Auto Insights Newsletter | August 2023

Light Commercial Vehicle sales boost market volumes in July

New vehicle sales in July 2023 (43 575 units) were 1.8% up on July 2022, according to naamsa.

Although Passenger vehicle sales dropped by 9.0% year-on-year in July to 28 040 units, Light Commercial Vehicles (LCV) sales more than compensated, climbing by 32.6% to reach 12 669 units, when compared with July 2022.

July new vehicle sales, however, slipped by 6.9% when compared to June 2023.

New vehicle sales

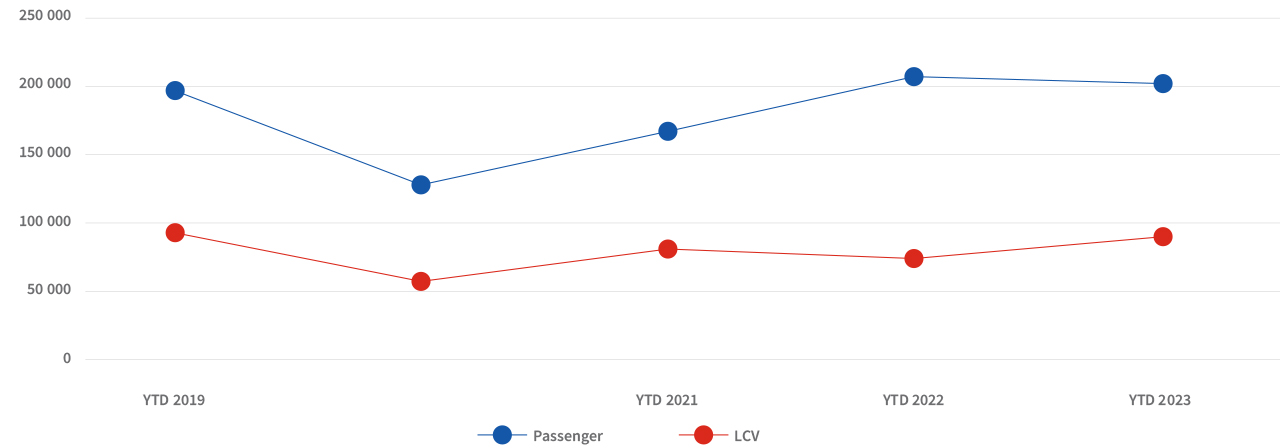

Overall sales for the first seven months of 2023 were 4.5% higher than for 2022, and 18.7% above sales for the same window in 2021.

More significantly, new vehicle sales so far in 2023 are 1.9% ahead of the volume from the same period in 2019, an indication that the market continues to run ahead of pre-Covid levels.

Dealer sales accounted for 84.8% of the 309 567 sales reported by naamsa between January and July. Passenger vehicle sales were down 2.4% year-on-year for the seven months, while LCV sales grew 21.9% compared to 2022.

The car rental industry accounted for an estimated 11.8% of new Passenger car sales in the January-July window, down from 12.9% in 2022 and 12.8% in 2021.

January to July - Passenger & Light Commercial new vehicle sales

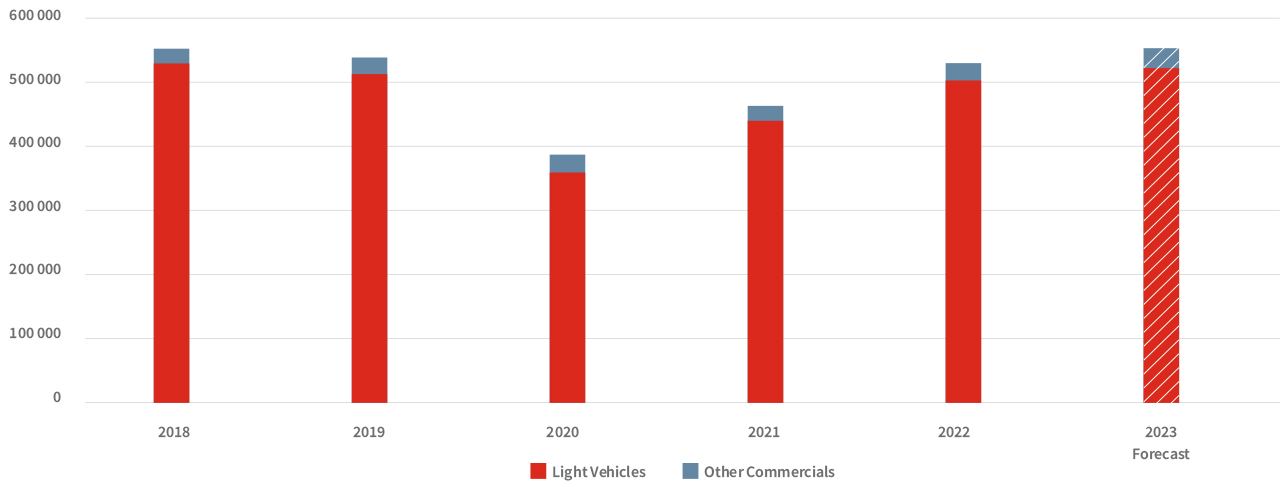

The vehicle sales market is expected to grow this year compared to 2022, despite continued pressures throughout the macroeconomic environment.

GDP growth for this year is expected to be significantly behind 2022, but the Rand appears to be steadying against major global currencies. Headline consumer inflation is projected to drop back within the Reserve Bank’s 3% - 6% target range and there is the possibility of the Reserve Bank ending the current cycle of interest rate hikes before the end of the year. There are also indications that the global shortage of semiconductors is continuing to ease and manufacturers are returning to normal production schedules.

Anticipated new vehicle sales for 2023 currently sit at around 551 000 units, of which Light vehicles (Passenger and Light Commercial) make up 520 000. Overall, new vehicle sales are expected to end 2023 around 4% up, significantly higher than our previous growth forecast of 2%.

New vehicle sales - 2018 to 2023

Segment performance in the first seven months of 2023

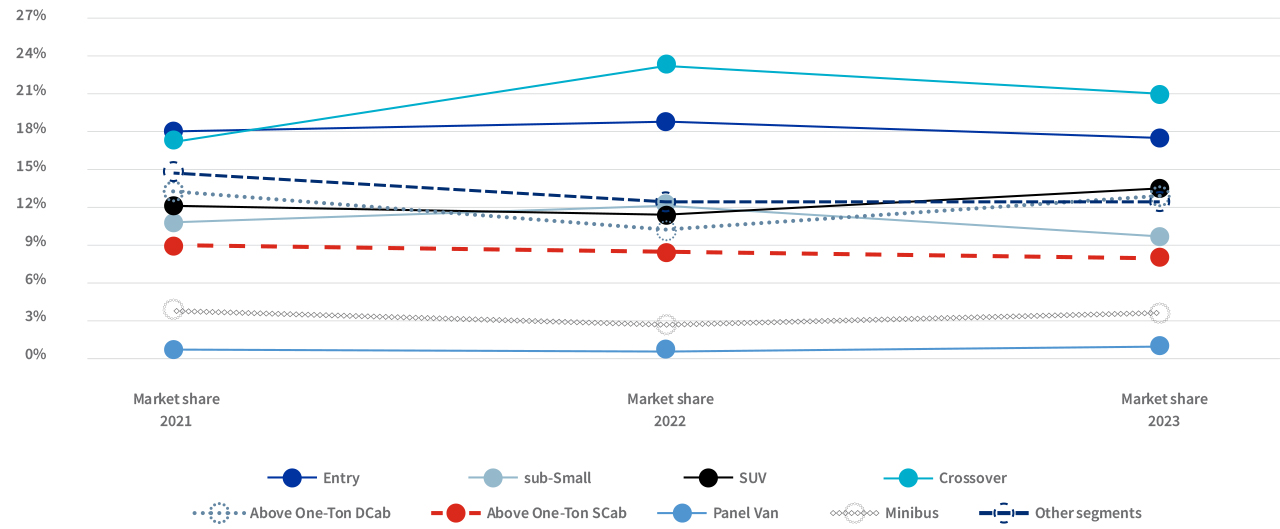

The Crossover segment (which includes the likes of the Haval Jolion, Toyota Corolla Cross and Volkswagen T-Cross) was the largest Light Vehicle (Passenger and LCV markets) segment in South Africa in the first seven months of 2023, with 61 324 new units sold – of which 89.3% were Dealer sales, and 6.2% reported through the Rental channel.

Sales for the Crossover segment dipped 6.4% from the same window in 2022, and make up 21% of all Light Vehicle sales– slightly behind the 23.4% market share for the comparable period in 2022.

The second-best performing segment in terms of volume was the Entry segment (which includes Renault Kwid, Toyota Starlet and VW Polo Vivo) with 51 463 units sold over the first seven months of 2023, 2.4% down from the same window in 2022.

Minibus segment sales, which currently includes Toyota’s Hiace and Quantum, and the Volkswagen Caddy Kombi, picked up 49.4% year-on-year in the January-July period from 2022, which in turn was still 25.2% down on the segment total for the first seven months of 2021.

This makes the Minibus segment the best performing Light Vehicle segment in terms of sales growth, despite not being one of the bigger segments. Over the period in review, the Minibus segment made up 3.7% of all Light Vehicle sales, up from the 2.5% market share over the same period in 2022.

The second most improved segment for year-on-year growth was the Panel Van segment (Hyundai Grand i10 Cargo, Toyota Quantum and Volkswagen Caddy Cargo), with sales climbing 48.6% from a year earlier.

Light Vehicle Segments - share of Light Vehicle market (Jan-Jul)

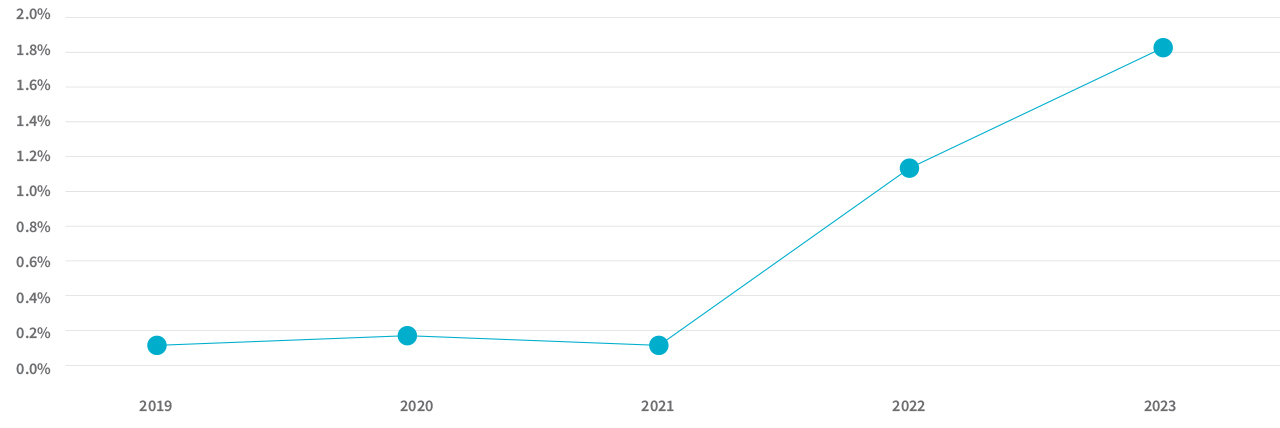

New Hybrid & Electric Passenger vehicle sales (which includes Traditional Hybrid, Plug-in Hybrid and Battery Electric vehicles) for the period in review numbered 3 691 units, 57.5% up on 2022, which in turn had accelerated 1 049% from 2021.

The full Passenger market share for these vehicles was 1.8% for the period.

January to July - Hybrid & Electric vehicle share of passenger sales

Traditional Hybrid vehicle sales continue to make up 81% of the sub-segment over the first seven months of 2023, with Battery Electric vehicles making up 16% of sales and Plug-in Hybrid vehicles responsible for 3.0%.

.png)

.png)

.png)

.png)