Auto Insights Newsletter | February 2022

New vehicle sales increase despite production challenges

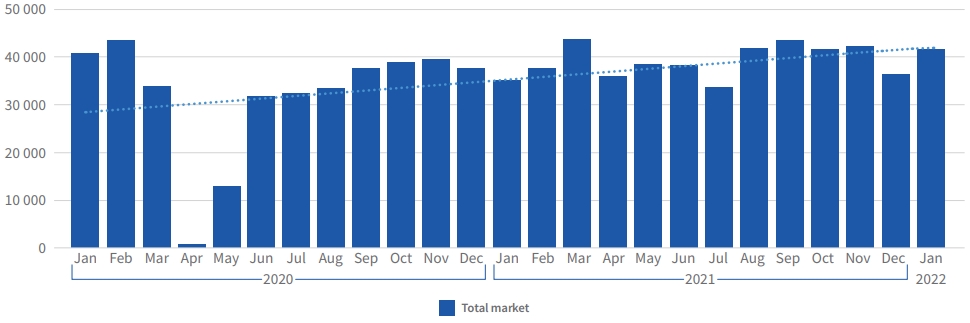

New vehicle sales in January 2022 (41 330 units) were 19.3% ahead of January 2021, according to naamsa.

The January 2022 fi gures were also 15% higher than December 2021 as the market continues to grow slowly despite the world-wide semi-conductor shortage which is hampering production and sales across the globe.

The high-volume brands, particularly those with off erings in the entry level segments, continue to sell relatively strongly but several premium brands look to be struggling as stock shortages begin to take their toll.

Passenger vehicle sales grew by 26.5% year-on-year in January to 30 026 units, and Light Commercial Vehicles (LCV) sales were 3.7% up, reaching 9 624 units, when compared to January 2021.

New vehicle sales

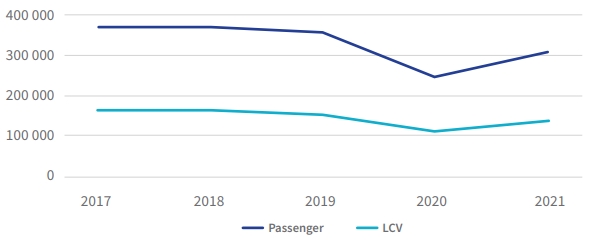

Overall sales for 2021 were 22.2% higher than in 2020, but still 13% down compared to 2019.

naamsa reported sales of 464 493 units in 2021, of which around 85% represented dealer sales. Passenger vehicle sales were up 23.4%, and sales of LCVs increased by 20% compared to 2020. The car rental industry accounted for an estimated 14% of new Passenger car sales in 2021, well ahead of the 9% share in the 2020 window and more comparable with the 18% in 2019.

Annual Passenger and Light Commercial new vehicle sales

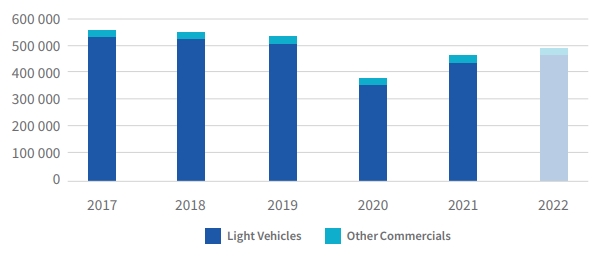

The initial market outlook for 2022 is showing some growth over 2021, despite pressures throughout the macroeconomic environment. GDP is expected to produce lower levels of growth in 2022 than 2021, headline consumer infl ation likely to drift towards the upper reaches of the Reserve Bank’s target range and the Reserve Bank is expected to hike interest rates during the year.

This is all in addition to the semi-conductor shortage and supply issues which are, however, expected to ease towards the end of the year.

This puts projected new vehicle sales for 2022 at around 494 000 units, of which 467 000 are Light vehicles (Passenger and Light Commercial). Overall, growth in new vehicle sales is expected to end 2022 in the region of 6%.

New vehicle sales - 2017 to 2022

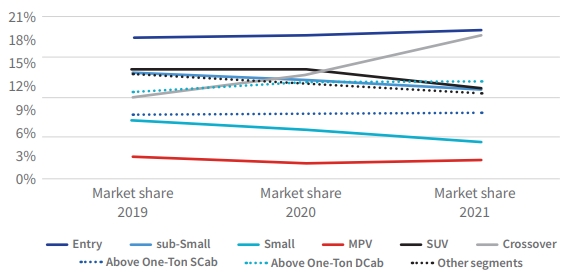

Market observations

The Entry segment (which includes the likes of the Kia Picanto, Toyota Starlet and Volkswagen Polo Vivo) was the largest Light Vehicle (Passenger and LCV markets) segment in 2021, with 84 000 new units sold – of which 79% were Dealer sales and 20% reported through the Rental channel. Sales for the Entry segment picked up 27% from 2020, which in turn was 28% down on 2019.

The second-best performing segment in terms of volume – but best in terms of year-on-year growth at 69% – was the Crossover segment (eg Ford EcoSport, Hyundai Venue and VW T-Cross) with 81 117 units sold over 2021. The last 12 months were this segment’s most successful annual performance in terms of volume sales and market share.

The Dealer channel accounted for 92% of Crossover segment sales and 5% were Rental sales. Over the full-year window, the Crossover segment makes up 19% of all Light Vehicle sales, up from the 13% market share this segment enjoyed a year ago.

The next most improved segment in 2021 was the MPV segment (eg Hyundai H1, Suzuki Ertiga and Toyota Avanza), with a year-on-year jump of 48% over 2020.

Light Vehicle segments - annual share of Light Vehicle market

Solutions that simplify the complex

Our new website makes it easier to navigate and discover a range of Lightstone products and solutions that make it easier for you to do business.

One place to access your subscriptions

We’ve simplified the complex with a single sign on functionality. Simply login and you will have access to all the products that you currently subscribe to. All in one portal.

What’s happening to the old website?

A few links on our new website may redirect you to certain pages on the old website. This is just a temporary solution to ensure legacy users still have access to certain products.

.png)

.png)

.png)

.png)