Auto Insights Newsletter | August 2021

Women go big in vehicle choice

Women’s buying preferences are changing and moving away from the small hatchback and sedan towards the bigger, sturdier Crossover and SUV options as safety, domestic convenience and more spending power drive purchasing decisions.

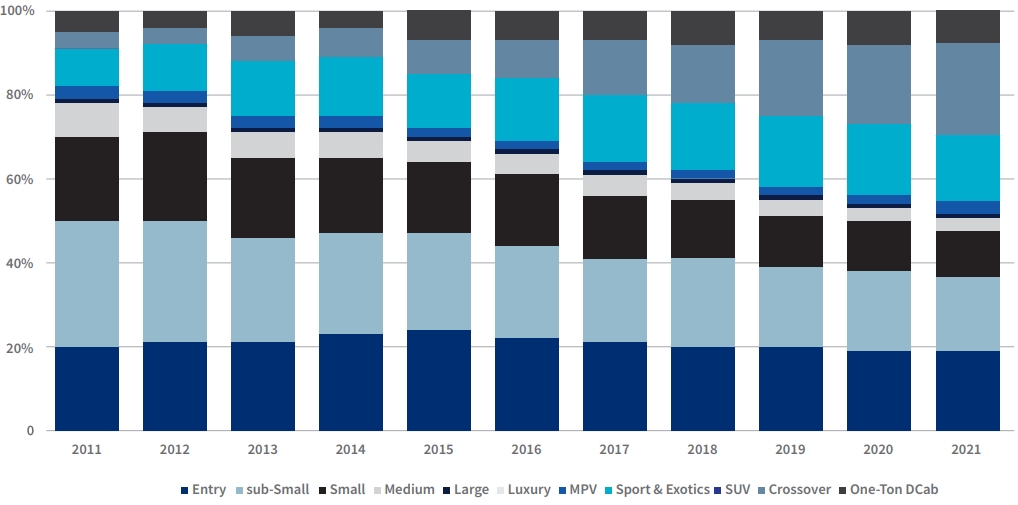

In 2011, looking at the Passenger and One-ton Double-cab pickup markets, women buyers were most active in the sub-Small segment (Ford Fiesta / Hyundai i20 / VW Polo), making up around 30% of sales to women, followed by the Entry (Ford Figo / Toyota Etios / VW Polo Vivo) and the Small segments (BMW 1 Series / Toyota Corolla / VW Golf) each making up around 20% of sales. The Medium segment (Audi A4 / BMW 3 Series / Hyundai Sonata) made up 8% of the sales in 2011, and the combined hatch / sedan share of sales to women in 2011 was 80%.

By contrast the combined share of sales for the SUV (Hyundai iX35 / Toyota Fortuner / VW Tiguan), Crossover (Ford EcoSport / Mazda CX-3 / Nissan Qashqai) and Double-cab segments (Ford Ranger / Isuzu KB / Toyota Hilux) was just 17%, with over half of that going to SUV.

Over the course of the decade, we have seen a definite shift away from the hatch / sedan option towards the chunkier appeal of the SUV / Crossover-type vehicle (with a Double-cab being viewed in a similar light to some of the larger SUVs). Over the first half of 2021, the most popular segment among women buyers is now the Crossover segment, with a 22% share of the market, followed by the Entry (19%), sub-Small (18%) and SUV segments (16%).

Share of women’s buying patterns by segment - Passenger and Double-cab

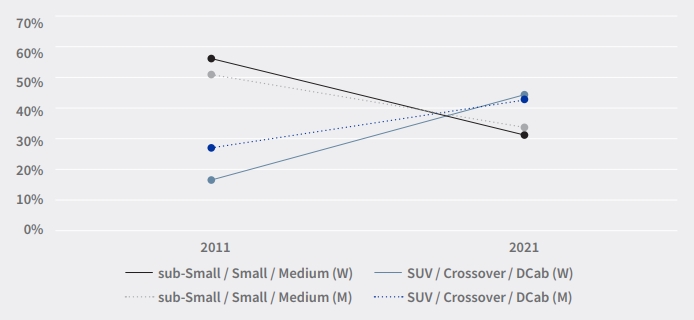

A combination of the sub-Small / Small / Medium segments (which made up 58% of sales to women in 2011) now makes up just 32% of purchases by women.

Conversely, the share for the SUV / Crossover / Double-cab axis has climbed from the 17% mentioned earlier to 45%, more than doubling its market share! It could be argued these patterns are simply tracking market trends, but if we compare the shift in women’s buying patterns to that of men there is clearly a more significant shift in the behaviour of the former.

Shift in buying patterns from sub-Small / Small / Medium hatches and sedans to SUV / Crossover / Double-cabs: Women vs Men

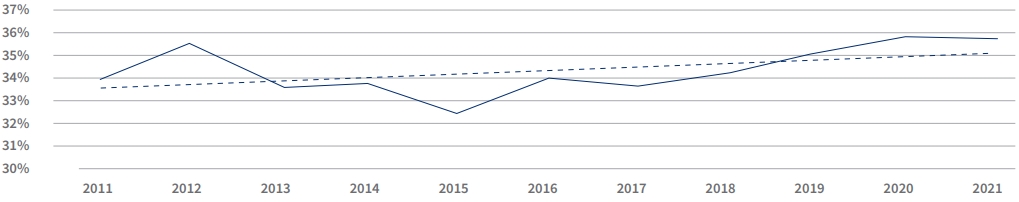

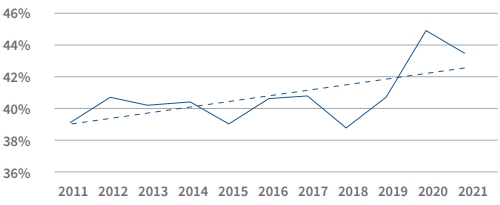

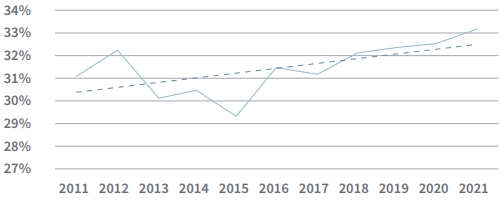

Women buying more – Signio

The graphs below demonstrate a slow but steady increase in the percentage of vehicles bought by women, who are accounting for just under 36% of new and used vehicle purchases, up from a low of 32% in 2015. The trendlines are positive in both the new and used vehicle categories.

Percentage of new and used vehicle deals by women

Percentage of new vehicle deals by women

Percentage of used vehicle deals by women

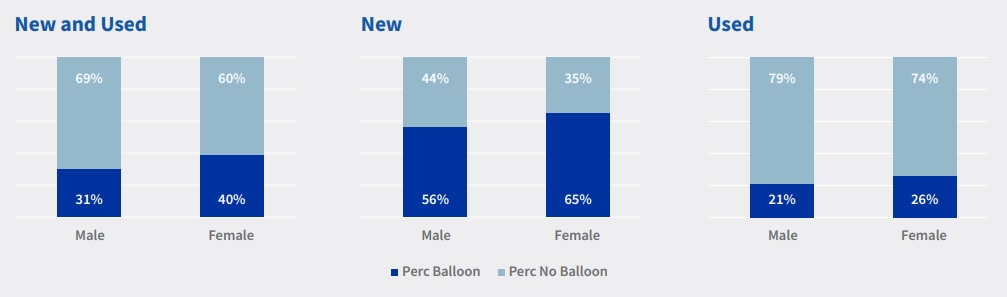

Balloon payments

Signio data for the last 36 months (August 2018 to July 2021) shows that women are more likely to use balloon payments than men – and that balloon payments are used mostly on new vehicles. This possibly indicates women’s intention to drive their chosen vehicle for longer and the need for more disposable monthly income that the lower monthly premiums balloon payment options provide.

Solutions that simplify the complex

Our new website makes it easier to navigate and discover a range of Lightstone products and solutions that make it easier for you to do business.

One place to access your subscriptions

We’ve simplified the complex with a single sign on functionality. Simply login and you will have access to all the products that you currently subscribe to. All in one portal.

What’s happening to the old website?

A few links on our new website may redirect you to certain pages on the old website. This is just a temporary solution to ensure legacy users still have access to certain products.

.png)

.png)

.png)

.png)