Auto Insights Newsletter | June 2023

Competitive pricing drives fastest growing Light Vehicle brands in SA

Some of the fast-growing brands in the South African Light Vehicle (Passenger and Light Commercial) include Chery, Haval, JAC, Mahindra and Suzuki – and they all come at a competitive price notwithstanding different backgrounds and histories.

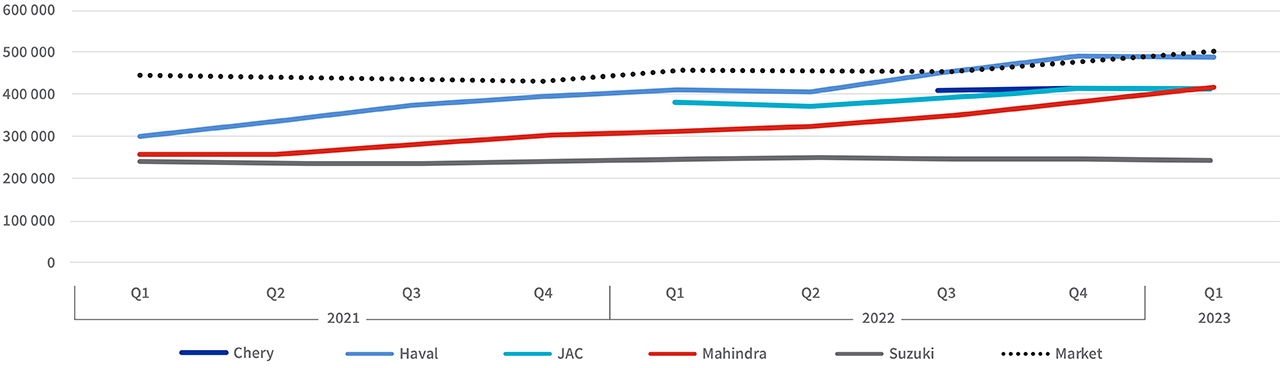

Quarterly Weighted Average Price by brand

The biggest market segments at present in South Africa are the Entry, sub-Small, SUV, Crossover and One-Ton Double-Cab segments, which collectively account for three out of every four new Light Vehicles sold locally.

Of the five marques mentioned above, Japanese brand Suzuki has been around the longest.

At present the average price of a Suzuki (weighted by sales volume) is around half that of the average new Light Vehicle, and around 90% of all new Suzuki vehicles sold fall into one of the five segments mentioned.

The three best-selling Suzuki vehicles in South Africa this year have been the Swift (sub-Small segment), the now-discontinued Vitara Brezza (Crossover) and the S-Presso (Entry). In light of the current push towards new and alternative energy-driven vehicles, the newly launched Grand Vitara (SUV) has a hybrid model in the range.

Mahindra (India) entered the domestic market in 2005 with an offering focused primarily on bakkies and SUVs. Although their range has diversified since then, Mahindra was the fourth best-selling One-Ton bakkie marque in South Africa in 2022.

Over the last year-and-a-half, the three top-selling Mahindras in the local market have been the Scorpio Pik-Up (One-Ton Single-Cab), the Scorpio Pik-Up (One-Ton Double-Cab) and the XUV300 (Crossover). The Weighted Average Price (WAP) of a Mahindra is gradually moving towards the market average, although at present is still 20% below it.

Chery (China) first appeared in South Africa circa 2008, withdrew in 2017 before re-entering the market last year, targeting the Crossover/SUV buyer. Chery offers three model-ranges, the Tiggo 4 Pro (Crossover), the Tiggo 7 Pro (SUV) and the Tiggo 8 Pro (SUV). The Chery WAP is around the R400 000 mark, almost 20% less than the market average.

Haval (China) launched in South Africa around 2019, and has consistently grown its market share. As with Chery, Haval’s range on offer is 100% Crossover/SUV focused. Of the five highlighted brands its WAP is closest to the market average. Haval’s Jolion (Crossover) and the H6 (SUV) both have hybrid options available.

JAC (China) is another newcomer to our shores, first reporting sales to

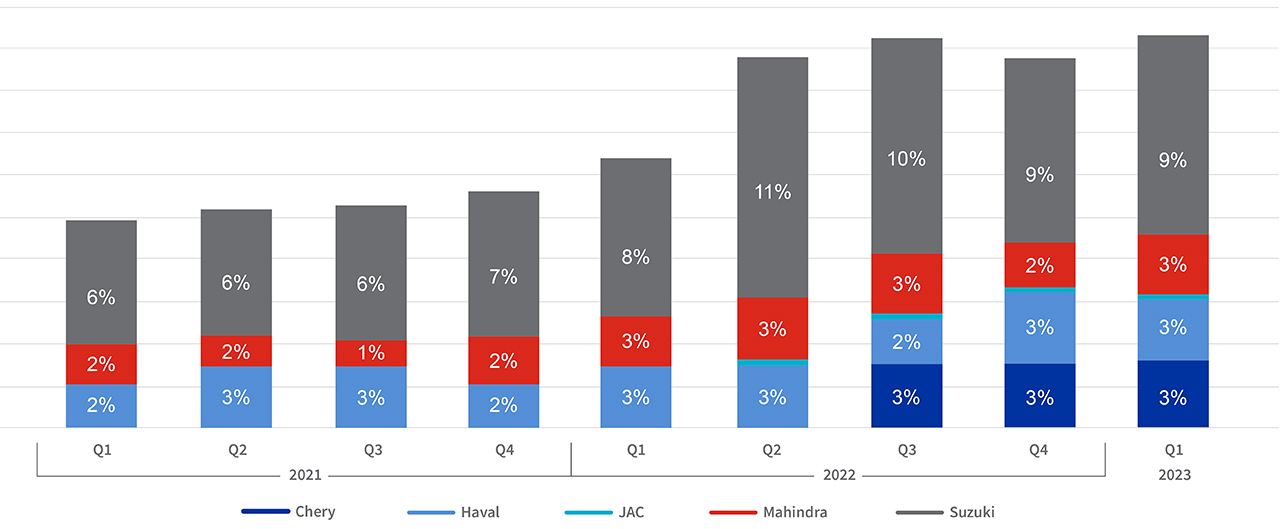

Quarterly Light Vehicle market share

.png)

.png)

.png)

.png)