Auto Insights Newsletter | June 2024

New vehicle sales

in reverse

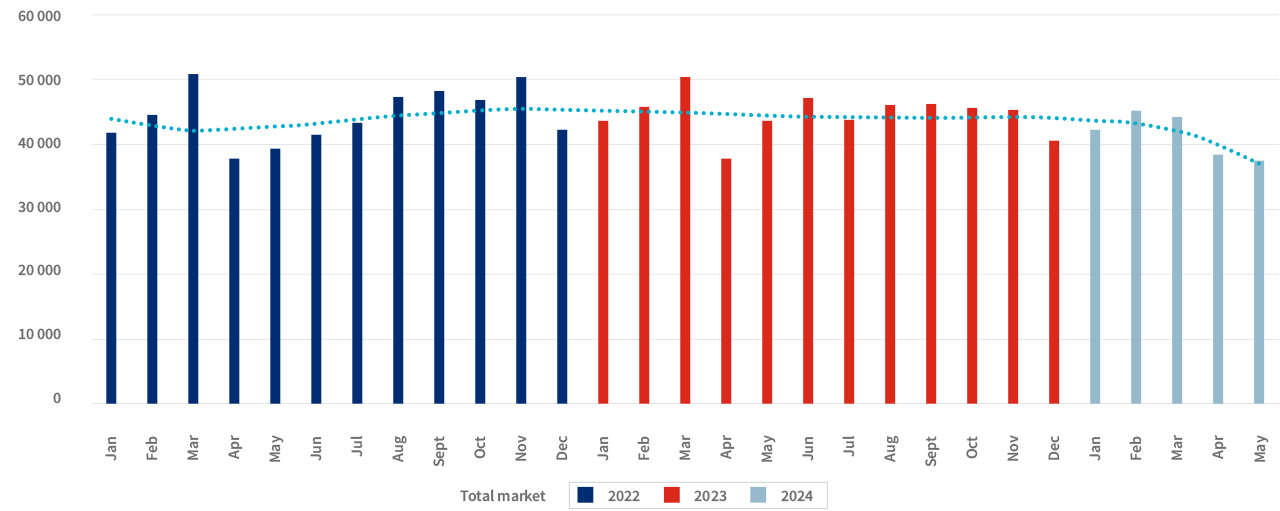

New vehicle sales in May 2024 (37 120 units) were 14.2% down on May 2023, according to naamsa, and 2.5% down on April 2024. The struggling market was partly attributed to the uncertainty surrounding the national elections at the end of May, although the positive reaction to the formation of a new government holds the promise of better times to come.

Passenger vehicle sales dropped by 11.6% year-on-year in May to 24 380 units, while Light Commercial Vehicles (LCV) sales fell to 10 337 units, a 19.4% plunge on sales in May 2023.

New vehicle sales: January 2022 - May 2024

Overall sales for the first five months of 2024 were 6% lower than for 2023, and 3.1% below sales for the same window in 2022. naamsa reported a total of 205 980 units sold between January and May, of which around 86.2% represented dealer sales.

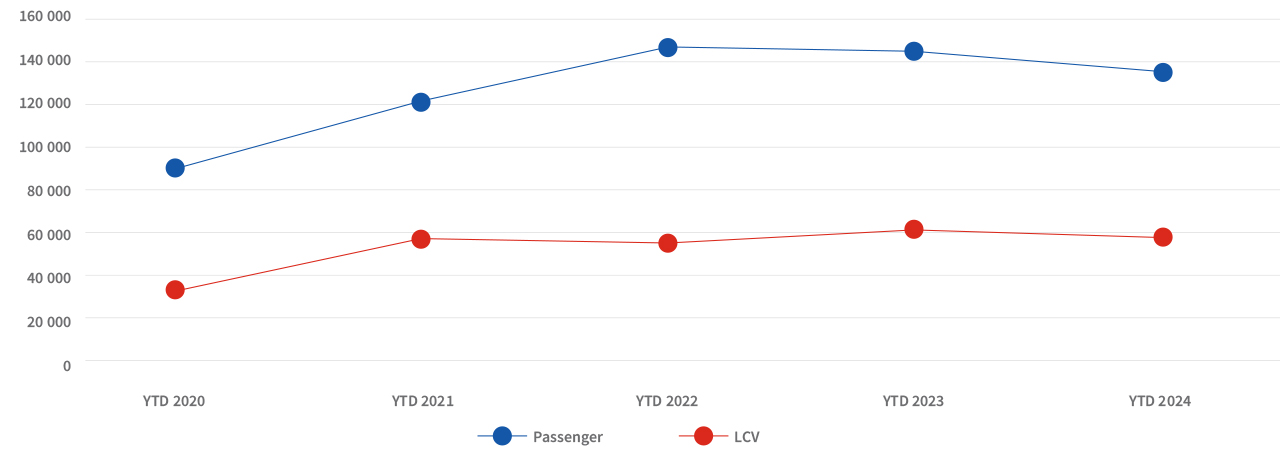

Passenger vehicle sales were down 6.4% year-on-year for the five months, while sales of LCVs declined 6.1% compared to 2023. The car rental industry accounted for an estimated 10.1% of new Passenger car sales in the January to May window, lower than the 10.3% share in the corresponding period in 2023 and 13.1% in 2022.

Passenger and Light Commercial new vehicle sales (January to May)

The market outlook for 2024 is not expected to grow because of heightened pressures throughout the macroeconomic environment, with GDP expected to grow at just 1.1% while the Rand has held reasonably steady against major global currencies.

Headline consumer inflation is projected to continue within the Reserve Bank’s 3% - 6% target range, with the possibility of an interest rate cut by the Reserve Bank later this year.

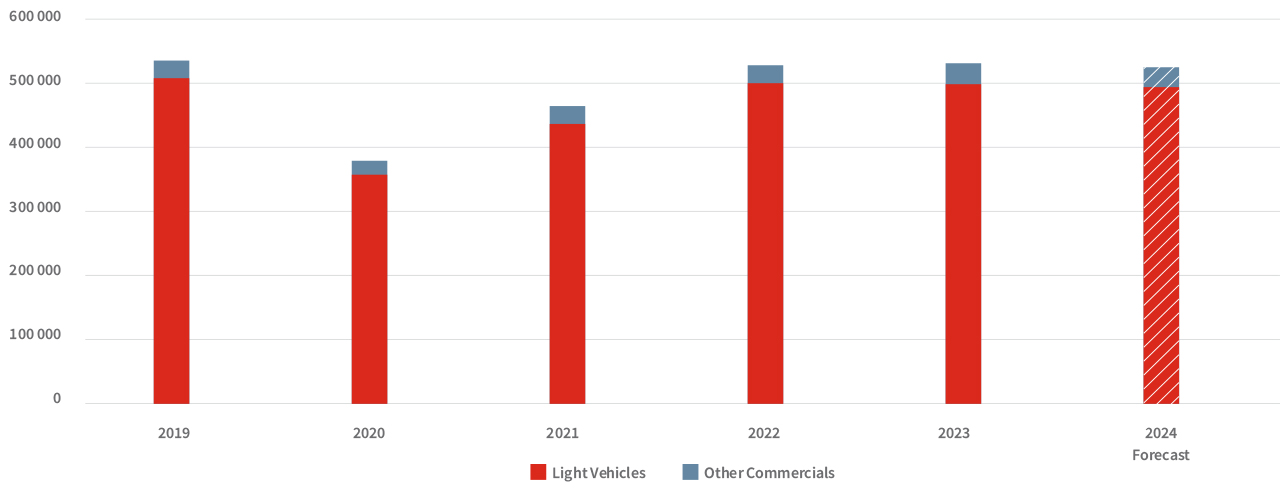

Anticipated new vehicle sales for 2024 currently sit at around 526 500 units, of which 494 000 are Light Vehicles (Passenger and Light Commercial). Overall, new vehicle sales are expected to end 2024 in the region of -1%, lower than the modest 0.5% growth in new vehicle sales in 2023.

New vehicle sales - 2019 to 2024

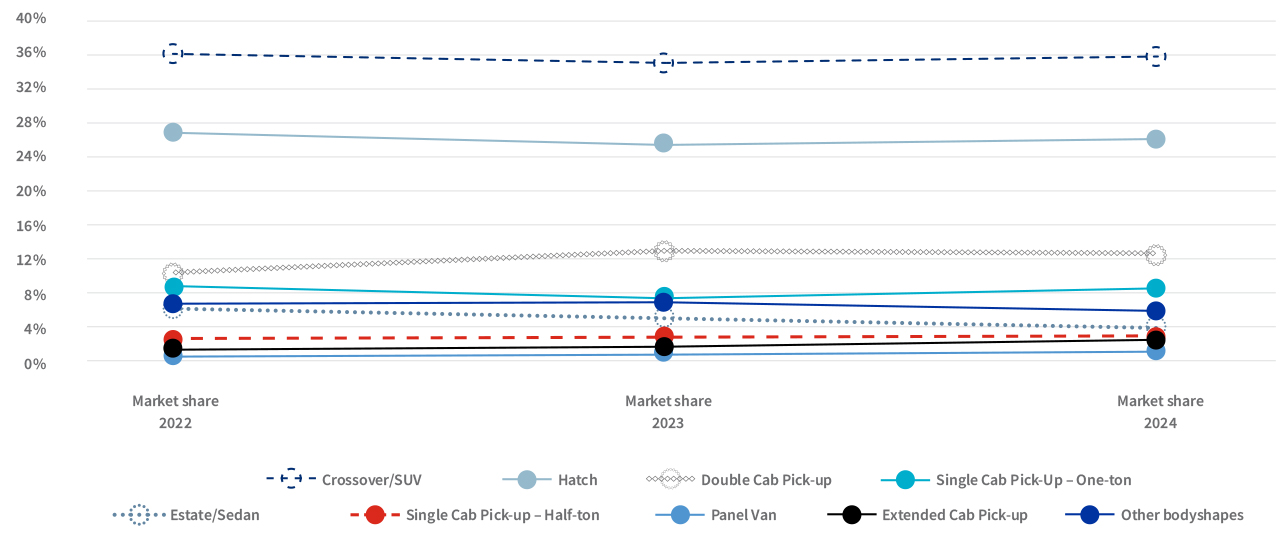

Market observations – bodyshape

The Crossover/SUV bodyshape remained the country’s best selling Light Vehicle (Passenger & LCV markets) bodyshape in the first five months of 2024. Sales of the Crossover/SUV, (which includes the Chery Tiggo 4 Pro, Haval Jolion and Toyota Corolla Cross) totalled 69 859 new units, of which 89.3% were Dealer sales, and 6.3% reported through the Rental channel.

Sales for the Crossover/SUV bodyshape for the five months dipped 4.7% from the same period in 2023, and made up 36% of all Light Vehicle sales for January to May, more than the 35.4% market share for the same period in 2023.

The second-best performing bodyshape in terms of volume was the Hatch (which includes Suzuki Swift, Toyota Starlet and VW Polo Vivo) with 50 676 units sold between January and May. Nevertheless, sales in this this category fell by 4.5% from the same period in 2023.

Sales for the Panel Van bodyshape, which includes the Suzuki Eeco, Toyota Quantum and Volkswagen Caddy, amongst others, leapt 29.7% year-on-year in the January to May period from 2023, which in turn was 37.4% up on the bodyshape total for 2022.

This makes the Panel Van bodyshape the best performing Light Vehicle segment in terms of sales growth, despite not being one of the bigger segments. Over the first five months of 2024, the Panel Van bodyshape made up 1.2% of all Light Vehicle sales, up from 0.8% in the same period in 2023.

The second most improved bodyshape for year-on-year growth over the first five months of 2024 was the Extended Cab Pick-Up bodyshape (which includes Ford Ranger, Isuzu D-Max & Toyota Hilux), with sales climbing 25.9% from a year earlier.

Light Vehicle bodyshapes - share of Light Vehicle market (January - May)

Hybrid & Electric vehicle sales

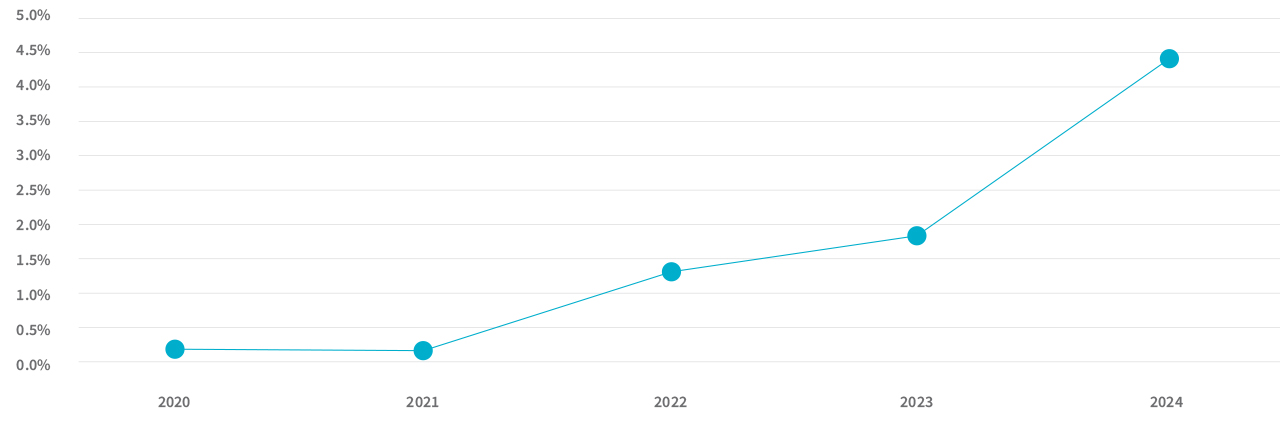

New Hybrid & Electric Passenger vehicle sales (which included Traditional Hybrid, Plug-in Hybrid and Battery Electric vehicles) for the first five months of 2024 numbered 5 906 units, and were 124% up on 2023, which in turn had jumped 37% from 2022. The full Passenger market share for these vehicles was 4.4% for the first five months of 2024.

Hybrid & Electric Vehicle share of Passenger sales (January to May)

Traditional Hybrid vehicles had 86% share of the sub-segment over the first five months of 2024, with Battery Electric vehicles making up 10% of sales and Plug-in Hybrid vehicles responsible for 4%.

.png)

.png)

.png)

.png)