Auto Insights Newsletter | June 2022

New vehicle sales climb despite multiple challenges

Market on track to grow by 12% in 2022

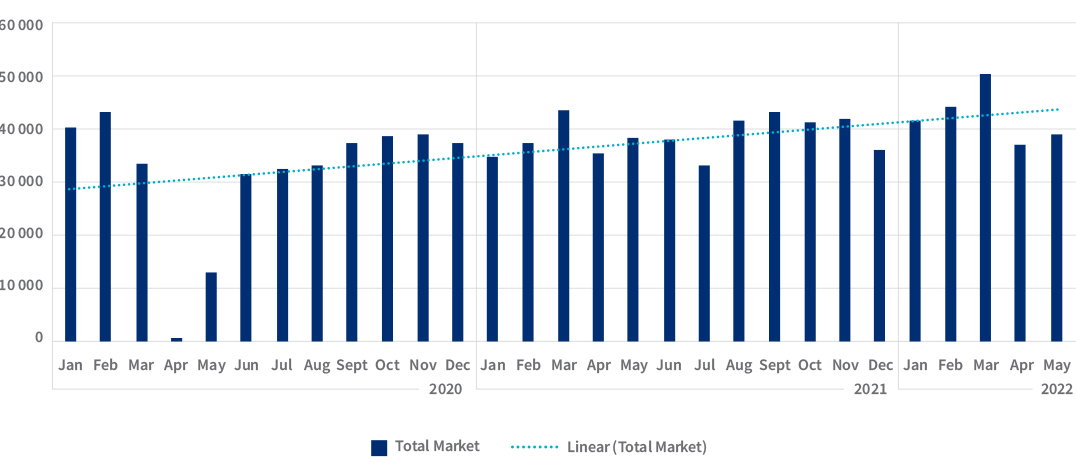

New vehicle sales in May 2022 (39 063 units) were 1.8% up on May 2021, according to naamsa.

The May 2022 figures were also 5.1% up on April 2021, as the local market continued to grow despite the world-wide semi-conductor shortage impacting motoring brands and markets across the globe, the constraints and delays in international shipping and the extensive flooding in KwaZulu-Natal in April, which affected the Port of Durban and, possibly more significantly, Toyota’s production facility.

While Passenger vehicle sales grew by 13.4% year-on-year in May to 27 348 units, Light Commercial Vehicles sales were 22.3% down, reaching 9 261 units, when compared with May 2021.

New vehicle sales

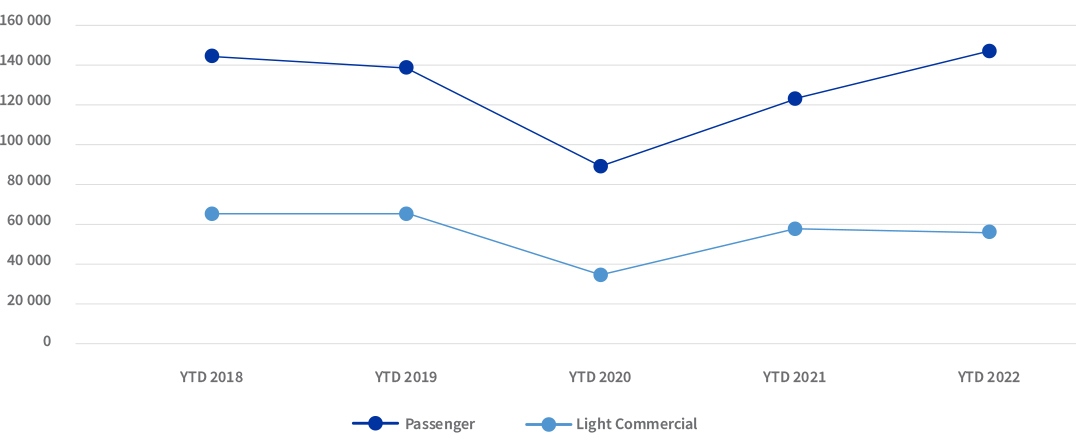

Overall sales for the first five months of 2022 were 12.2% higher than for 2021, and 62.5% above sales in the 2020 window.

naamsa reported a total of 212 423 units sold between January and May, of which around 85.5% represented dealer sales. Passenger vehicle sales were up 20.9% year-on-year for the five months, but sales of LCVs dropped 5.1% compared to 2021.

The car rental industry accounted for an estimated 13.1% of new Passenger car sales over the first five months of 2022, slightly behind the 13.4% share in the 2021 window, as well as the 14.0% in 2020.

January to May - Passenger & Light Commercial new vehicle sales

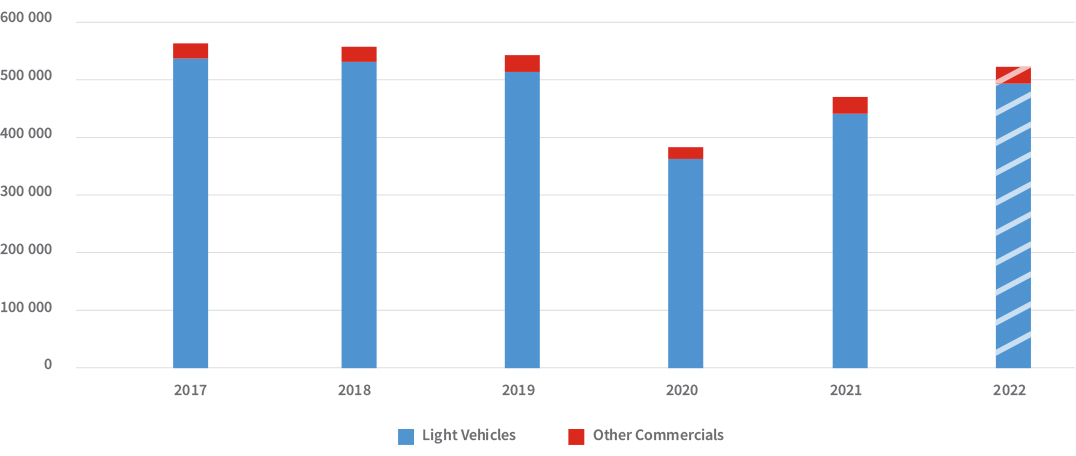

The market outlook for 2022 is showing some growth over 2021, despite pressures throughout the macroeconomic environment, with GDP growth expected to be lower in 2022 compared to 2021, with headline consumer inflation already pushing the upper reaches of the Reserve Bank’s target range and the Reserve Bank continuing to hike interest rates over the course of the year. The war in the Ukraine is already having an impact on global markets, and this is in addition to the semi-conductor shortage and supply issues.

This puts projected new vehicle sales for 2022 at around 518 000 units, of which 489 500 are Light vehicles (Passenger and Light Commercial). Overall, growth in new vehicle sales is expected to end 2022 in the region of 12%.

New vehicle sales - 2017 to 2022

Market observations

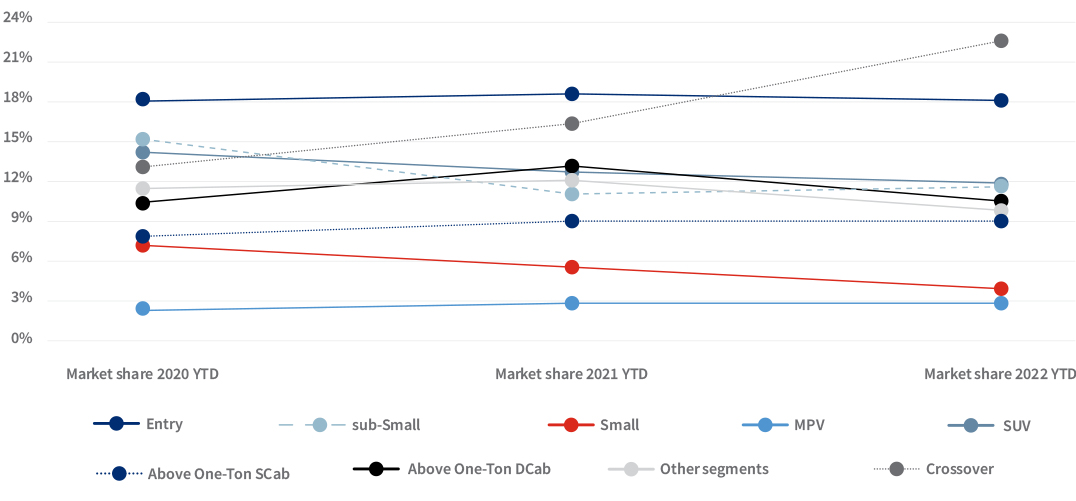

The Crossover segment (which includes the likes of the Haval Jolion, Toyota Corolla Cross and Volkswagen T-Cross) was the largest Light Vehicle (Passenger & LCV markets) segment for the first five months of 2022, with 45 866 new units sold – of which 92% were Dealer sales, and 7% reported through the Rental channel.

Sales in this segment have been impacted by the closure of the Toyota plant in KZN due to flood damage, as this is where the Corolla Cross is manufactured.

Sales for the Crossover segment between January and May also picked up 52% from 2021, which in turn was 77% ahead of the segment total for the first five months of 2020. This makes the Crossover segment the best performing Light Vehicle segment in terms of sales growth. Over the first five months of 2022, the Crossover segment made up 23% of all Light Vehicle sales, up from the 17% market share this segment enjoyed a year ago.

The second-best performing segment in terms of volume was the Entry segment (eg, Renault Kwid, Toyota Starlet and VW Polo Vivo) with 36 594 units sold over the first five months of 2022, with sales strengthening from 2021 by 13%.

The MPV segment (eg, Hyundai Staria, Suzuki Ertiga and Toyota Rumion) was the second most improved segment for year-on-year growth, increasing by 39% compared to the first five months of 2021.

Light Vehicle segments - share of Light Vehicle market (Jan-May)

.png)

.png)

.png)

.png)