Auto Insights Newsletter | June 2021

New vehicle sales climbing towards pre-Covid-19 levels

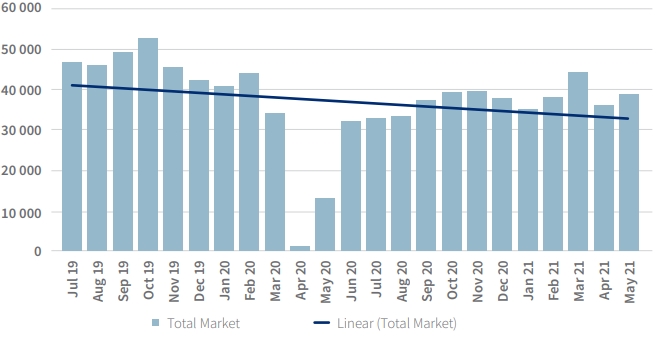

New vehicle sales in May 2021 were 198% (38 344 units) up on May 2020, reported naamsa. May 2020 marked South Africa’s move from lockdown level 5 to 4, and dealers were able to begin trading again in the latter stages of the month.

The May 2021 figures were 7.7% up on April, suggesting ongoing recovery in the market. But this will depend, to a considerable extent, on South Africa’s continuing response to the pandemic – in particular a successful vaccination programme – and the extent to which further restrictions are introduced on the movement of people and economic activity.

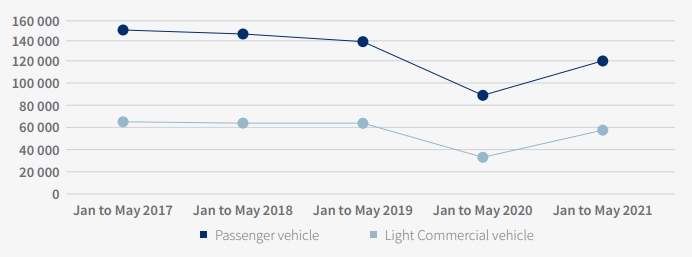

Passenger vehicle sales grew by 169% year-on-year to 24 105 units, and Light Commercial Vehicles sales were 288% up, surging to 11 912 units, when compared with May 2020.

Overall sales for the first five months of 2021 were 44.9% higher than for the first five months of 2020, which in turn were 38.3% down on 2019. This New vehicle sales graph shows the downward trend in sales since June 2019, reflecting the generally difficult economic circumstances in the country even prior to Covid-19.

naamsa reported a total of 189 396 units for 2021, of which around 85% represents dealer sales. Passenger vehicle sales were up 35%, and sales of LCVs increased by 68.4% compared to the January to May 2020 window.

The car rental industry accounted for an estimated 13.3% of new Passenger car sales between January and May 2021, and this compares favourably to a 14% share in the 2020 window and 12% in 2019.

New vehicle sales

Passenger and Light Commercial new vehicle sales year-to-date

January-May

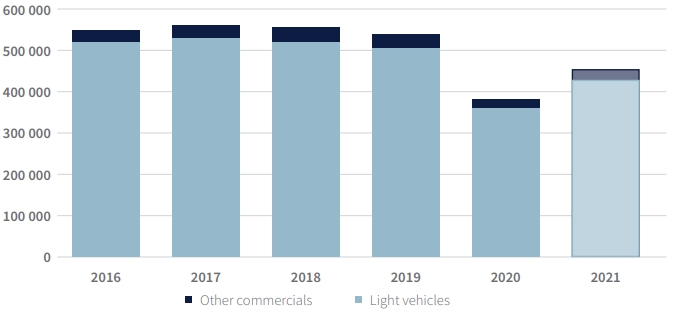

New vehicle sales fell by 29.1% in 2020 compared to 2019 as the fallout from the Covid pandemic and resultant lockdowns affected the local (and global) economy.

The Passenger market was the hardest hit, dropping almost 31% to 246 541 units, the lowest annual total since 2003. There is an improved market outlook, however, for 2021, as GDP is expected to grow, albeit off a much lower base, headline consumer inflation is projected to remain relatively subdued and interest rates are likely to continue at historically low levels.

This puts projected new vehicle sales for 2021 at around 470 000 units, of which 442 000 are Light vehicles (Passenger and Light Commercial). Overall, growth in new vehicle sales is expected to end close to 24%.

New vehicle sales 2016 to 2021

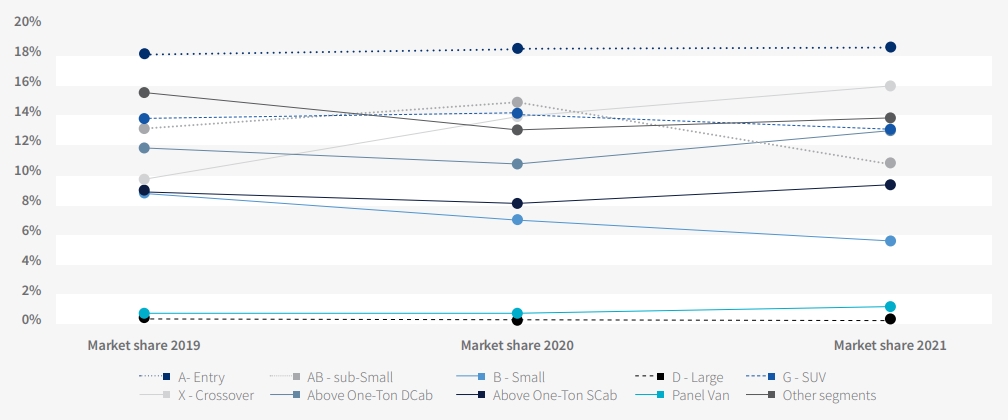

Market observations

The Entry segment (which includes the likes of the Kia Picanto, Toyota Starlet and Volkswagen Polo Vivo) was the largest Light Vehicle (Passenger & LCV markets) segment for the first quarter of 2021, with 20 209 new units sold – of which 79% were Dealer sales, and 18% reported through the rental channel. Sales for the Entry segment were down by 1.4% compared to the three months ending March 2020, which in turn was 11.5% down on 2019-Q1.

The second-best performing segment in terms of volume was the Crossover segment (which includes Ford EcoSport, Hyundai Venue & VW T-Cross) with 17 276 units sold in the three months to March 2021. This segment is up 12.4% on the corresponding period in 2020.

The Large segment (which includes the likes of the Audi A5, A6 & BMW 5 Series) enjoyed the highest growth in percentage terms (42.9%) over the same window to March 2020, making it the best performing Light vehicle segment over the last three months. Over this three-month window, the Large segment made up 0.3% of all Light vehicle sales, up from 0.2% market share a year ago.

Large segment sales of 313 units were recorded between January and March 2021, of which 89.5% were Dealer sales, and one sale was reported through the Rental channel.

The next most improved segment in the first quarter is the Panel Van segment (eg Hyundai Grand i10, Toyota Quantum & VW Caddy), with a year-on-year jump of 31.9% over the three months to March 2020.

Light vehicle segments - share of Light vehicle market - Quarter 1

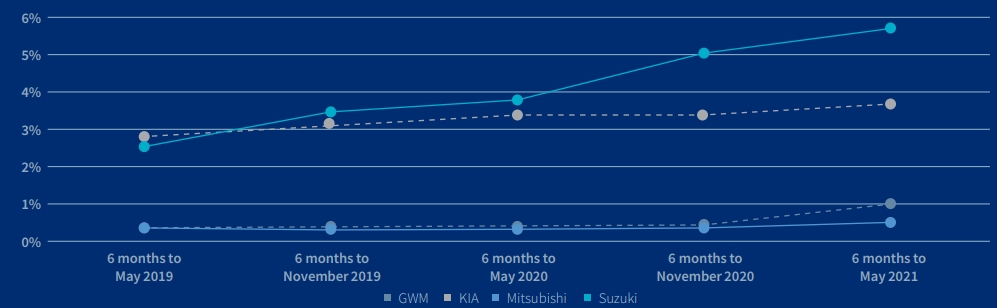

The six months to May 2021 saw the Light vehicle market expand by around 31% compared to the same period in 2020.

This recovery highlights the impact of the hard lockdown last year and lost selling days, and has seen several brands improve their sales/market share either through the introduction of new vehicle types or through refreshing their existing ranges.

The four marques selected all managed to sell at least 500 more vehicles in the December 2020 through to the May 2021 window when compared to the same period in 2019/20. It is also not surprising that three of the four have line-ups with strong ties to the top three segments in terms of sales volume: Entry, Crossover and SUV.

GWM is the odd one out in this group, as they currently operate in the Light Commercial market. The introduction of the new P-Series pickup in the latter stages of 2020 has enabled the brand to improve its market share from 0.4% for the six months to May 2020 to 1.1% in 2021.

Kia recently introduced the Sonet to the local market and this, along with many revisions to a number of existing ranges, saw the marque increase in market share to 3.7% in the December 2020 to May 2021 window from 3.5% the year before.

Mitsubishi also introduced updates to their existing range and this helped push their market share from 0.3% in the six months to May 2020 to 0.6% in May 2021.

Lastly, Suzuki saw its market share for the six months to May improve from 3.8% in 2020 to 5.7% in 2021. This improvement was assisted in no small part by the performance of S-Presso, which was launched just prior to the lockdown in 2020, and the Vitara Brezza which entered the South African market earlier this year.

Selected Light vehicle brands market share 2019 - 2021

Solutions that simplify the complex

Our new website makes it easier to navigate and discover a range of Lightstone products and solutions that make it easier for you to do business.

One place to access your subscriptions

We’ve simplified the complex with a single sign on functionality. Simply login and you will have access to all the products that you currently subscribe to. All in one portal.

What’s happening to the old website?

A few links on our new website may redirect you to certain pages on the old website. This is just a temporary solution to ensure legacy users still have access to certain products.

.png)

.png)

.png)

.png)