Property Newsletter | March 2022

2021 residential property sales recover from Covid

… as sales fall at entry level, rising at mid to luxury levels

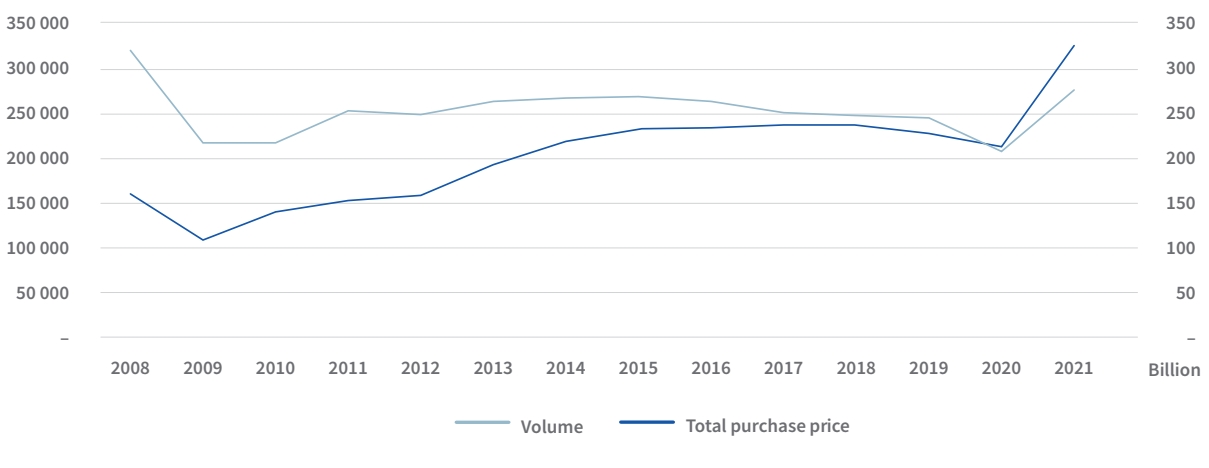

Residential property sales have made up ground lost during Covid and transfer volumes could be on track to break the 300 000 level last seen in 2008.

The total value of transfers in 2021 reached an all time high of R326 billion.

Transfers value and volume

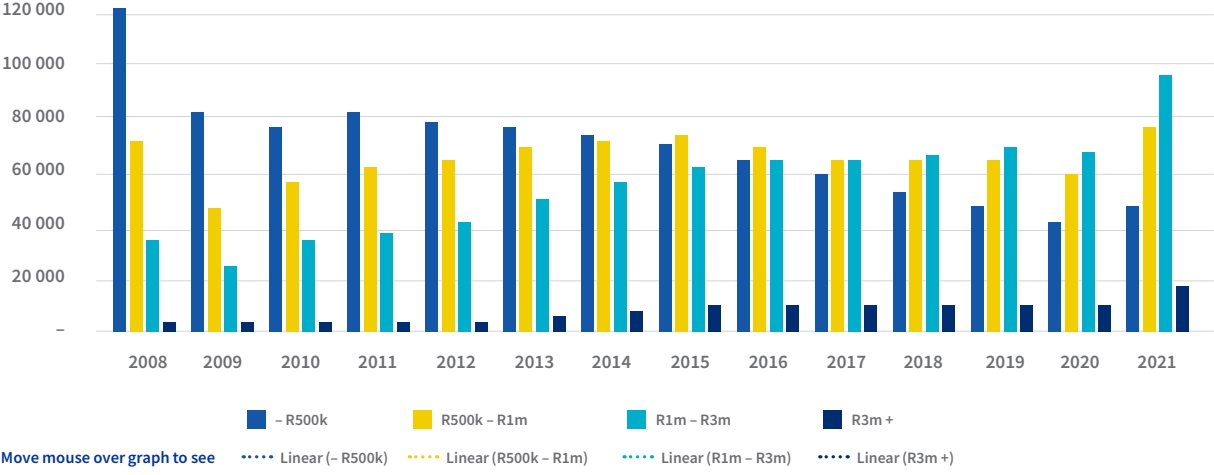

However, the data suggests it is the lower-income levels which are struggling. The less than R500k house band dropped signficantly from 2008 to 2009, then held steady until around 2015 and after that declined year after year until a welcome rise in transactions in 2021. The property market would want to see this sector continue to improve in the year ahead as it may be an indicator of improved economic circumstances for lower income workers.

Transfers purchase band: 2008 – 2021

Volumes in the R500k-R1m category touched 76 623 in 2021, their highest number since 2008 (72 003), while the R1m-R3m band has shown the most growth, from 34 771 in 2008 to 96 900 in 2021.

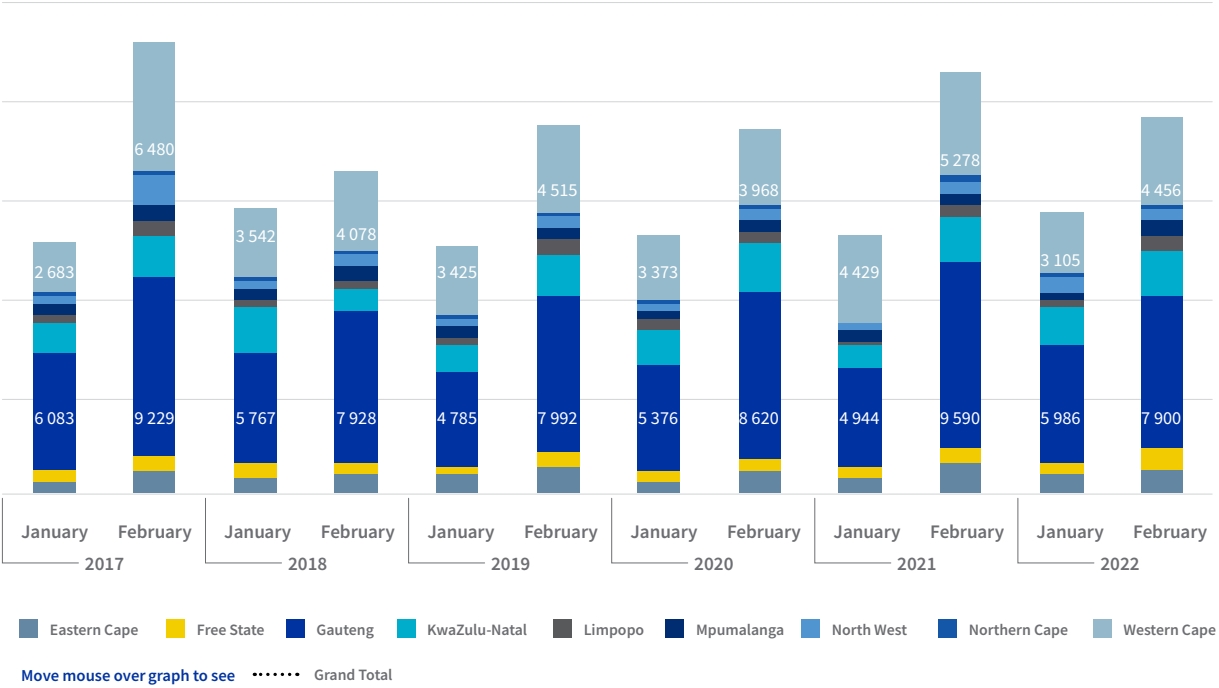

Looking ahead, the 2022 numbers are encouraging. In January, 12 494 transfers took place, the highest in that month since 2019, and the 16 696 transfers recorded in February were higher than 2019 and 2020, but short of 2021. Overall, the 29 190 in the first two months of 2022 compares favourably with the 30 706 in 2021 and ahead of 2020 (27 020) and 2019 (25 068).

Transfers purchase band: month on month

Gauteng and the Western Cape dominate the market, followed by KwaZulu-Natal, when comparing the opening two months of the past six years.

Transfers by province: month on month

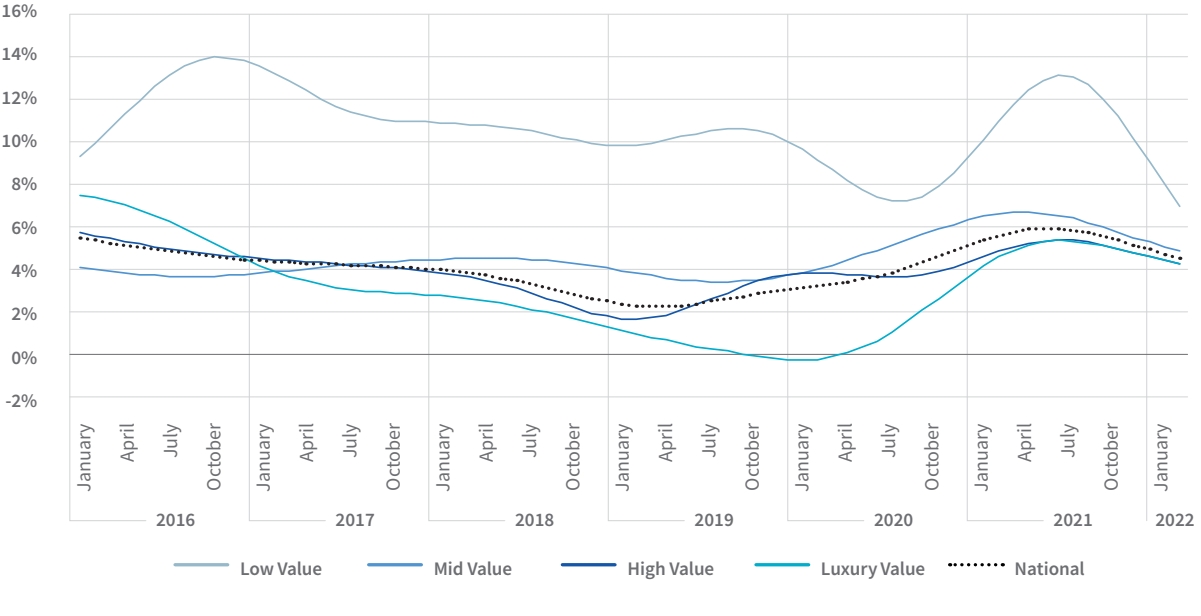

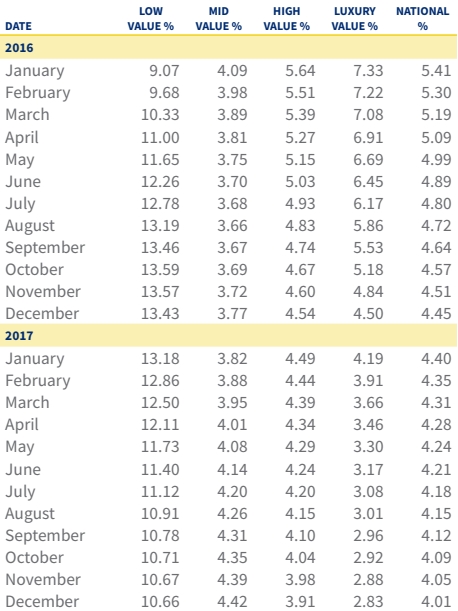

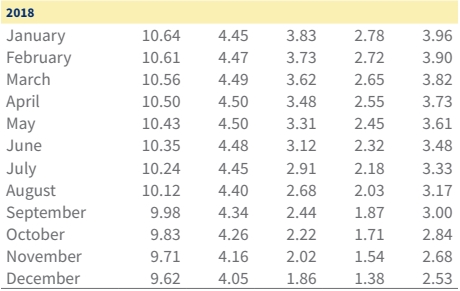

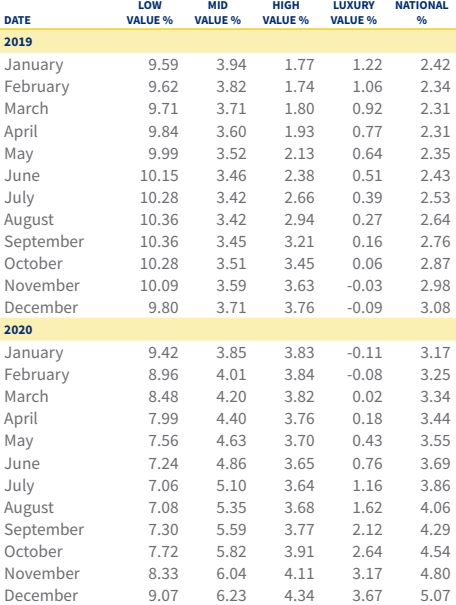

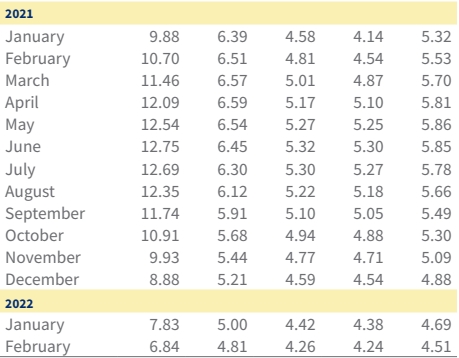

House price inflation

House price inflation by value segment

The house price inflation average for residential property in South Africa was 4.88% in Decemer 2021, up from a low of 2.31% in March 2019 and a recent high of 5.85% in June 2021

Three price bands – Mid Value, High Value, Luxury Value – ended 2021 at around the national average, while the Low Value HPI was at 8.88% in December 2021. So, despite declining volumes in the Low Value market, homes are holding their value better than other bands.

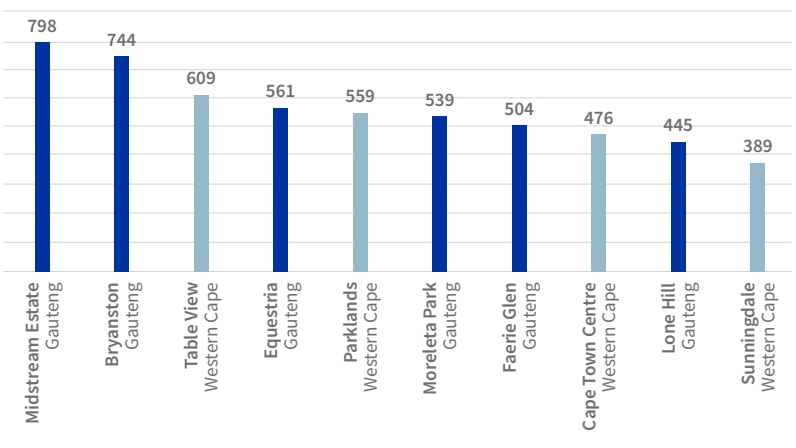

Top ten suburbs by transfers in 2021

Six Gauteng suburbs and four Western Cape suburbs make up the top ten in terms of transfer activity over the past twelve months.

Midstream Estate (798) in Midrand and Bryanston (744) in Sandton led the way, with Table View in the Western Cape in third place with 609 transfers.

Equestria was in fourth place, and one of three suburbs to the east and south-east of the Pretorial CBD to make the list with Moreleta Park and Faerie Glen. Parklands, Cape Town centre and Sunningdale make up the Western Cape contingent. Lone Hill in Sandton is the sixth Gauteng suburb in the top ten.

National highest volume of transfers for the last 12 months

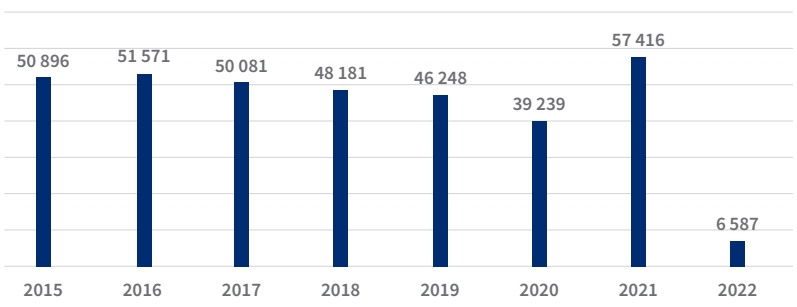

A good year for coastal living

Coastal transfers jumped to 57 416 in 2021, signficantly up on 2020’s 39 239 and the highest number recorded since 2015.

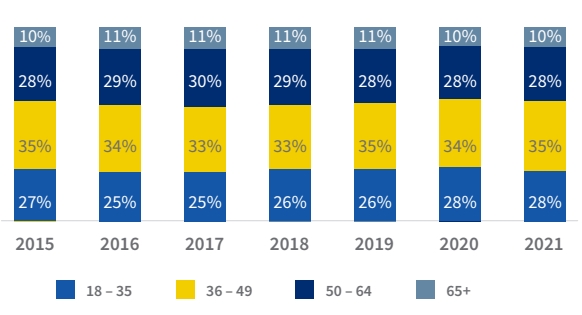

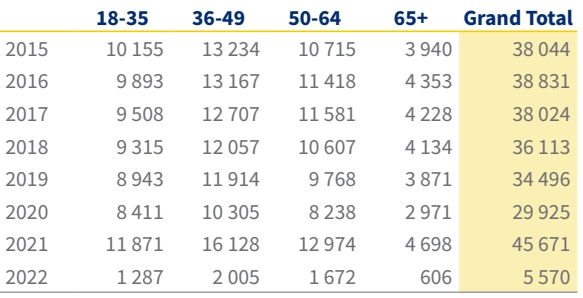

The 36-49 band accounted for 35% in 2021, the single largest purchaser band, as has been the case since 2015. The 50-64 age band was second at 28.4%, a change from the previous year where the 18-35 age band had been in that position. The patterns otherwise are consistent and it will be interesting to see if any shifts occur going forward if, as expected, more young professionals head for the coast to work-from-home.

Coastal transfers: 2015 – 2022

Age band of coastal transfers

Solutions that simplify the complex

Our new website makes it easier to navigate and discover a range of Lightstone products and solutions that make it easier for you to do business.

One place to access your subscriptions

We’ve simplified the complex with a single sign on functionality. Simply login and you will have access to all the products that you currently subscribe to. All in one portal.

What’s happening to the old website?

A few links on our new website may redirect you to certain pages on the old website. This is just a temporary solution to ensure legacy users still have access to certain products.

.png)

.png)

.png)

.png)