…as Sedan sales’ share collapses by more than 60%

South African vehicle preferences have changed markedly in the last ten years, with the Crossover/SUV segment more than doubling its market share while the Sedan segment has fallen to a third of what it was in 2012.

But in terms of these and other major bodyshape groupings, is the trend at a national level being mirrored in the major metros around South Africa?

In 2012 the Crossover/SUV segment accounted for 15% market share of the Light Vehicle (LV – Passenger and Light Commercial) market, while the Sedan segment stood at 20%.

This placed these segments third and second respectively in terms of largest market share – bettered only by the Hatch segment (34%). Fast-forward to 2022 and the Crossover/SUV segment has climbed to the top of the pile with 36% market share to date, while the Sedan segment’s share has dropped to just 6% of the LV market – and fifth spot overall.

This trend is largely mirrored across seven of the largest metros in South Africa, (Cape Town, Ekurhuleni/East Rand, eThekwini/Durban, Johannesburg, Mangaung/Bloemfontein, Nelson Mandela Bay/ Gqeberha and Tshwane/Pretoria.)

With respect to the Crossover/SUV segment, market share ranged between 15% and 18% across all these metros in 2012, and has increased to between 36% and 43% in 2022. This puts the market share of this segment for all seven metros either on par or ahead of the national share – and in Cape Town, Mangaung/Bloemfontein, Nelson Mandela Bay/Gqeberha and Tshwane/Pretoria, more than two out of every five light vehicles sold this year have been Crossover/SUVs.

Crossover/SUV bodyshape

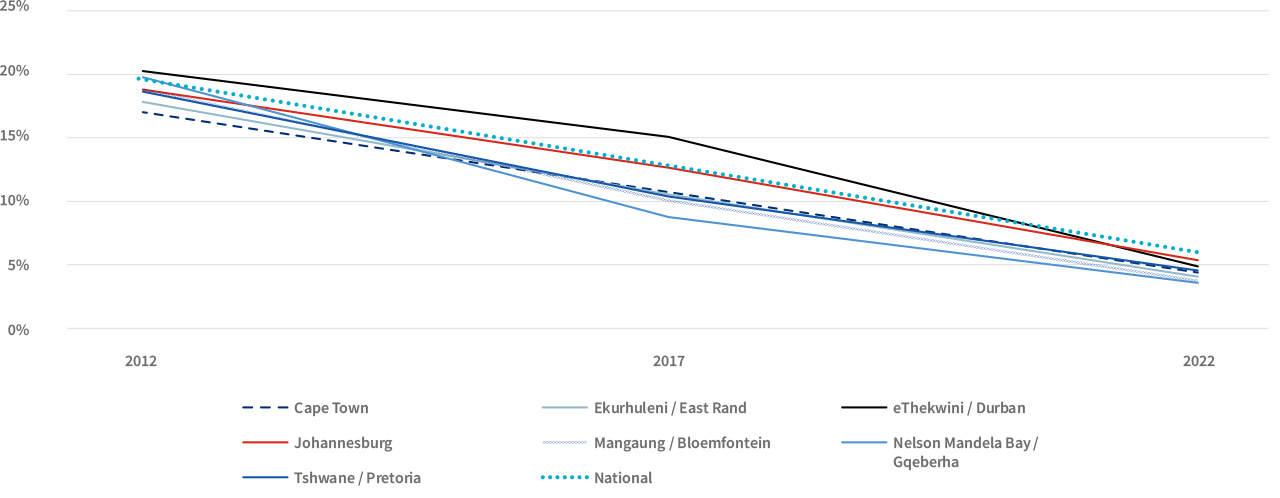

As far as the Sedan segment goes, all seven metros had a market share for this segment of between 17% and 20% in 2012 (on par with or below national), and all have seen the share for this segment drop to between 3% and 5% this year (below national).

Sedan bodyshape

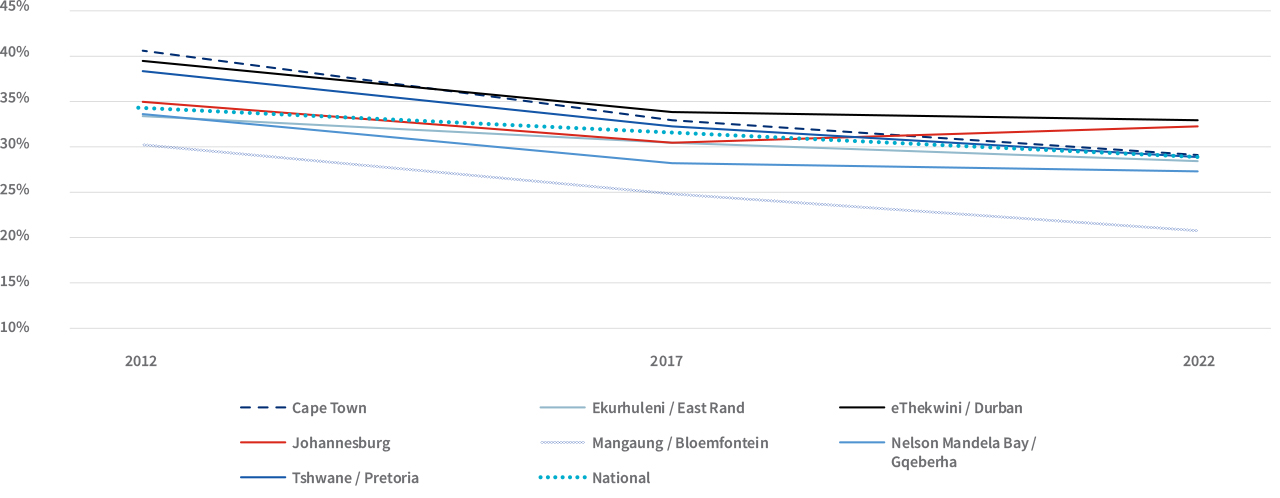

So, how do the other segments stack up? The Hatch segment was the biggest selling segment in 2012 with sales making up 34% of all LV sales.

Hatches have now dropped to second behind Crossovers/SUVs in 2022, with sales making up 28% of the LV market. From a local perspective, Mangaung/Bloemfontein and Cape Town have seen their Hatch market share hardest hit over the last decade, with the former dropping from 30% in 2012 to 20% in 2022, and Cape Town from 40% to 29% over the same period. The metro with the least affected Hatch market is Johannesburg, where the segment has slipped from a 35% market share in 2012 to 32% this year.

Hatch bodyshape

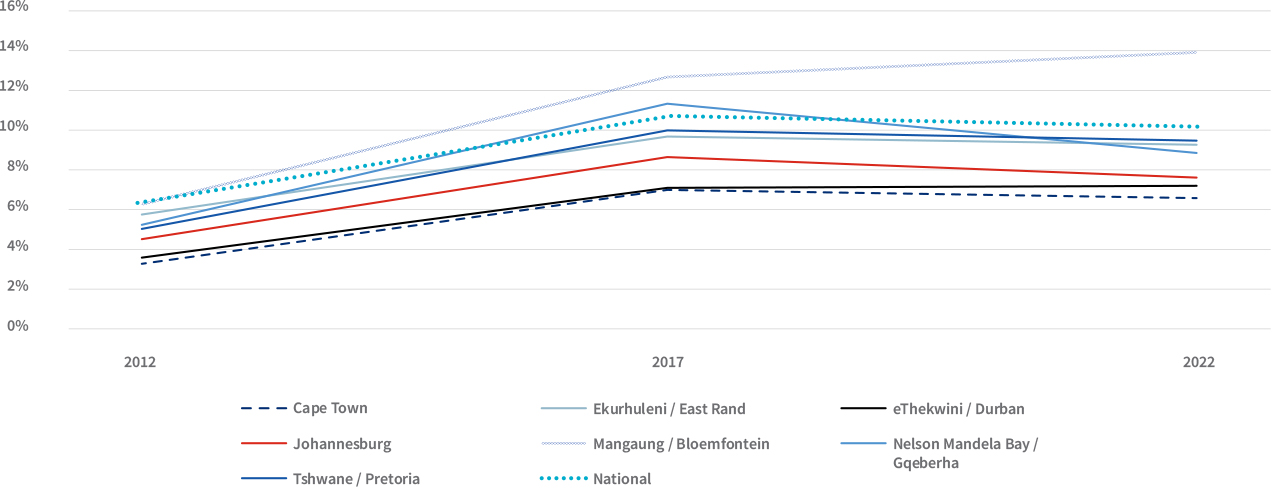

The One-ton Double-cab segment is in an interesting study in the current market, as it has come under pressure with the diminished availability of the Toyota Hilux due to the flood-related plant closure at Toyota’s Prospecton facility in KwaZulu-Natal.

This segment’s market share is marginally down across the country for 2022 against 2021, but when compared with 2012, there is still significant growth.

Nationally, the LV market share for this segment has jumped from 6% in 2012 to 10% in 2022 (13% in 2021). This segment has grown most in the Free State, with the market share in Mangaung/Bloemfontein growing from 6% in 2012 to 14% in 2022 (16% in 2021).

Other metros which have seen market share for this segment double over the decade are Cape Town and eThekwini/Durban. Ekurhuleni/East Rand and Johannesburg have seen the smallest growth in this segment with share of sales for the former making up 6% in 2012, climbing to 9% in 2022 and for Johannesburg these shares are 5% and 8% respectively. With the reopening of the Toyota plant, the market shares for this segment can expect to move closer to their 2021 levels by the end of this year.

One-ton Double-cab bodyshape

.png)

.png)

.png)

.png)