Auto Insights Newsletter | June 2023

Light Commercial Vehicle sales drive post-Covid recovery

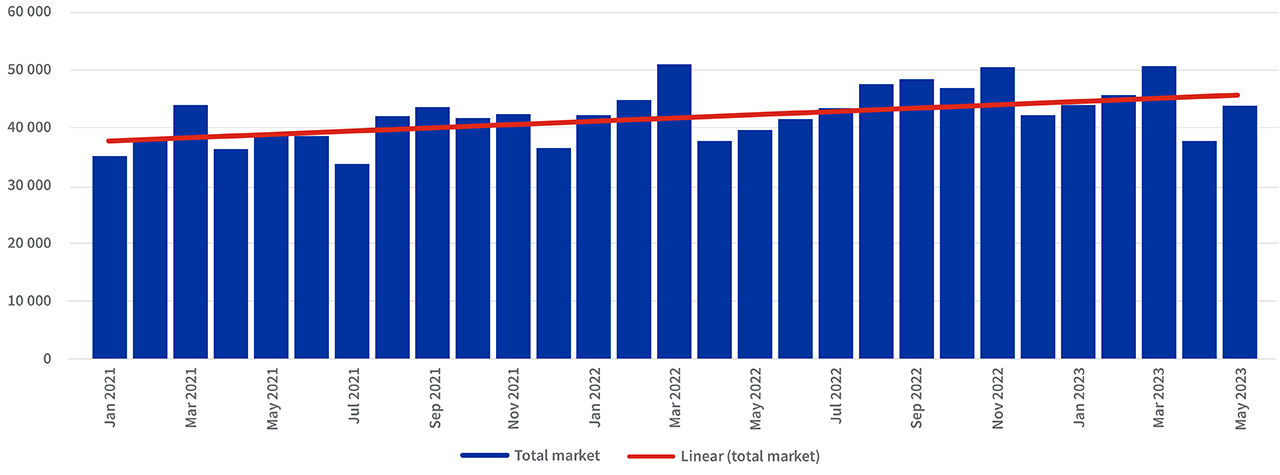

Data releases from naamsa (the Automotive Business Council) indicate that new vehicle sales in May 2023 (43 205 units) were 10.5% up compared to May 2022, and 16% ahead of sales in April 2023.

This, as passenger vehicle sales inched forward by 0.5% year-on-year in May to 27 452 units while Light Commercial Vehicles sales soared by 38.6%, reaching 12 832 units.

New vehicle sales

Overall sales for the first five months of 2023 were 3.1% higher than for 2022, and 15.6% above sales for the same window in 2021. More significantly, as the graph below shows, new vehicle sales in 2023 are 3.5% ahead of the same period in 2019, a sign that the market has effectively recovered to pre-Covid levels.

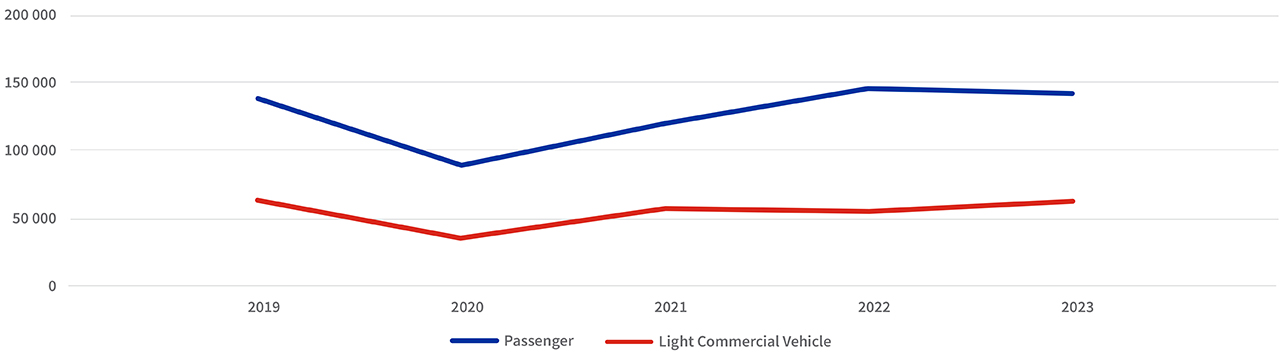

January to May - Passenger & Light Commercial new vehicle sales

The market is expected to grow in 2023 despite continued macroeconomic pressures, with GDP growth expected to be significantly less in 2023 and the Rand continuing to weaken against major global currencies.

Headline consumer inflation is projected to drop back within the Reserve Bank’s 3% - 6% target range and it is possible the Reserve Bank could end the current cycle of interest rate hikes before the end of the year. There are also indications that the global shortage in semi-conductors is easing and manufacturers are returning to normal production schedules.

Anticipated new vehicle sales for 2023 currently sit at around 539 500 units, of which 508 500 are Light vehicles (Passenger and Light Commercial). Overall, new vehicle sales are expected to grow by 2% in 2023, lower than our previous forecast of 3%.

New vehicle sales - 2018 to 2023

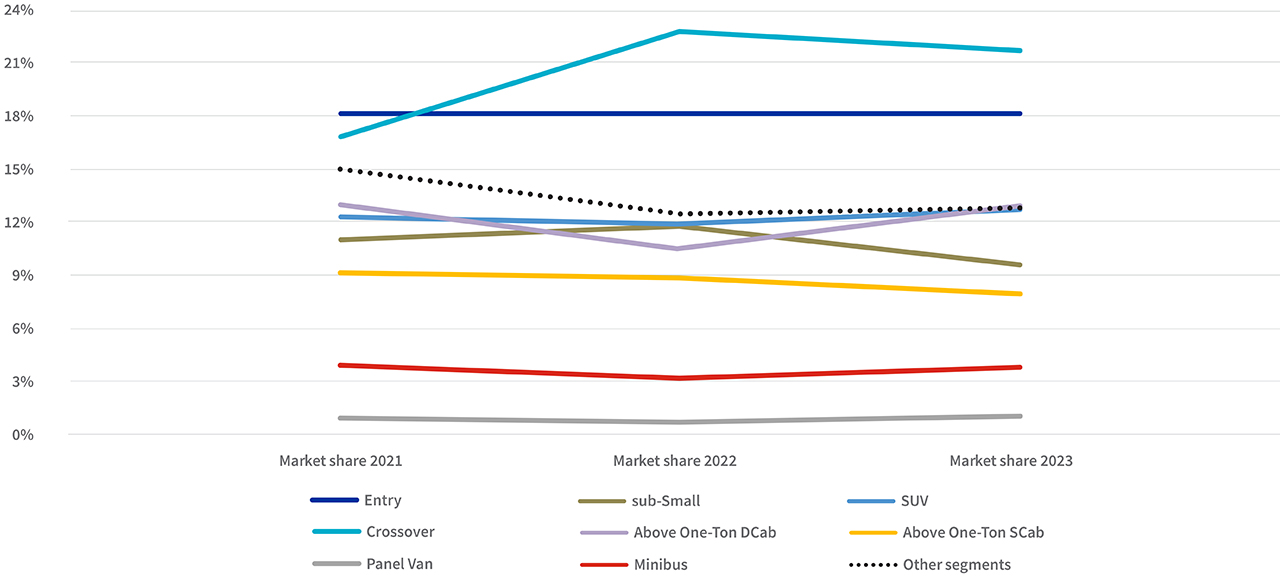

Segment performance in first five months

The Crossover segment (which includes the Haval Jolion, Toyota Corolla Cross and Volkswagen T-Cross) was the largest Light Vehicle (Passenger and LCV markets) segment in South Africa in the first five months of 2023, with 44 799 new units sold, of which 89.5% were Dealer sales, and 5.9% reported through the Rental channel.

Despite being the largest market segment, Crossover sales in the first five months of 2023 dipped 2.2% compared to the same period last year, and made up 21.7% of all Light Vehicle sales so far in 2023, slightly behind 22.7% market share recorded for the first five months of 2022.

The Entry segment (which includes Renault Kwid, Toyota Starlet and VW Polo Vivo) was the next best seller with 37 055 units sold to end May 2023, up by 1.5% from the same window in 2022.

Sales for the Panel Van segment, which includes the Hyundai Grand i10 Cargo, Toyota Quantum and Volkswagen Caddy Cargo, jumped 37.4% year-on-year in the January-May period from 2022, which in turn was 7.4% down on the segment total for the first five months of 2021.

This makes the Panel Van segment the best performing Light Vehicle segment in terms of sales growth, despite being one of the smaller segments. Over the first five months of 2023, the Panel Van segment made up 0.8% of all Light Vehicle sales, up from the 0.6% market share for the same period in 2022.

The second most improved segment for year-on-year growth in the first five months of 2023 was the Above One-Ton Double-Cab segment (which includes Ford Ranger, Isuzu D-MAX and Toyota Hilux), with sales climbing 28.4% from a year earlier.

Light Vehicle segments - share of Light Vehicle market (January to May)

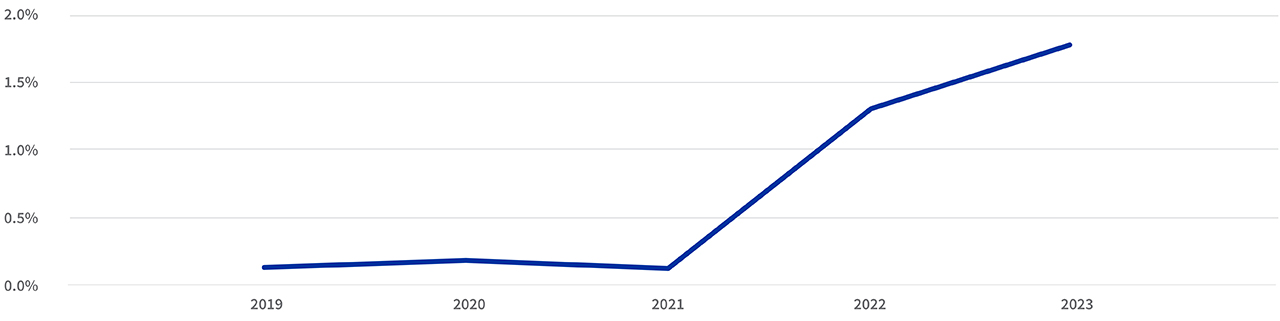

Hybrid and Electric Vehicle sales

New Hybrid and Electric Passenger Vehicle sales (which includes Traditional Hybrid, Plug-in Hybrid and Battery Electric Vehicles) for the first five months of 2023 numbered 2 575 units, 34.1% up on 2022, which in turn had accelerated 1 301% from 2021. Hybrid and Electric vehicle sales account for 1.8% of the Passenger Market for the period January-May 2023.

Hybrid & Electric Vehicle share of passenger sales (January to May)

Traditional Hybrid Vehicles continue to dominate sales with an 83.5% share of the sub-segment in 2023, with Battery Electric Vehicles making up 14.1% of sales and Plug-in Hybrid Vehicles responsible for 2.4%.

.png)

.png)

.png)

.png)