Property Newsletter | September 2022

The road often travelled

Mixed town fortunes along the N3

The N3 is the busy national road that carries high volumes of traffic between Johannesburg and Durban, South Africa’s largest and third-largest cities – and passes through or nearby Mooi River, Howick and Hilton, three towns in the KwaZulu-Natal midlands well-known for quite different reasons.

Lightstone’s Town Characterisation provides insights into a town’s character by merging data from a diverse set of metrics, from retail locations, business registration data and property sales and valuations to telemetry data around vehicle movements (and auto sales stats, not accessed here).

We compare each town’s size, past and future growth, density and school coverage, among other characteristics – and the snapshot summary below tells a tale of a struggling Mooi River, a relatively well-off Hilton and a rapidly growing Howick somewhere in-between.

| Town | Town size | New growth | Historic growth | Formalisation | Density | School coverage | Hospital coverage |

|---|---|---|---|---|---|---|---|

| Hilton | D: Marginal | C: High | C: High | C: Mostly | C: Space to grow | A: Good | B: Moderate to Good |

| Howick | C: Small | C: High | C: High | C: Mostly | C: Space to grow | B: Moderate to good | A: Good |

| Mooi River | C: Small | B: Mid | B: Mid | C: Mostly | C: Space to grow | B: Moderate to good | D: Poor |

Population

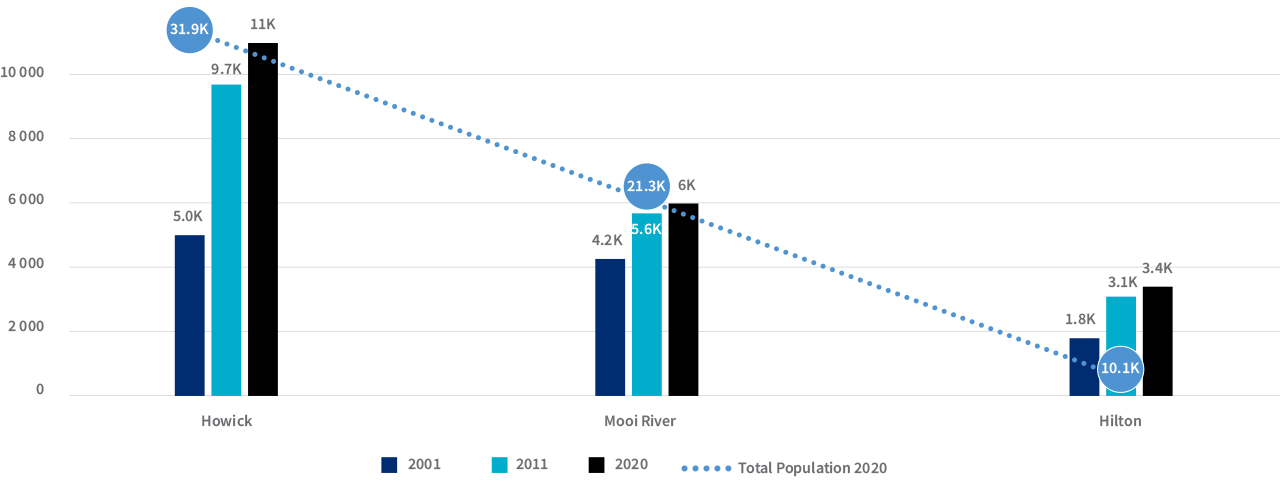

Howick is the seat of the uMngeni Local Municipality and is the largest of the three towns. Its number of households are growing the quickest, followed by Hilton with Mooi River showing the least growth.

The number of households grew (see graph below) by just over 100% in Howick in 20 years, from 5 000 to 11 000. Its population in 2020 was 31 853 which means the average household had three people in it.

Mooi River’s number of households grew by 50% but off a smaller base. It’s population was 21 300 in 2020, amounting to 3.5 people per household.

Hilton is the smallest of the three, with 10 100 people in 2020 spread across 3 400 households, amounting to 3.2 people per household. Its number of households grew from 1 800 in 2001 to 3 400 in 2020, an increase of just under 100%.

| Town | HH_2001 | HH_2011 | HH_2020 | Total population 2020 |

|---|---|---|---|---|

| Hilton | 5 028 | 9 708 | 11 037 | 31 853 |

| Howick | 4 242 | 5 642 | 6 039 | 21 329 |

| Mooi River | 1 820 | 3 057 | 3 408 | 10 051 |

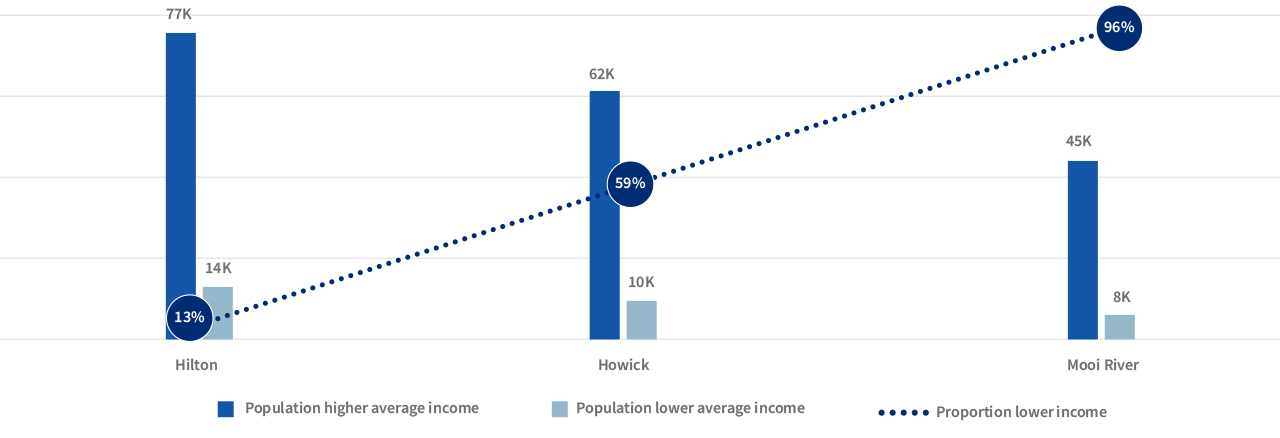

The total income of 89% of households in South Africa is less than R44k a month, and the graph below shows the inequality of household income in the three towns along the N3.

Of those earning more than R44k a month, the average in Hilton is R77k a month, against R62k a month in Howick and R45k a month in Mooi River. Hilton is a relatively well-off town, with just 13% of households earning under R44k a month, while this jumps to 59% in Howick and 96% in Mooi River.

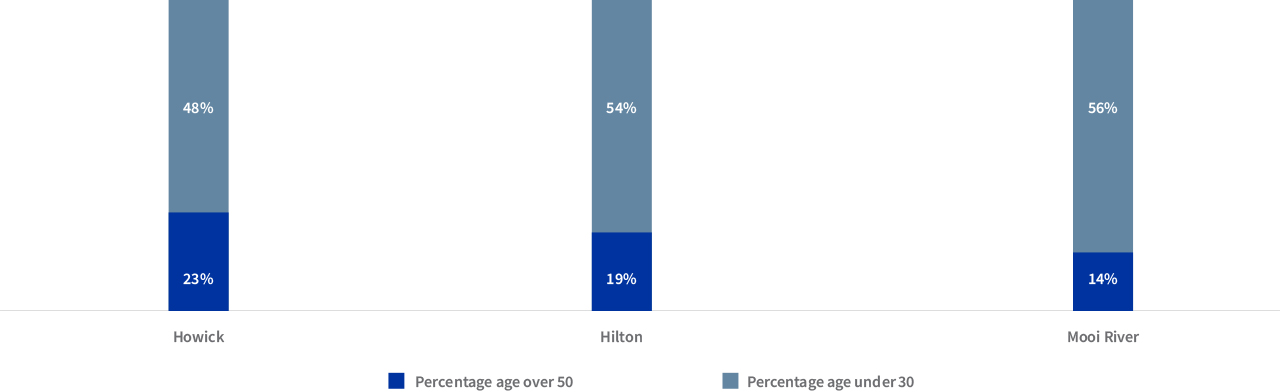

While Hilton is relatively well off, it has the highest percentage of households over the age of 50, and the least under the age of 30 – while Mooi River, which has the highest number of households under R44k, in fact averaging at R8k a month, has the largest population under 30, and the lowest over 50.

Average household income of those on either side of R44 000

Unfortunately, this means the town with the most young people in households is in fact the poorest.

Percentage of population younger than 30 and over 50

Property’s mixed signals

The state of the property market in each town is viewed through different lenses – the average valuation of a freestanding house (FH) versus a sectional title unit (SS); how prices have escalated over the past five years; property churn over the past two years; and property development over the past ten years.

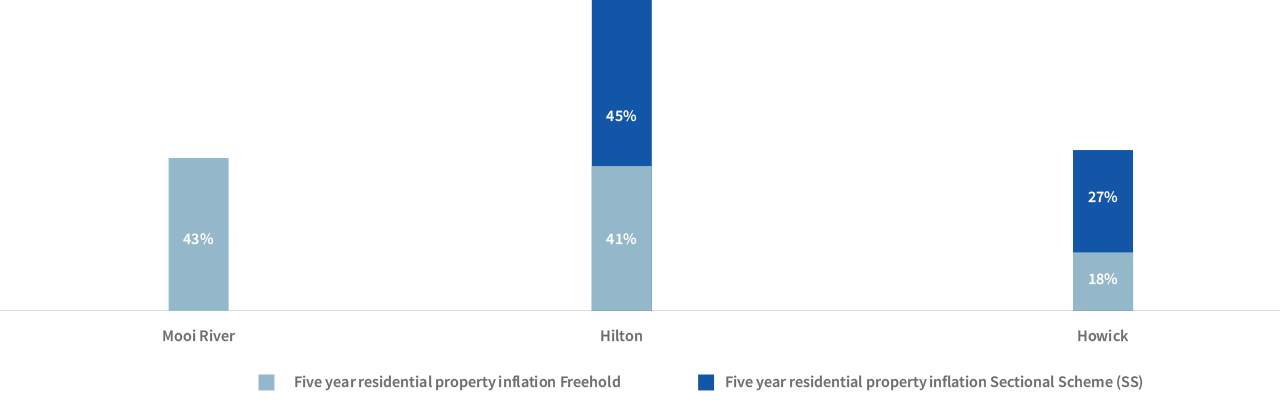

The growth in value of Freehold properties (see graph below) in Mooi River (43%) and Hilton (41%) have significantly outpaced Howick (18%), while Sectional Scheme properties in Hilton have soared by 45% over five years, compared to 27% in Howick.

Five year escalation in property Freehold and Sectional Scheme (SS) property prices

*Sectional Schemes (SS) properties refer to Sectional Title units within Sectional Schemes

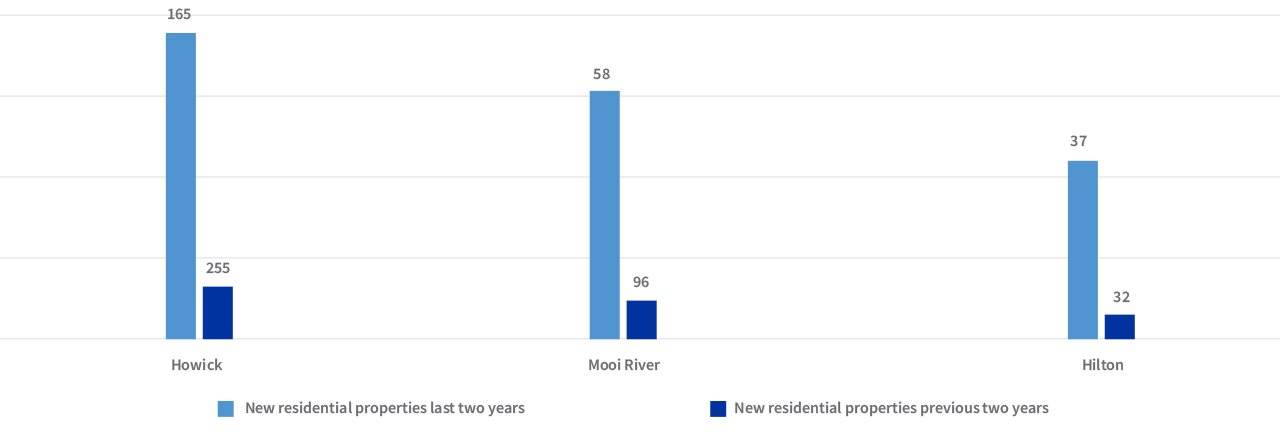

However, while Howick’s residential properties lag in terms of property inflation, Howick leads the way when it comes to new property development – it outperforms both Mooi River and Hilton over the last four years. This growth does appear to be slowing down compared to Hilton which has been fairly stable over the last four years.

New residential property in the last two years compared to the previous two years

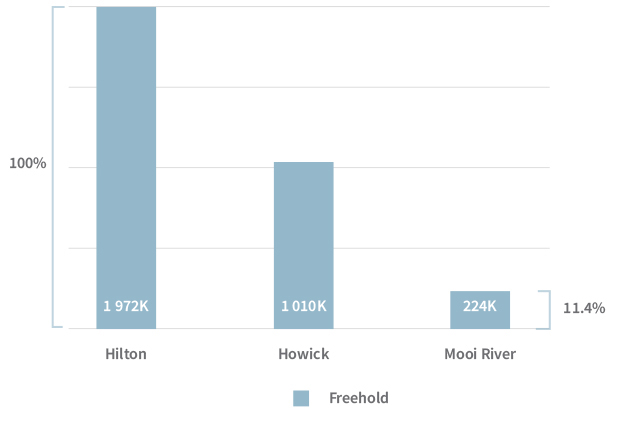

Average Freehold value

Average Sectional Scheme value

The average value of Freehold and Sectional Scheme properties reinforces each town’s character: the average value of Freehold property in Hilton is R1.9m, while the average value of Sectional Scheme property is R2m, while Howick’s average values are R1m and R2m respectively. The average value of Freehold property in Mooi River is significantly less at R224 000.

Number of schools and number of hospitals by town

| Town | Business saturation | Investment growth |

|---|---|---|

| Hilton | A Enough Business to Support | Sustained Investment - Declined |

| Howick | B Average Work Opportunity | Sustained Investment - Same |

| Mooi River | B Average Work Opportunity | Sustained Investment - Same |

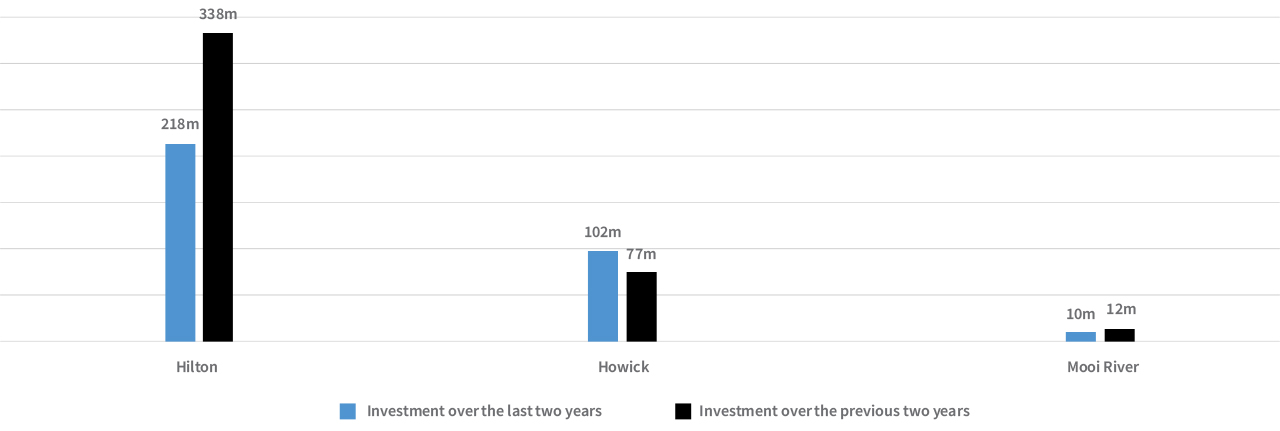

Lightstone uses property data as a proxy for investment in towns to determine an “investment/ability to grow” score. We look at the sum value of large property transactions in the town (which could include school, hospital, sewerage works, new residential developments, by way of example) over the last two years and then the two years prior to that.

We deduce two things:

- By comparing the last two years with the previous two years before that we get a view on whether investment is declining, static or increasing.

- We look at the last two years investment in conjunction with the population size to classify the town’s investment status – for example, a significant investment in property proportionately per household would be classified as “Poised for take-off”; if little is happening then “Lip Service” and if nothing is happening we classify it as “Forgotten”.

The business data is based on businesses registered with the CIPC, with business size derived from Lightstone’s internal models.

In terms of CIPC registered business we consider:

- The number of VAT registered businesses

- % of start-up businesses (opened in the last 2 years)

- % of “larger” businesses (analytically derived based on director gravitas scoring).

We also compare the number of businesses to population size and classify a town’s business coverage or provision.

Our analysis of the data suggests that investment growth in Howick and Mooi River is static, while it has declined in Hilton – although off much-higher levels, which are much higher relative to population numbers.

Investment over the last two years compared to the previous two year period

Interestingly the number of start-ups is highest in Mooi River, where it could be argued they are needed most, while surprisingly low in Howick, given it has had the most significant increase in population and is the largest town evaluated. Predictably, though, Howick is home to the most number of VATregistered businesses, and Mooi River the least.

Percentage of larger businesses and startups by town

Total VAT registered businesses

Shopping is plentiful

In terms of retail we consider:

- Total known number of chain stores

- Number of major malls

- Total gross lettable area of all malls

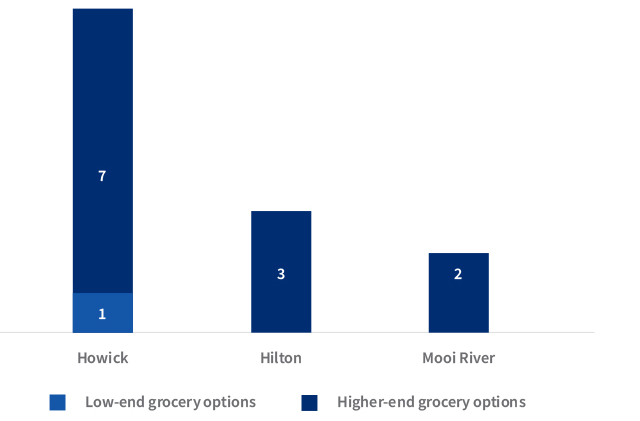

- Number of chain grocery stores aimed at the lower end of the market (think Shoprite, Boxer, etc) vs the upper end (Woolworths, PnP, etc)

- Compare the number of chain stores to population size and classify the retail coverage or provision.

| Town | First Retail |

|---|---|

| Hilton | B: Sufficient |

| Howick | B: Sufficient |

| Mooi River | B: Sufficient |

Split of high vs low-end grocery options by town

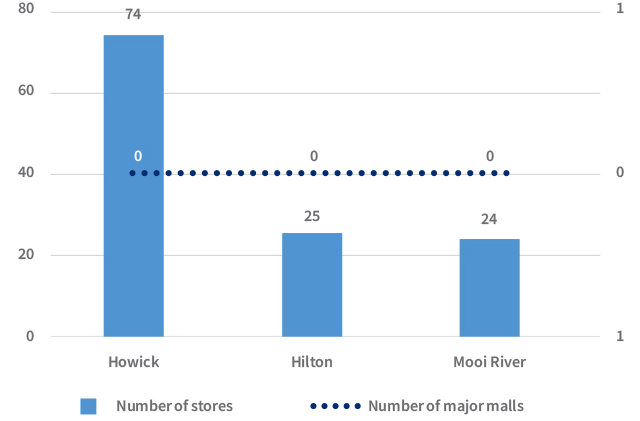

Total retail landscape per town and number of major malls it has

The above data is based on Lighstone’s researched malls and stores landscape.

Town mall area in town (in square meters)

As expected, Howick has the most number of grocery options.

.png)

.png)

.png)

.png)