Property Newsletter | January 2022

House price inflation set to follow 2021 trend

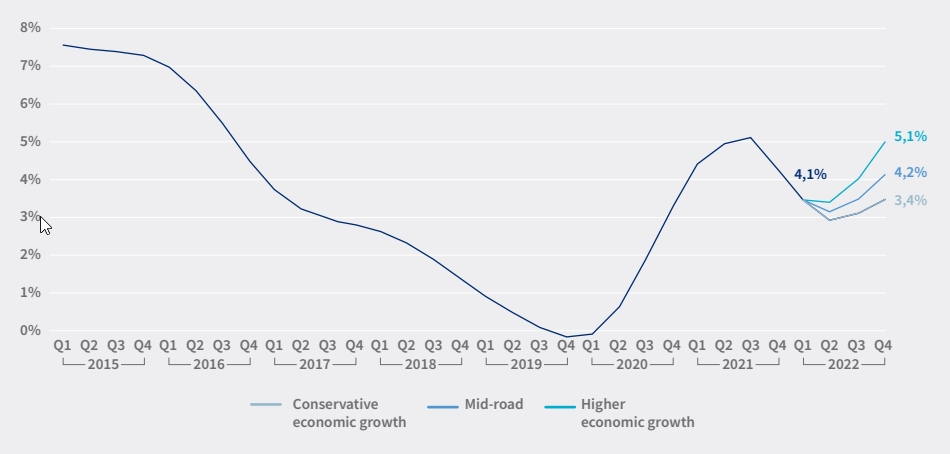

Lightstone’s forecasted scenarios suggest home values could rise by between 3.4% and 5.1% in 2022

South Africa’s residential house price inflation (HPI) in 2022 is expected to mirror what was achieved in 2021. This is despite continued uncertainty caused by Covid-19, the underperforming economy and political tensions around leadership in the ruling party which may negatively impact clear policy formulation.

HPI ended 2021 just above Lightstone’s mid growth HPI scenario of 4% – and the expectation is that HPI in 2022 will finish somewhere between 3.4% and 5.1%. Interestingly, Lightstone sets its low growth HPI scenario forecast significantly higher than the 2021 scenario, suggesting the residential market has weathered the worst of the pandemic storms.

-

2021 HPI actual

| HPI forecast | 2021 | 2022 |

| Low growth HPI | 2.1 | 3.4 |

| Mid growth HPI | 4.0 | 4.2 |

| High growth HPI | 5.2 | 5.1 |

Forecast over time

Forecast and reality in 2021

HPI in 2021 was 4.35%, slightly above our mid growth HPI scenario where we predicted an end-of-year HPI of 4.0%.

The expectation was that under such a scenario HPI would mirror the consumer price index (CPI)

This scenario was predicated on economic growth recovering to pre-Covid-19 levels but without the serious economic reforms needed to set South Africa up for strong longer-term growth. It also took into account the historically low interest rate environment, and a growing response from a market segment to the work-from-home trend, a feature of the 2021 high growth HPI scenario.

HPI scenarios in 2022

Our scenarios for 2022 are based on assumptions around the key factors that influence house prices.

GDP growth is the strongest driver of sustainable house price growth. We have tested three likely GDP scenarios and our best case puts GDP growth at 3%, while a more realistic estimate would be 2% with a low estimate at a pedestrian 1.5%.

Our estimates are in line with other economists, many of whom forecast GDP growth from around 1.9% to just above 2% in 2022, with inflation around 4.6%. However, projections are that GDP growth will slip in 2023 to around 1.8%, although economic reforms could lead to revising these predictions upwards.

Apart from GDP growth, we expect the Reserve Bank to effectively manage CPI in the 3% to 6% target band, setting the repo rate as one of the tools to achieve this.

Looking at both GDP growth and CPI inflation, our high growth GDP scenario assumes a CPI inflation figure at the top end of the target band at 5.5%.

We think it is more likely CPI will end the year closer to 5% (the assumption made for the mid growth GDP estimate) and we assume CPI inflation will end the year at 4.5% for our low growth GDP estimate.

Depending on which scenario plays out, we expect the Reserve Bank to increase interest rates by a cumulative 50 to 150 basis points during the year as it seeks to manage CPI inflation while also increasing South Africa’s attractiveness as a foreign investment destination.

So, what does this mean for the housing market?

After a short-term boost driven by the historically low interest rates experienced over the past two years, national house price inflation peaked in May 2021 but ended 2021 on a downward trend.

Under the low HPI growth scenario we would expect this trend to continue throughout the first two quarters of 2022 before bottoming out and to recover slightly at the end of the year at 3.4% – an increase on the low end projected twelve months ago.

It is likely though that slightly stronger economic growth and less aggressive interest rate hikes in the first two quarters of the year should lead to a softer landing with house price growth stabilising in the second quarter and picking up in the third and fourth. The outcome of this is our mid growth HPI scenario where we expect house price inflation to close the year at 4.2%, closer to where it started the year.

In a more optimistic higher economic growth scenario we would expect house price inflation to rapidly recover in the second quarter with strong momentum going into the third and fourth quarter resulting in an end-of-year house price inflation of 5.1%. This would however require positive economic reforms resulting in a 3% GDP growth for the year.

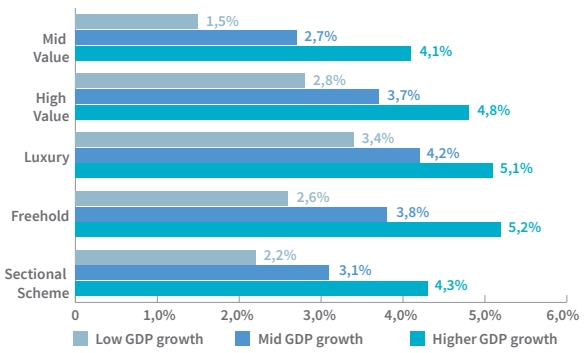

Market segment winners and losers

Freehold properties – especially in the Luxury market segment – could end the year with HPI at over 5% if high economic growth and lower interest rate increases prevail. This is typically because a large portion of these higher valued properties have bigger mortgage loans attached to them, and are therefore more responsive to positive changes in the macro-economic environment.

The Mid-value market segment entered 2022 on a discouraging downward HPI trend and is set for a difficult recovery – especially under a low growth economic scenario where HPI for this segment might drop to just 1.5%.

Forecast by category

As Covid-19 appears to become more manageable and its status transitions from pandemic to endemic, the conditions for economic renewal become easier. In particular, the tourism industry will begin the task of reclaiming lost international markets and commerce and industry will accelerate recovery to pre-pandemic levels.

However, all eyes will be on policies and programmes initiated by the South African government because economic reforms will lay the foundation for better than anticipated growth – which in turn will benefit the residential market and help attain the high growth HPI scenario.

.png)

.png)

.png)

.png)