Auto Insights Newsletter | June 2024

New Light Vehicle

inflation tracking CPI

Used and New vehicle prices move in different directions

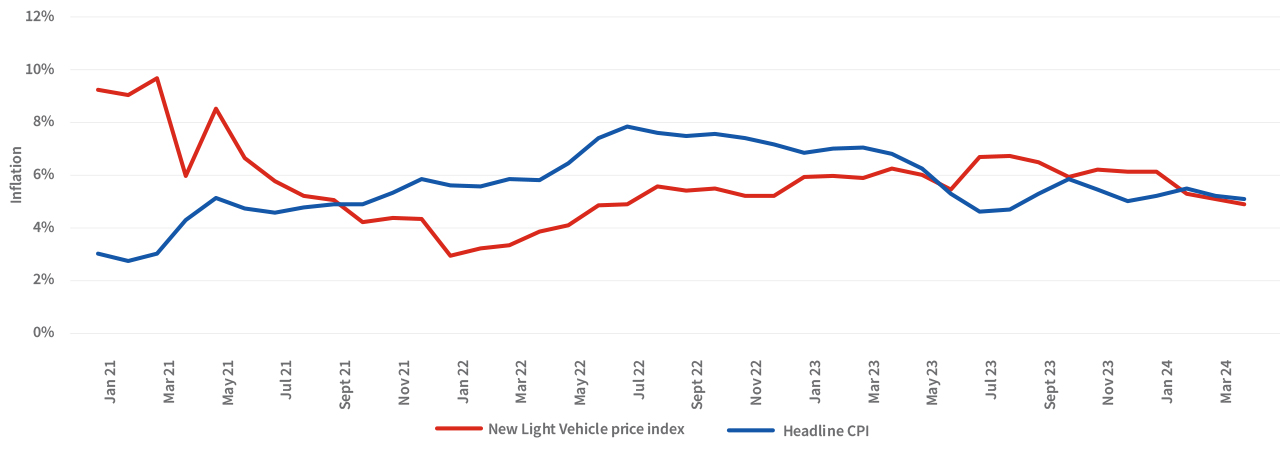

New Light Vehicle price inflation in South Africa rose 5% year-on-year (y-o-y) in April 2024, the third successive month where New Vehicle price inflation has come in below Headline CPI (5.2% in April, as released by StatsSA).

The April 2024 number was also lower than the March y-o-y increase of 5.2%. On a monthly basis, April prices climbed 0.9% from March, which in turn was 1% down on February.

New Light Vehicle price inflation vs headline CPI

Over the first four months of 2024, New Vehicle price inflation has grown by 5.4% compared to the same period in 2023, matching the increase in Headline CPI for the same period.

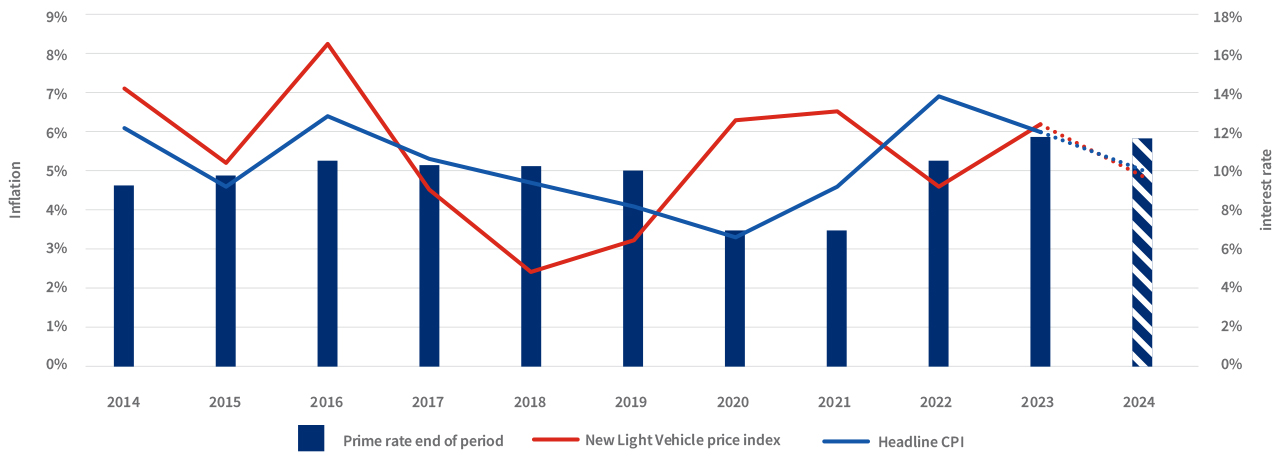

Growth in New Vehicle price inflation in 2023 came in at an annual average of 6.2% in 2023, which was a significant jump on the 4.6% rise seen in 2022, but reasonably similar to the 6% rise in Headline CPI in 2023. The projected outlook for New Vehicle price inflation for 2024 is 5%, close to the likely Headline CPI average of 5.1%.

New Light Vehicle price inflation vs Headline CPI vs prime rate

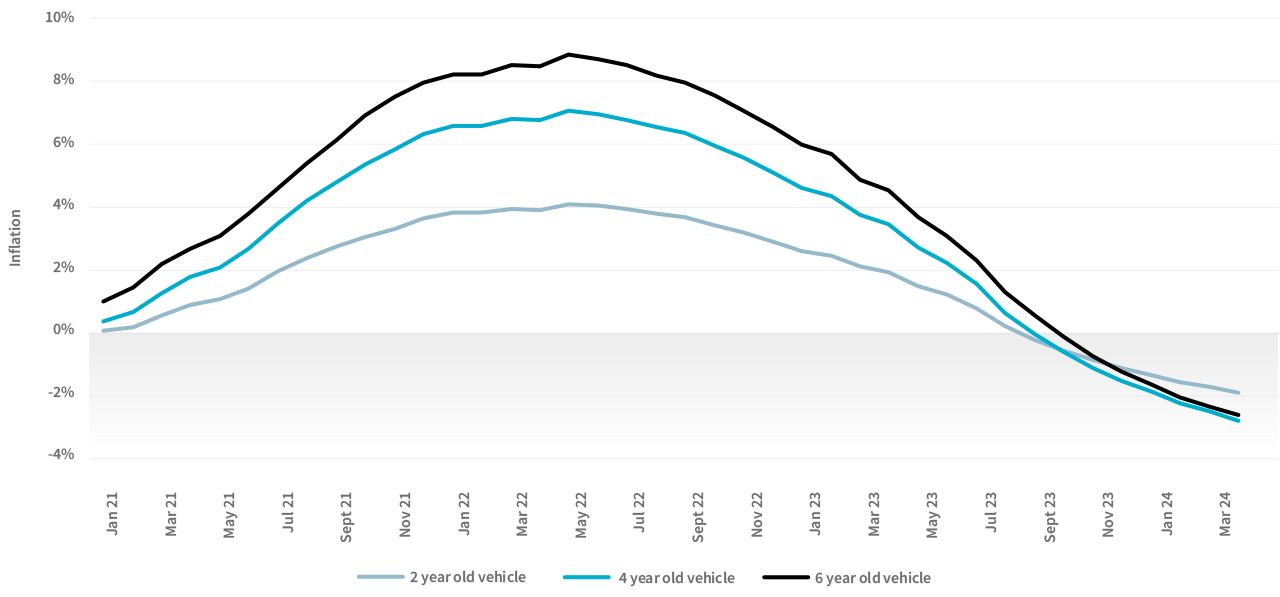

Used Passenger Vehicle inflation y-o-y for 2-year-old vehicles (see graph below) was -1.9% at the end of April (meaning, on average, a 2-year-old Passenger car was retaining 1.9% less of its original value in April 2024 than it was in April 2023). This is marginally lower than in March 2024 (-1.8%), and quite a bit lower than in April 2023 (+1.9%).

For 4-year-old vehicles, inflation was running at -2.8% y-o-y in April, versus -2.5% in March and +3.4% in April last year, while for 6-year-old Passenger Vehicles, April’s inflation was -2.6%, compared to -2.4% in March 2024 and +4.5% in April 2023.

Used Passenger Vehicle inflation – 2, 4 and 6 year-old vehicles

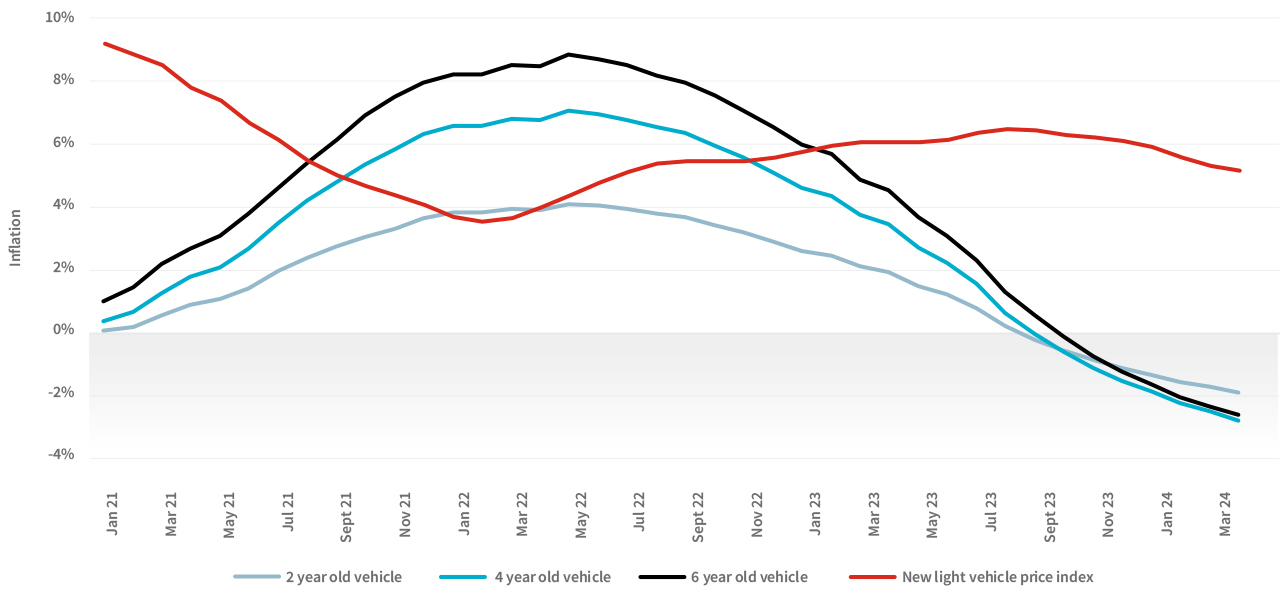

Over the last three years, we can see (graph below) how New Vehicle inflation and Used Vehicle inflation generally trend in opposite directions. As New Light Vehicle inflation declined through 2021 and into 2022, and New Vehicle sales struggled to recover from the Covid-induced slump, Used Vehicle sales were on the rise, and the increased demand drove the price inflation for these vehicles higher.

New Light Vehicle price index (trend cycle) vs Used Passenger Vehicle inflation

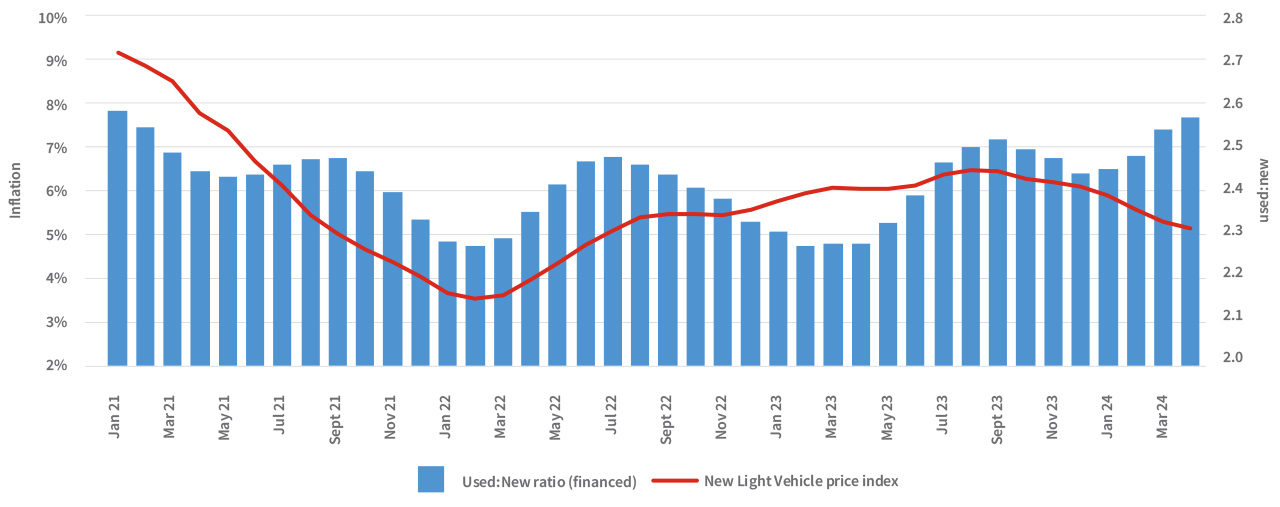

Interestingly, the trend cycle for the ratio of used to new financed vehicle sales appears to roughly mirror the trend cycle for New Light Vehicle Price inflation. This makes sense, as the more slowly new vehicle prices are increasing, the more attractive new vehicles become to prospective consumers and the gap between the number of used cars being sold vs the number of new cars narrows.

New Light Vehicle price index (trend cycle) vs Used:New ratio (trend cycle)

.png)

.png)

.png)

.png)