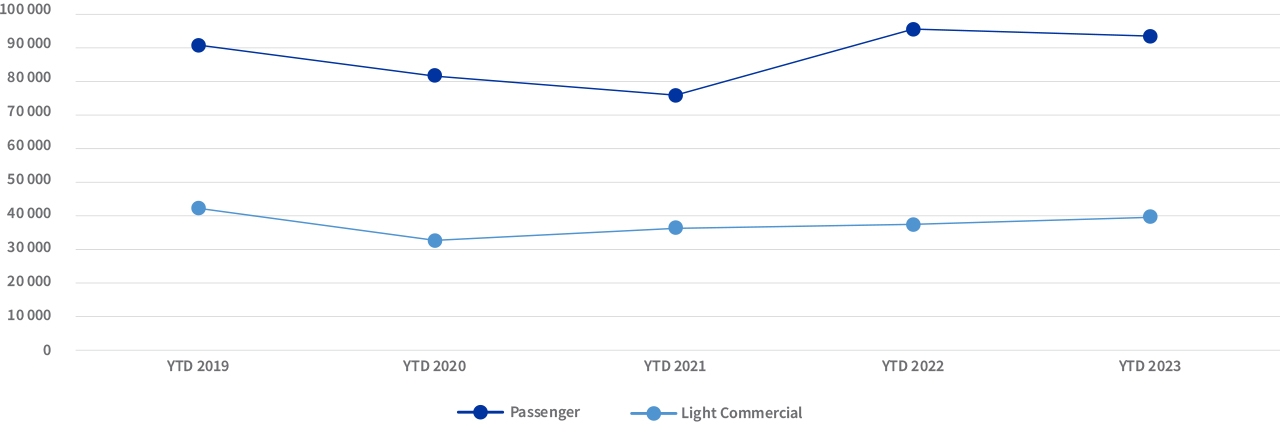

Passenger and Light Commercial new vehicle sales (January – March)

The market outlook suggests some growth in 2023 over 2022 despite continued pressures throughout the macroeconomic environment.

GDP is expected to be at significantly lower levels of growth in 2023 than 2022 and the Rand has continued to weaken against major global currencies. However, headline consumer inflation is projected to drop back within the Reserve Bank’s 3% - 6% target range and there is the possibility the Reserve Bank will end the current cycle of interest rate hikes before the end of the year. There are also indications that the global shortage in semi-conductors is easing and this will allow manufacturers to resume normal production in the foreseeable future.

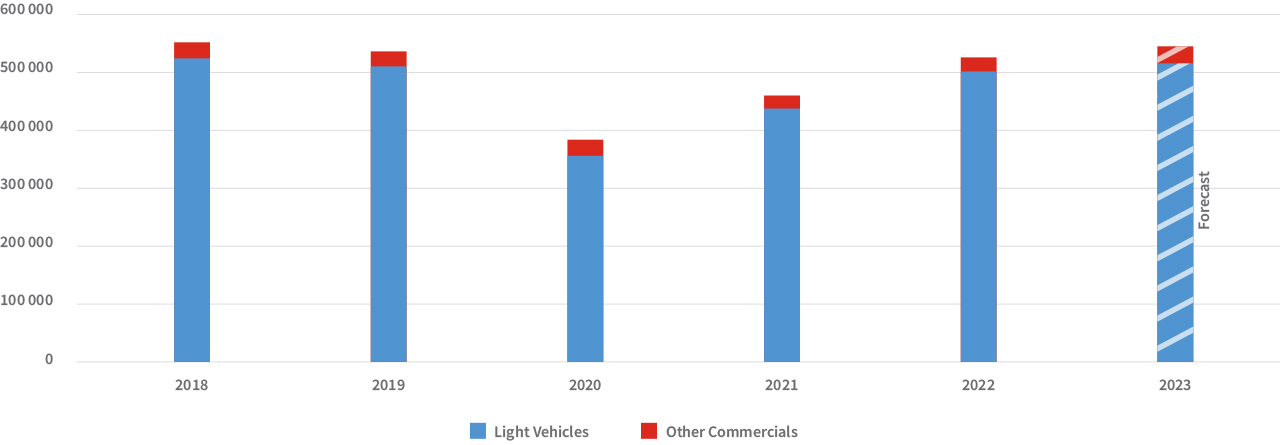

Anticipated new vehicle sales for 2023 currently sit at around 543 000 units, of which 512 000 are Light vehicles (Passenger and Light Commercial). Overall, we expect new vehicle sales to grow by around 3% in 2023, lower than our previous forecast of 5%.

New vehicle sales – 2018 to 2023

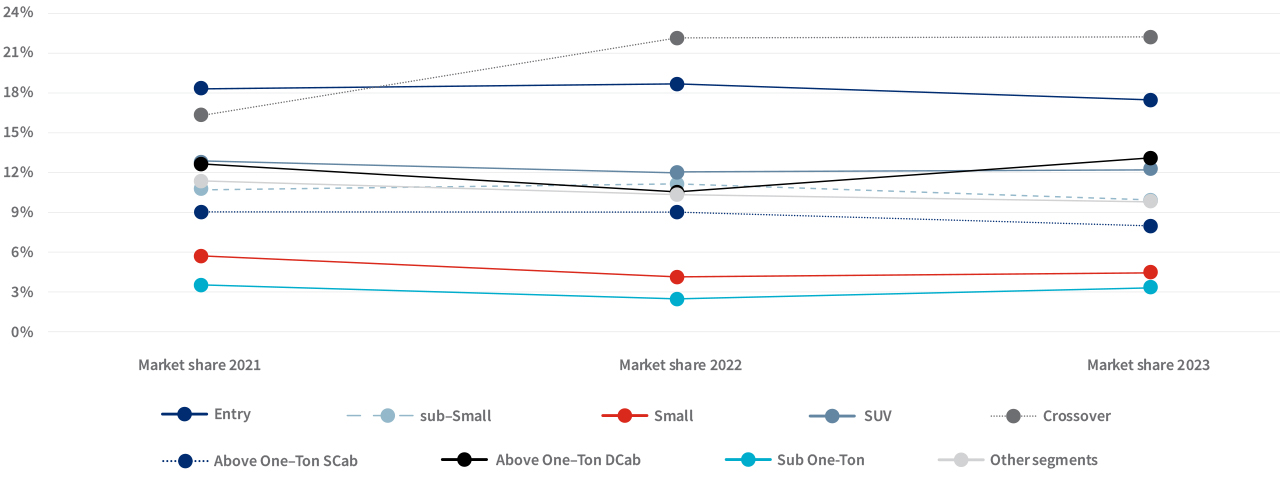

Segment market observations

The Crossover segment (which includes the Haval Jolion, Toyota Corolla Cross and Volkswagen T-Cross) was the largest Light Vehicle (Passenger & LCV markets) segment in South Africa in the first quarter of 2023, with 29 207 new units sold – of which 87.7% were Dealer sales, and 7.1% reported through the Rental channel.

Crossover segment sales in the first quarter picked up 1% from Q1-2022, and make up 22.2% of all Light Vehicle sales so far in 2023 – slightly behind the 22.3% market share for the first three months of 2022.

The Entry segment, which includes the Renault Kwid, Toyota Starlet and VW Polo Vivo, performed second best in terms of volume, with 22 830 units sold during the first three months of 2023. Sales were however down by 5% from the same period in 2022.

Sales for the Sub One-ton segment, which currently consists of the Nissan NP200 and the Suzuki Super Carry, picked up 30% year-on-year in the first quarter from 2022, but which in turn was 16% down on the segment total for the first three months of 2021. This makes the Sub One-Ton segment the best performing Light Vehicle segment in terms of sales growth. Over the first quarter of 2023, the Sub One-Ton segment made up 3.1% of all Light Vehicle sales, up from 2.4% market share in Q1-2022.

The second most improved segment for year-on-year growth in the first quarter was the Above One-Ton DCab segment (which includes the Ford Ranger, Isuzu D-MAX & Toyota Hilux), with sales climbing 27% from a year earlier.

Light Vehicle Segments – share of Light Vehicle market (January – March)

Hybrid and Electric vehicles continue to grow

New Hybrid and Electric Passenger vehicle sales (which includes Traditional Hybrid, Plug-in Hybrid and Battery Electric vehicles) for the first quarter of 2023 numbered 1 664 units, 19% up on 2022, a significant reduction from the 1 440% acceleration in the same period in 2021. The full Passenger Market share for these vehicles was 1.8% for the first three months of 2023.

Hybrid and Electric vehicle share of Passenger sales (January – March)

Traditional Hybrid vehicles continue to contribute the majority of these sales with an 85% share of the sub-segment over the first three months of 2023, with Battery Electric vehicles making up 14% of sales and Plug-in Hybrid vehicles responsible for 2%.

.png)

.png)

.png)

.png)