Property Newsletter | July 2022

Upswing in Joburg East’s property fortunes

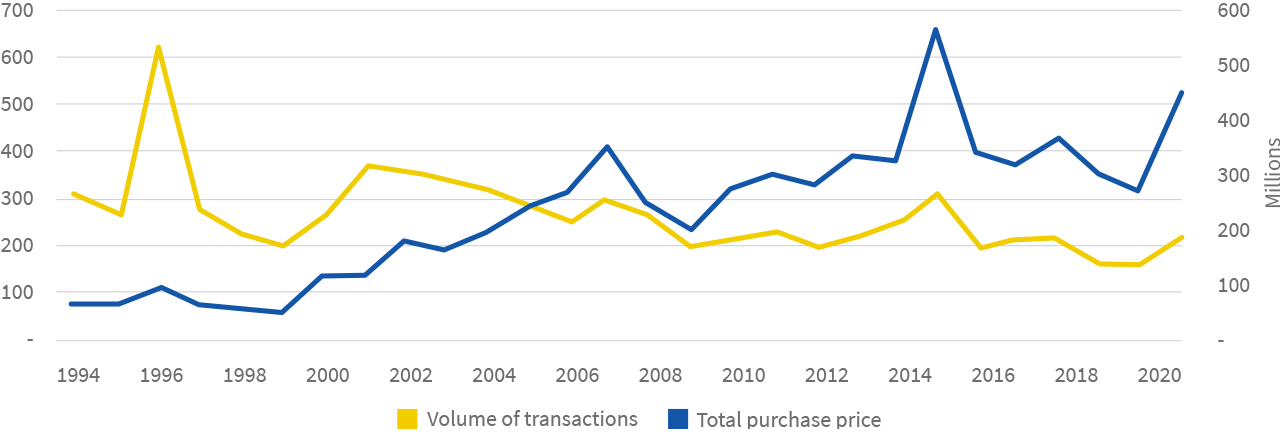

The value of property transactions and the volume of sales in Joburg East have risen since 2020.

This is good news for a region that had seen annual sales gradually fall since the boom sales year of 1996 – although prices had been climbing steadily since 1998, and spiked in late 2015 and early 2016.

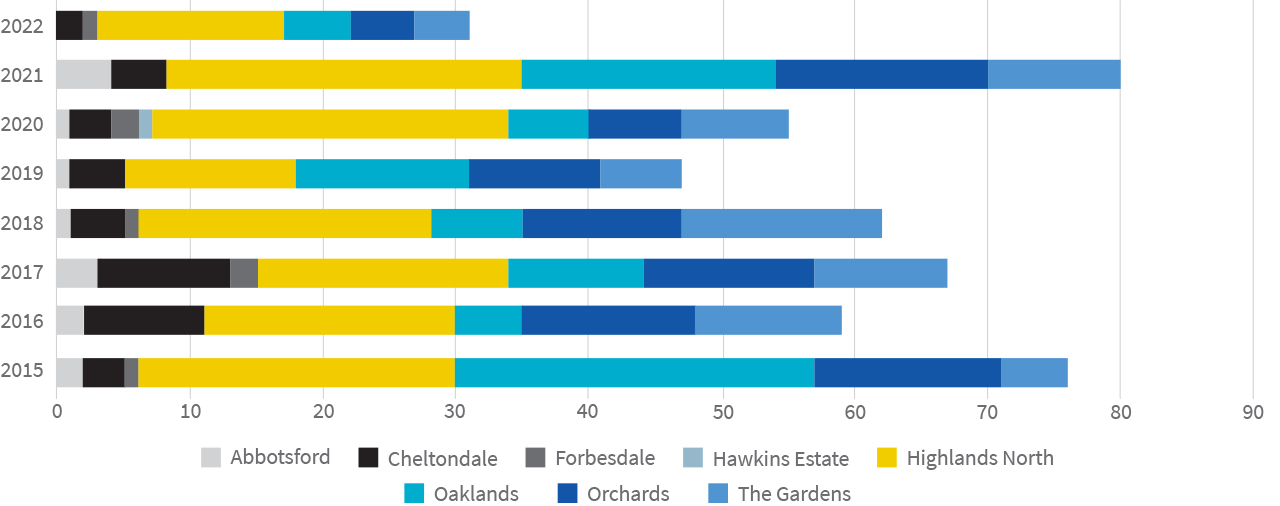

Volume of transactions

Joburg East’s property stock consists of 3 330 properties, and is dominated by Highlands North (1 307 – 39%), followed by Oaklands (644 – 19%), Orchards (587 – 18%), The Gardens (407 – 12%), Cheltondale (236 – 7%), Abbotsford (108 – 3%), Forbesdale (22 -1%) and Hawkins Estate (19 – 1%).

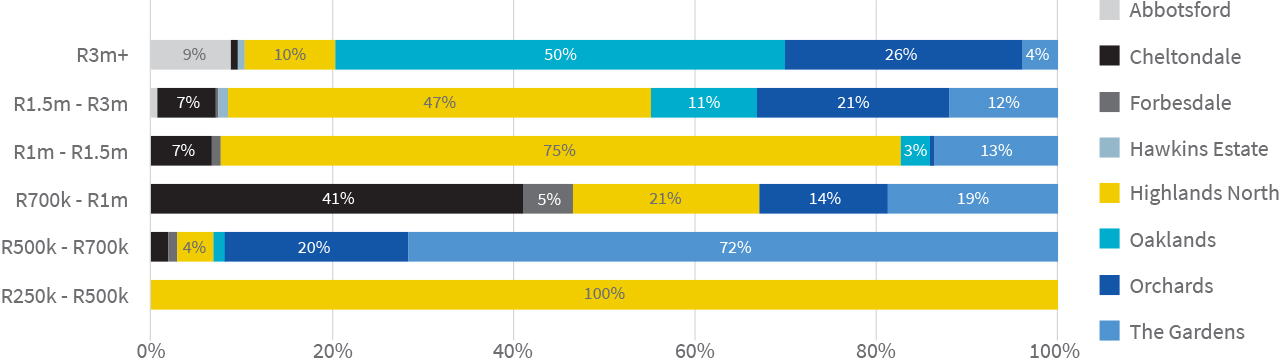

Highlands North has the most properties in Joburg East, but also the largest spread, with properties in each of the six price bands. As the graph below demonstrates, Highlands North accounts for all the properties below R500k, while other price bands are more or less spread across the suburbs.

Suburbs contribution to property

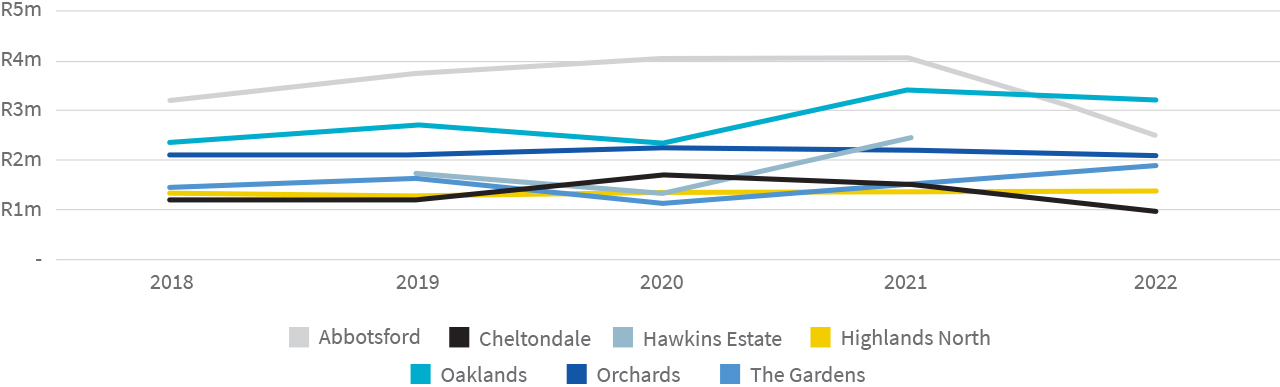

While Highlands North has a full spread of price bands, the average value (see graph below) of a transfer in 2022 is the second lowest in Joburg East at R1 409m. This is less than half of the region’s highest average value of R3.2m in Oaklands. Forbesdale, a tiny suburb sandwiched between Orchards, Maryvale and Cheltondale, has the lowest average value in Joburg East at R900k.

Average value of transfers per suburb

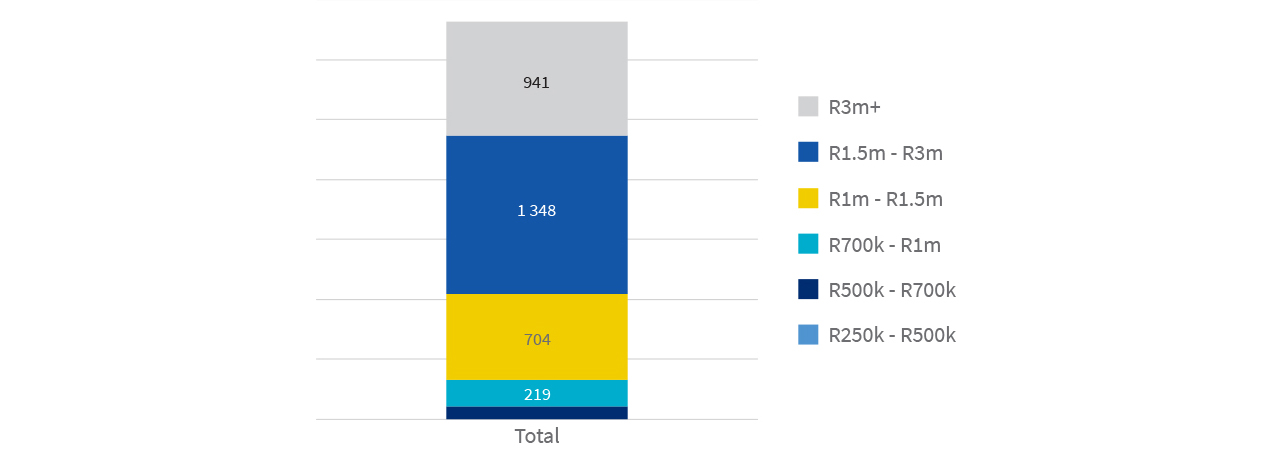

Most of Joburg East’s stock (90%) is valued at more than R1m (see graph below), with the largest price band being R1.5m-R3m (40%).

Value band of property

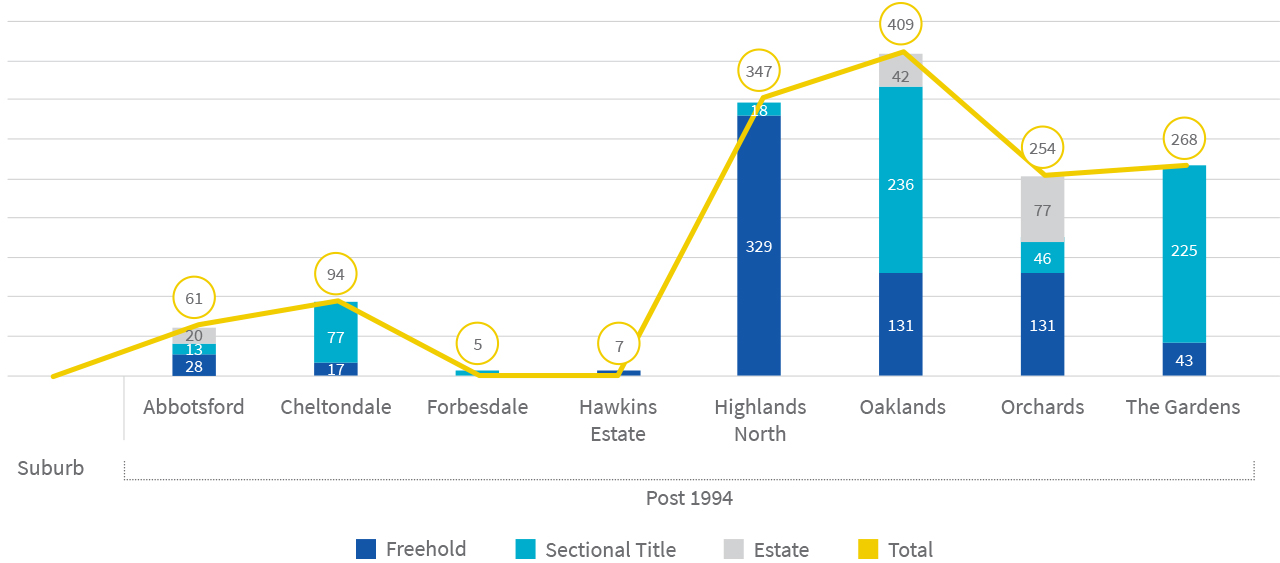

Interestingly, of the region’s 3 330 properties, 1 445 (43%) were developed after 1994, and most development has taken place in Oaklands and Highlands North, followed by Orchards and The Gardens. There has been little development in the other suburbs.

Of the development, the bulk in Highlands North (95%) were Freehold while the majority in Oaklands were Sectional Title (58%), followed by Freehold (32%) and Estate (10%). Sectional Title has dominated development in The Gardens (84%) while Orchards was more or less evenly balanced between Freehold (52%) and Sectional Title and Estate (48%).

Development post 1994

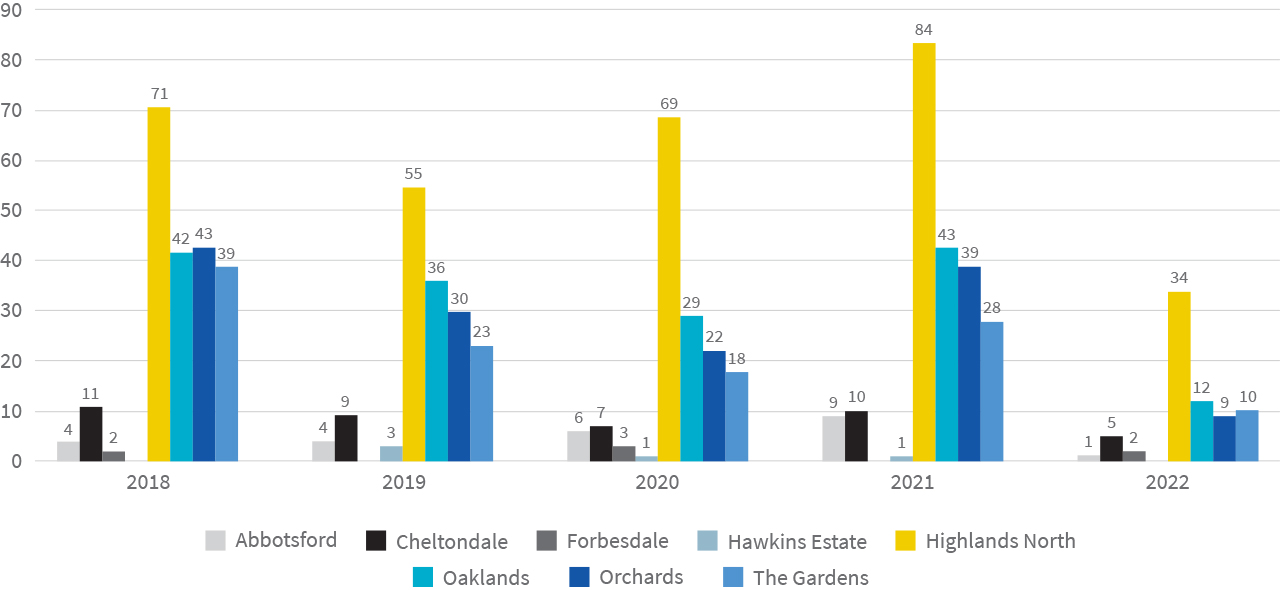

As expected, most transfers have been recorded in Highlands North, and in 2021 it accounted for nearly double that of Oaklands. This is in contrast to 2019 when the gap between the two suburbs was relatively small.

Volume of transfers

First time buyers by suburb

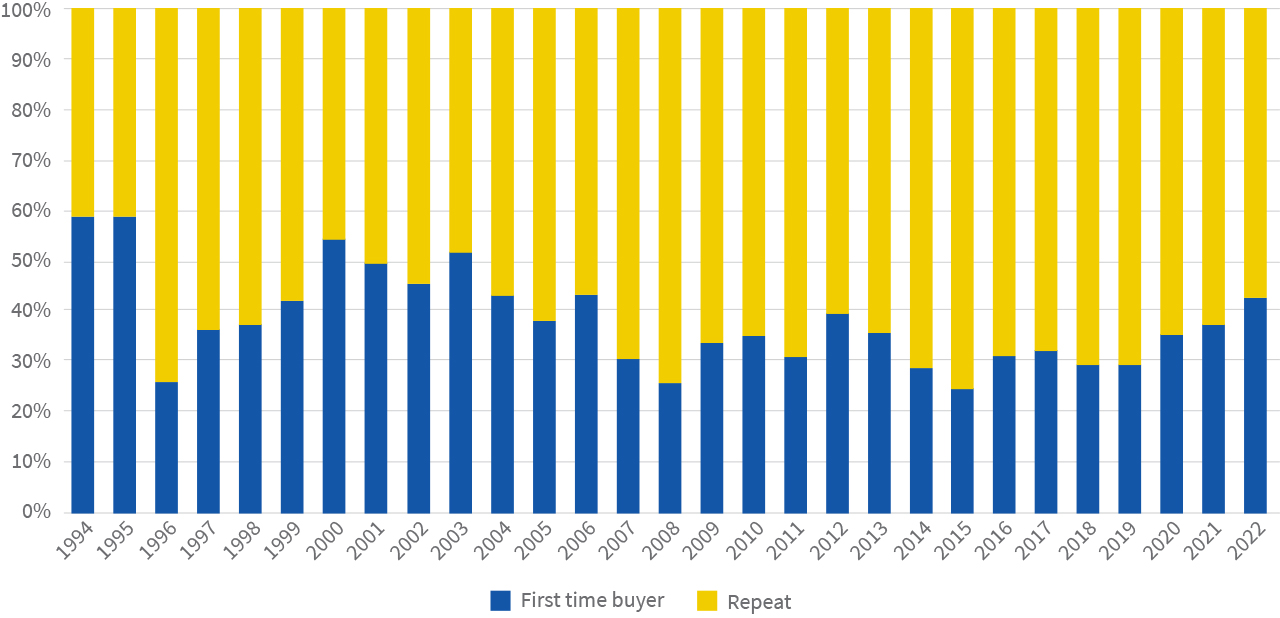

There were more first-time buyers in 2021 than any year since 2015, with most opting for Highlands North followed by Oaklands and then Orchards. The proportion of first-time buyers (37% in 2022) is well short of the 59% recorded in 1994 – the best year of the period for fi rst-time buyers.

% First time buyers

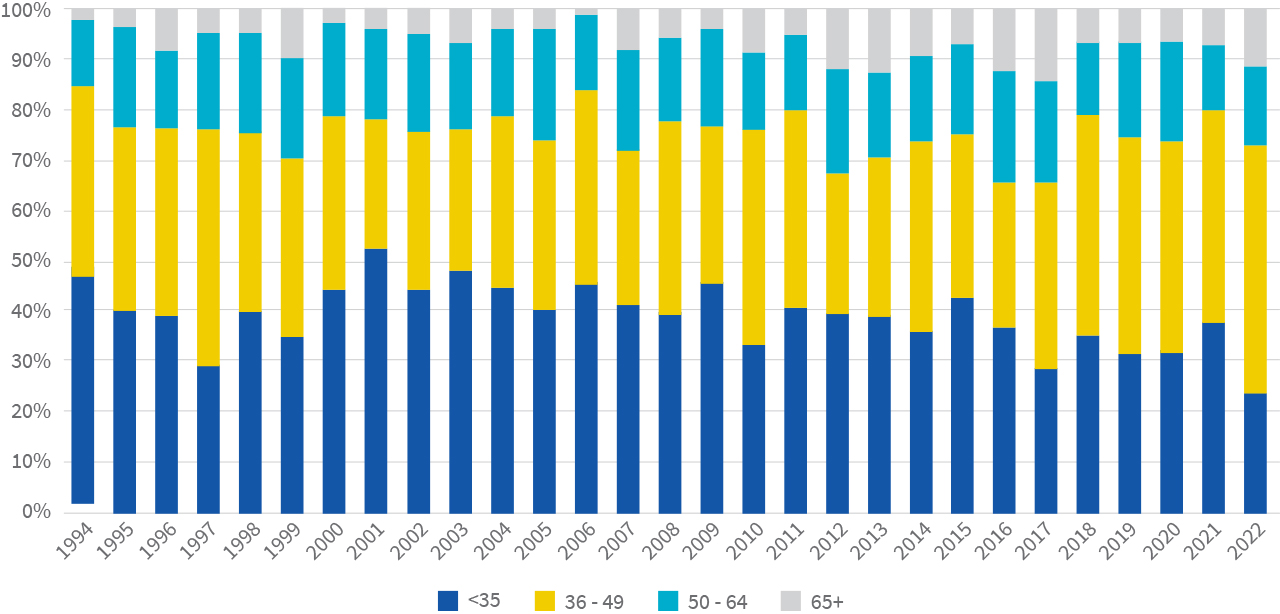

The age of buyers is getting older. In 2001, under 35s accounted for 53% of buyers, as opposed to 37% in 2021. The largest market (see graph below) is the 36 to 49 age group, with 42% in 2021, followed by under 35s at 38%. The 50 to 64 age group accounted for 13% and the 65+ category just 7% - half of what the senior age group recorded in 2017.

Age of buyers

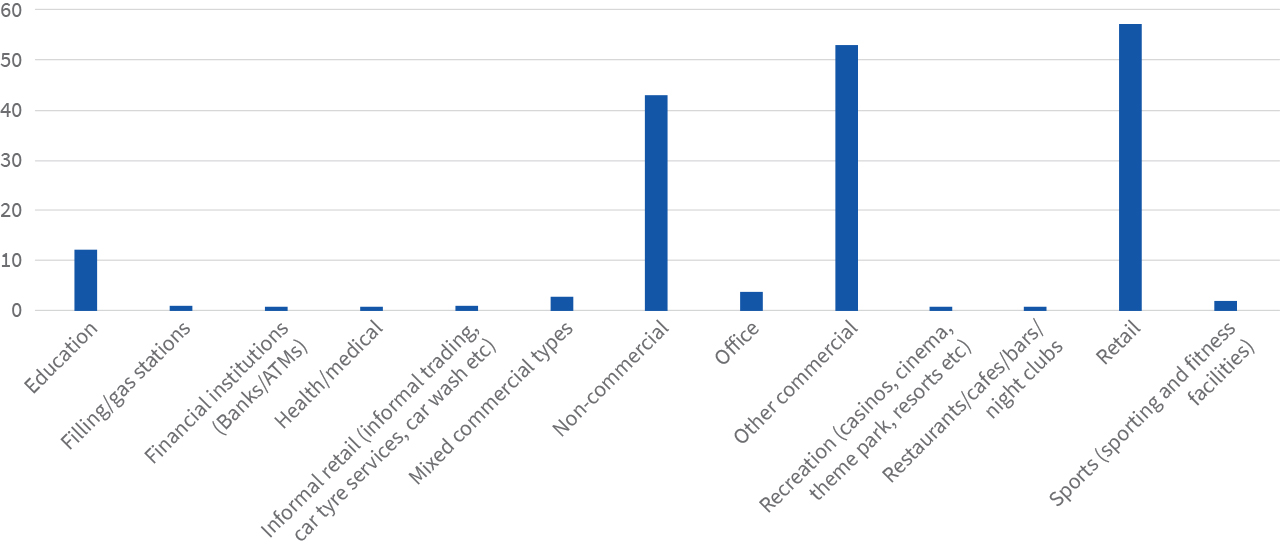

Commercial property in Joburg East

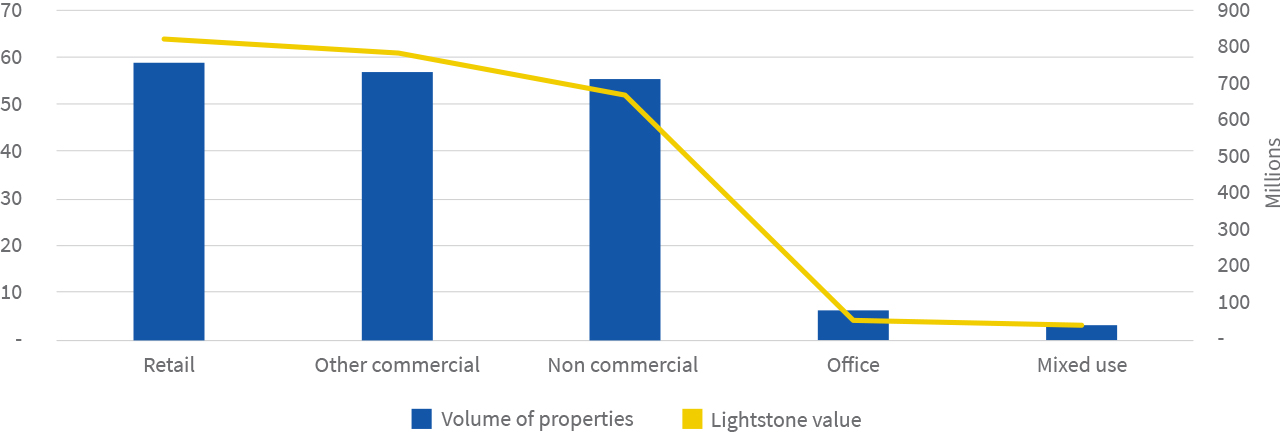

Retail property constitutes the largest portion of commercial property, and the most valuable at R821m. It is followed by Other Commercial, being smaller retailers such as painting suppliers or small hardware stores, valued at R780m. Non-commercial, typically government departments, is next biggest at R675m.

Estimated stock of property by type

Estimated Lightstone value of properties in Johannesburg East

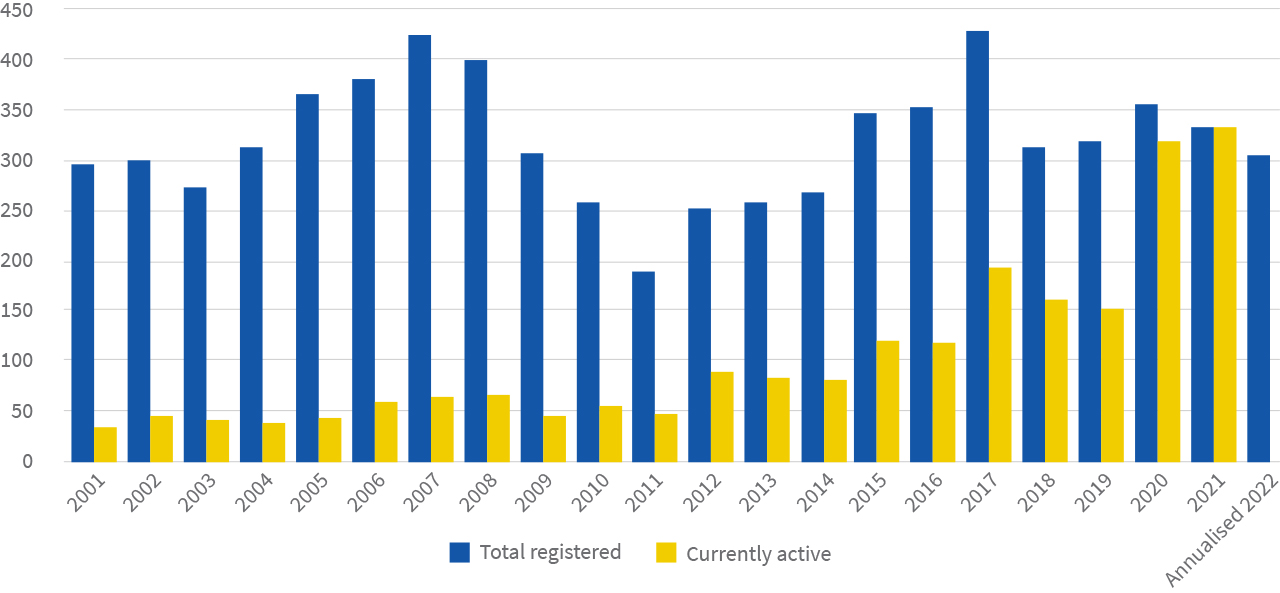

In terms of companies operating in Joburg East, the number of registered companies has dropped from the highs of the late 2000s and 2017. Total registrations are expected to be slightly lower at around the 300 mark at year end and it remains to be seen how many of the active companies remain active after 2 years.

Companies registered and active post 2000

.png)

.png)

.png)

.png)