Property Newsletter | March 2024

Record sales value for Soweto’s residential property market

While declining volumes are evidence of further upside potential

Soweto’s growing residential property market has been in the news recently, and for good reason. Homeowners spent nearly R900m on 2 200 properties in

2023, the highest annual sales value recorded in the iconic township.

Lightstone’s data was used in many media stories which appeared recently (two examples below) that highlighted Soweto’s relatively good performance in

a market under pressure.

Now better known as a tourist hub and home to 1.3 million residents, Soweto played host to many political events which helped shaped post-apartheid

South Africa. Some 3 000 people descended on Kliptown in 1955 to adopt the Freedom Charter, and the Hector Peterson Memorial in Orlando West pays

tribute to the student-led protest which began on 16 June 1976.

And of course Vilakazi Street was once home to Nobel Peace Prize winners, President Nelson Mandela and Bishop Desmond Tutu, and today hosts well

known restaurants and Soweto TV.

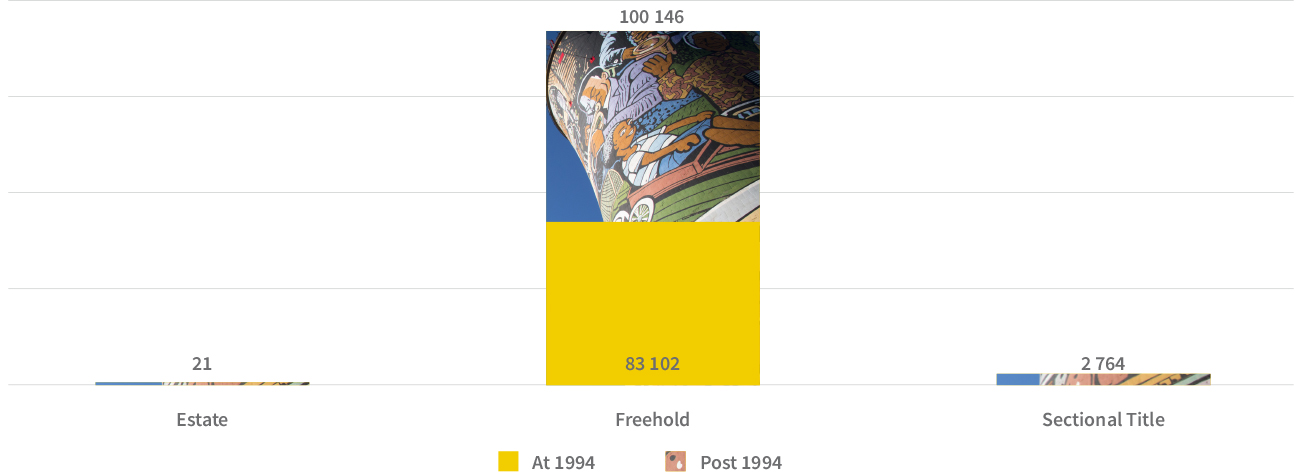

Soweto is now a suburb of the City of Johannesburg Metropolitan Municipality in Gauteng covering more than 200 square kilometres and has 186 000

properties (see graph below), more than double the 83 000 in 1994. More than 99% of the properties are freehold.

Property stock in Soweto

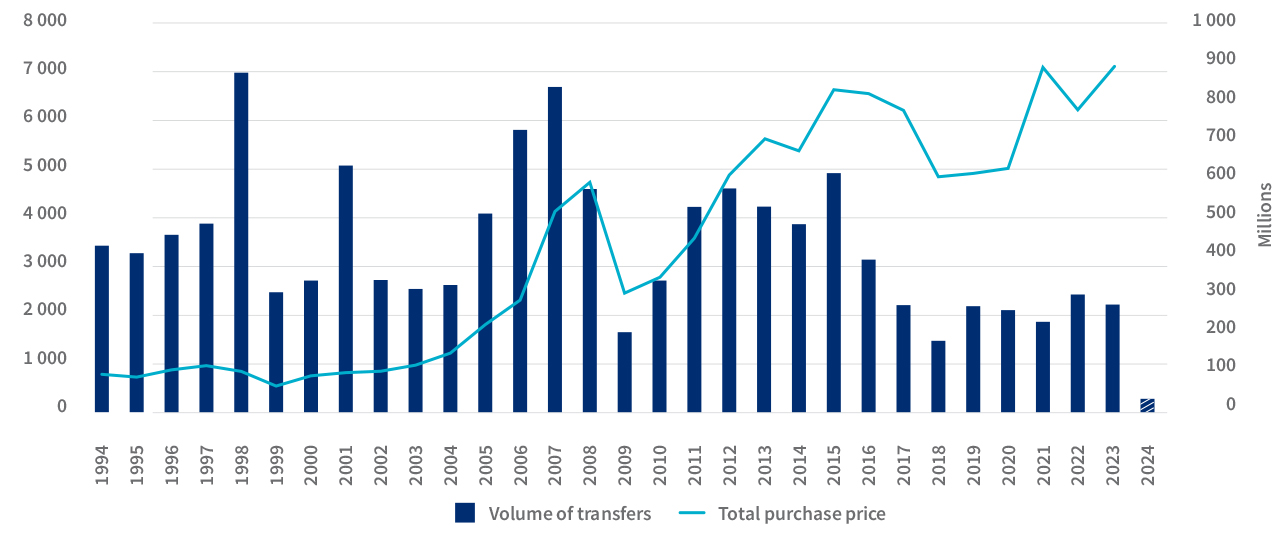

Interestingly, while the value of sales has been rising steadily since 2010 – other than a dip around 2018-2020 – the volume of transfers has dropped and

the years since 2016 have been the quietest since 1994, other than 2009 at the time of the global financial markets crash.

The graph below shows how fewer people are paying more for properties, and while this is good for the market in one way, it highlights the need to

stimulate greater activity at more affordable levels.

Total transfers: 1994 – 2024

The vast majority of homes in Soweto are priced between R250 000 and R1m – 70 000 are priced between R250 000-R500 000, 71 500 between R500 000 and R700 000, and 38 500 priced between R700 000 and R1m.

Current value of stock

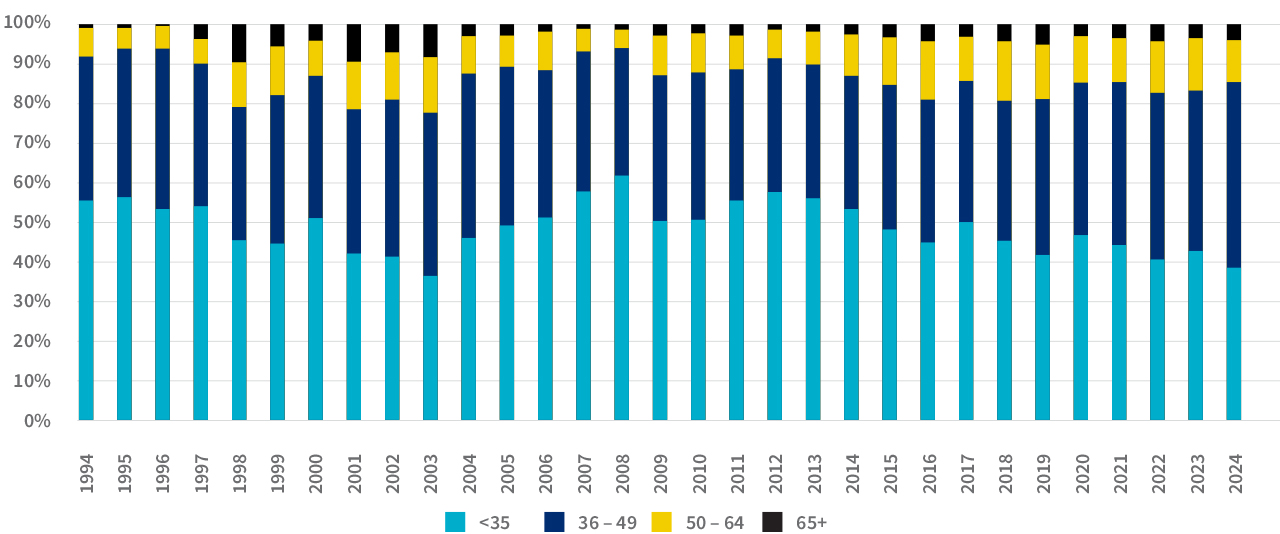

As with other areas in South Africa, the age profile of buyers (see graph below) is moving upwards.

Buyers aged between 36-49 accounted for 40% of transactions in 2023, up from 36% in 1994. It is the older age groups which have shown the most growth,

with 50-64 year olds accounting for 13% in 2023 (7% in 1994) and those above 65 making up 3% of buyers in 2023 against none in 1994.

Age of buyers: volume of sales

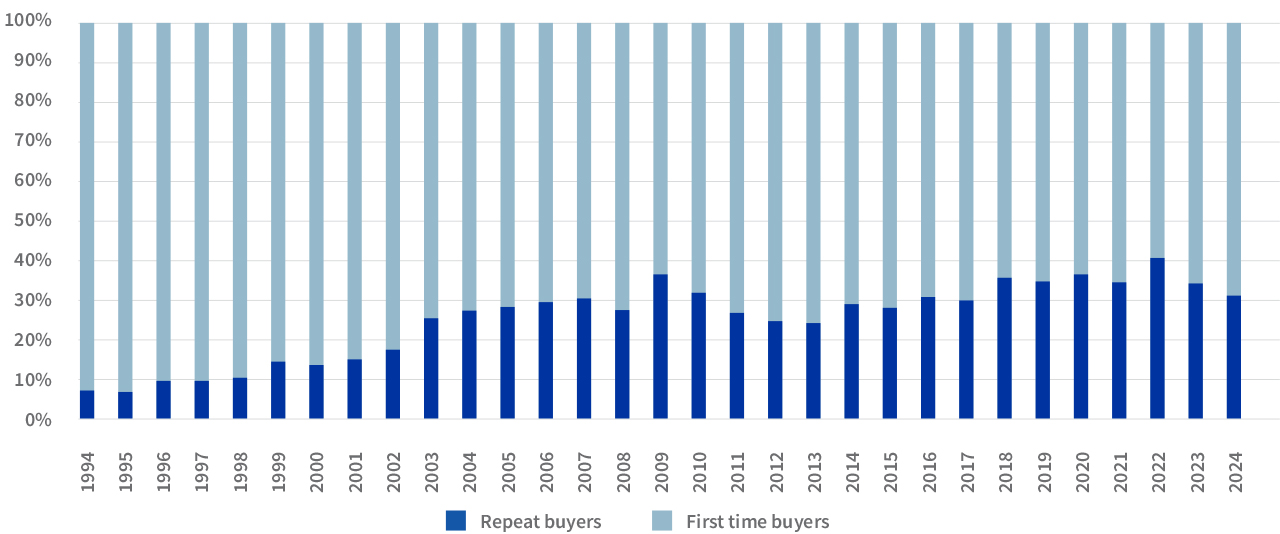

First time buyers accounted for 93% of the market in 1994 (see graph below), reducing to 60% in 2022 as the market matured before rising slightly to 66% in 2023.

First time buyers vs repeat: volume of sales

.png)

.png)

.png)

.png)