Auto Insights Newsletter | August 2021

Vehicle sales inch up

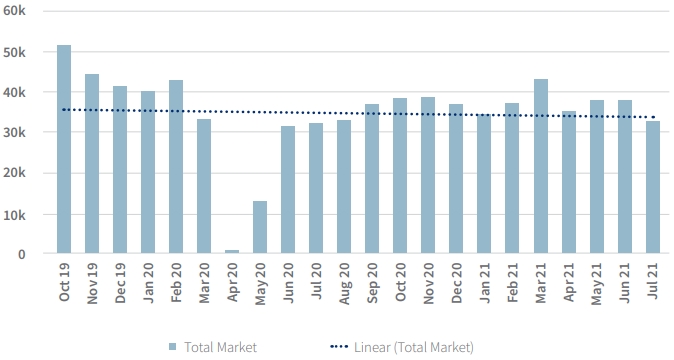

New vehicle sales in July 2021 (33 063 units) were up 2% compared to July 2020 according to naamsa – but down by 13.3% compared to June 2021- perhaps due to Lockdown Level 4 restrictions and the recent civil unrest.

Vehicle sales for the remainder of the year are likely to come under further pressure as global semi-conductor shortages continue to negatively affect vehicle production around the world.

Passenger vehicle sales grew by 9.7% year-on-year in July to 20 689 units, but Light Commercial vehicle sales were 8.1% down, dropping to 10 257 units when compared with July 2020.

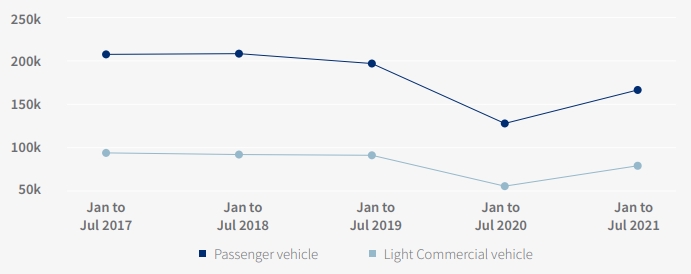

Overall sales for the first seven months of 2021 were 33.8% higher than for the first seven months of 2020, but still 14.2% down compared to 2019.

naamsa reports that 260 574 units were sold by end July 2021, of which around 85% represents dealer sales. Passenger vehicle sales were up 30.2%, and sales of LCVs increased by 42.3% compared to the January to July 2020 window. The car rental industry accounted for an estimated 12.8% of new Passenger car sales between January and July 2021, and this compares favourably to a 10% share in the 2020 window and 14% in 2019.

New vehicle sales

Passenger and Light Commercial new vehicle sales year-to-date

January-July

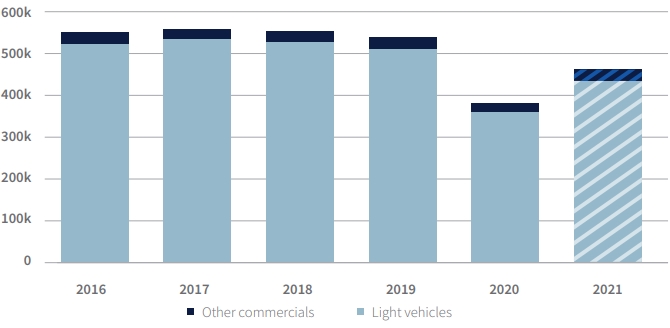

The market outlook for 2021 has been affected by the month-long Level 4 Lockdown, along with the civil unrest in KwaZulu-Natal and Gauteng. On a positive note, GDP is still expected to grow, headline consumer inflation is likely to remain relatively subdued and interest rates should continue at historically low levels.

This puts projected new vehicle sales for 2021 at around 460 000 units, of which 433 000 are Light vehicles (Passenger and Light Commercial). Overall, growth in new vehicle sales is expected to end close to 21%.

New vehicle sales 2016 to 2021

Market observations

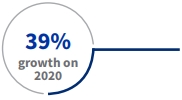

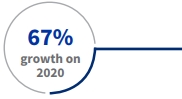

The Entry segment (which includes the likes of the Kia Picanto, Toyota Starlet and Volkswagen Polo Vivo) topped the Light Vehicle (Passenger and LCV markets) segment for the first seven months of 2021, with 44 481 new units sold – of which 79% were Dealer sales and 18% reported through the Rental channel.

Sales for the Entry segment picked up 39% from the seven months ending July 2020, which in turn was 38% down on the 2019 window.

The second-best performing segment in terms of volume was the Crossover segment (including Ford EcoSport, Hyundai Venue and VW T-Cross) with 42 592 units sold in the seven months to July 2021, and this segment has strengthened by 74% compared to the same period in 2020.

This significant year-on-year growth enjoyed by the Crossover segment makes it the best performing Light Vehicle segment in terms of sales growth – and it’s the leading segment choice for women. (See our story “Women go big in vehicle choice” in this newsletter).

The Dealer channel accounted for 91% of Crossover segment sales, and 5% were Rental sales. Over this seven-month window, the Crossover segment makes up 17% of all Light Vehicle sales, up from 13% a year ago.

The next most improved segment over the first seven months is the Large segment (eg Audi A5, BMW 5 Series and Jaguar XF), with a year-on-year jump of 67% over the seven months to July 2020.

Light vehicle segments - share of Light vehicle market - January to July

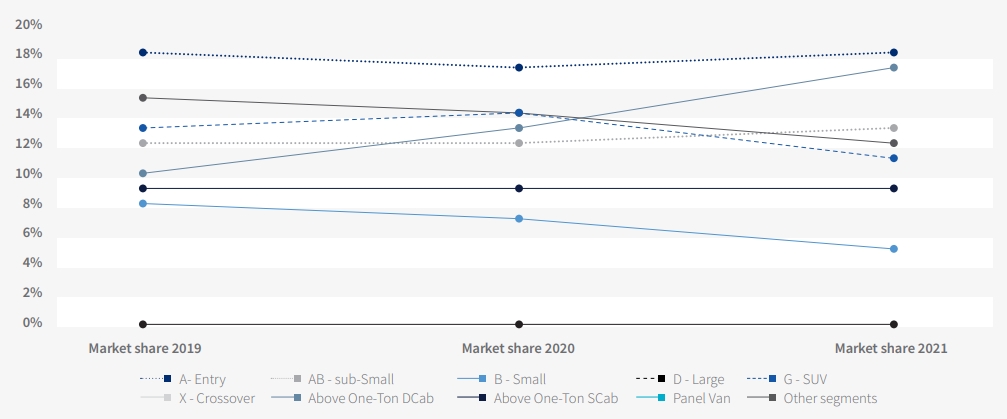

There is much talk globally around non-fossil fuel powered vehicles, and many countries and OEMs have committed to targets to phase out petrol / diesel-engine vehicles in favour of electric and hybrid options.

In some countries in northern Europe, more than 50% of monthly new Light vehicle sales are already either electric or plug-in hybrid vehicles, with vehicle types such as the Ford Mustang Mach-E, the Volkswagen ID.4 and the Volkswagen e-up dominating sales. Of course, a number of these countries have incentivised the purchase of hybrid / electric-powered vehicles through various tax exemptions, making them very competitively priced when compared to their petrol-powered siblings.

In South Africa, we are not quite there yet, with just 0.1% of Passenger cars sold in 2021 being either electric or hybrid- powered options. This share has been consistent over the past decade as the limited number of options and the associated price tags attached to these vehicles have dampened appeal among consumers – not to mention the sparse (albeit growing) charging network available in the country and an unreliable electricity infrastructure.

Market share of fuel types in the Passenger market

In 2012 only five marques had a hybrid offering in the local market, with domestic sales being dominated by Toyota, Lexus and Honda. In 2013 this number jumped to eight, including Nissan’s all-electric Leaf. This number of brands moved between six and nine until 2020 which saw sales from ten different marques. This crept to 11 in 2021.

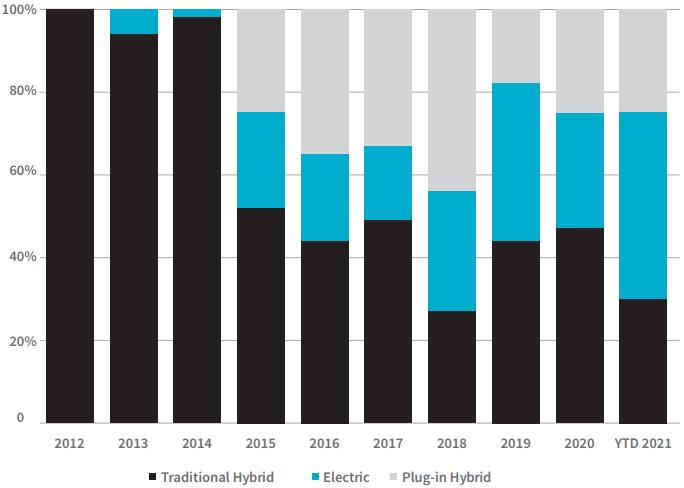

The change in the spread between the traditional hybrid, the plug-in hybrid and the all-electric sales has also been significant, with the latter, after humble beginnings in 2013 (6% of hybrid / electric sales), gaining momentum as more options entered the market and currently holding a 45% share of the hybrid / electric market.

Share of hybrid / electric power in the Passenger market

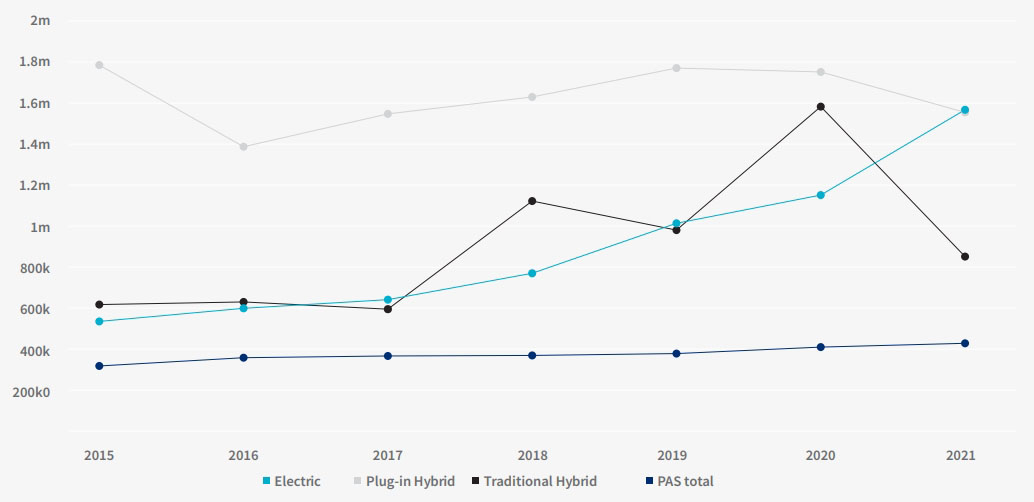

However, in SA we have yet to see the hybrid / electric market make any significant inroads into the petrol / diesel market share, and this is possibly to do with price in the country. Since 2015, the weighted average price of hybrid and electric vehicles has consistently exceeded that of the overall Passenger market, occasionally at levels more than double the market average.

Weighted average prices (Rand)

Current examples of the offerings in the hybrid / electric space in South Africa include: the Mini Hatch (electric), Lexus UX (traditional hybrid), Volvo XC90 (plug-in hybrid), Jaguar I-Pace (electric) and BMW i3 (electric).

Solutions that simplify the complex

Our new website makes it easier to navigate and discover a range of Lightstone products and solutions that make it easier for you to do business.

One place to access your subscriptions

We’ve simplified the complex with a single sign on functionality. Simply login and you will have access to all the products that you currently subscribe to. All in one portal.

What’s happening to the old website?

A few links on our new website may redirect you to certain pages on the old website. This is just a temporary solution to ensure legacy users still have access to certain products.

.png)

.png)

.png)

.png)