Property Newsletter | May 2022

Turnaround needed for floundering affordable housing market

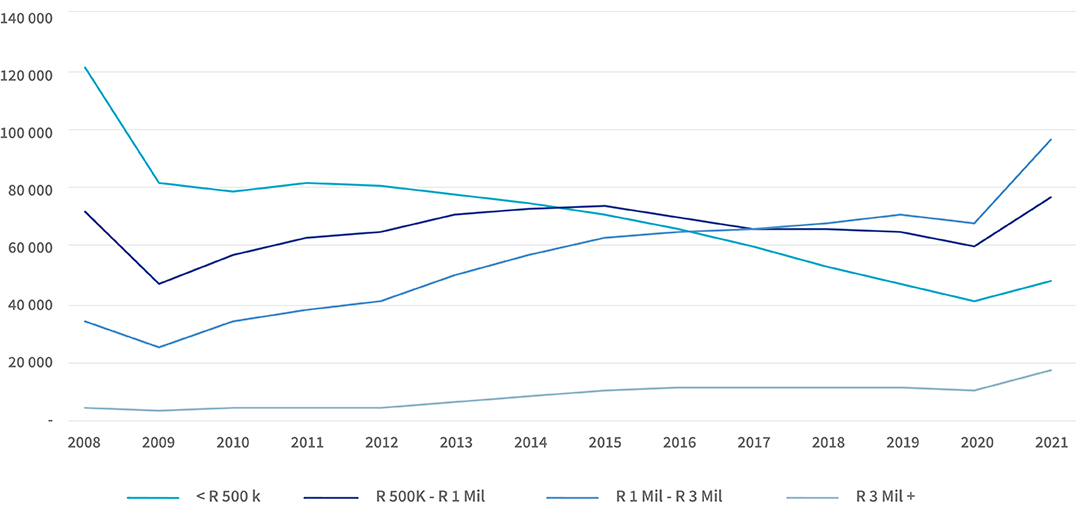

Fewer homeowners are entering the formal property market at entry level, with transfers in the Affordable housing band falling from 121 000 in 2008 to 48 000 in 2021 – which itself was a recovery from the all-time low recorded in 2020.

The consistent drop in Affordable transfers – defined as those under R500k – is in contrast to other price bands.

Both the R500k-R1m and the R1m-R3m bands fell during the 2009 market decline before consolidating in the years 2013-17, and have again shown gains since drops caused during the hard Covid-19 lockdowns of 2020. The R3m+ band was flat until modest growth from 2013 onwards, also rising relatively sharply after 2020 due to Covid delays and 2020 registrations being processed in 2021.

The downward trend in the Affordable housing market tends to reinforce the view that it is the poorer communities who are suffering most as South Africa contends with poor economic performance, the effects of Covid-19, the July insurrection and more recently the KZN floods.

It is an area that requires policy intervention and of course economic growth as newcomers to the property market are important to residential property market growth and stability.

Volume of transfers by purchase band

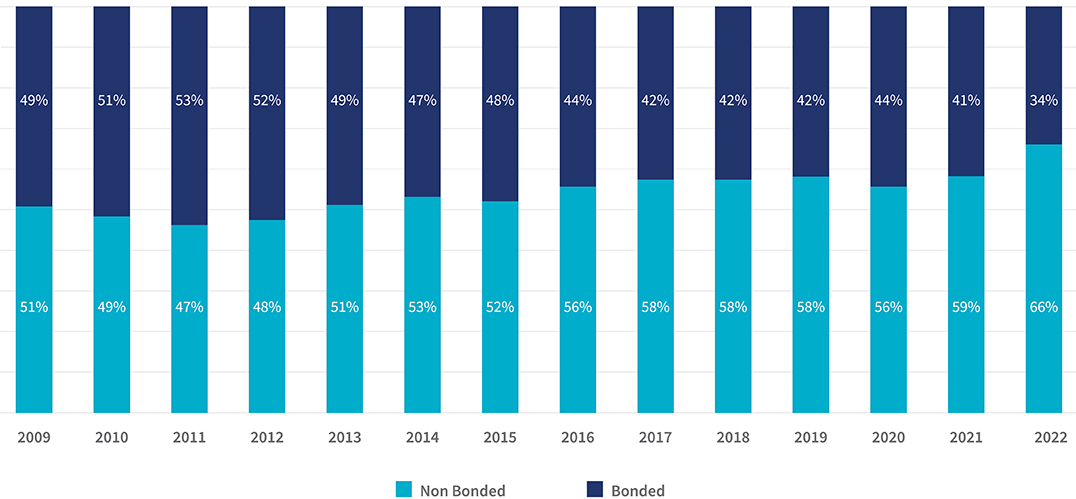

Interestingly, the proportion of bonded transfers (graph below) has fallen from a 14-year high of 49% in 2013 to a low of 41% in 2021. Data for 2022 shows bonded transfers falling even further to just 34%.

Transfers R500K and less - proportion bonded

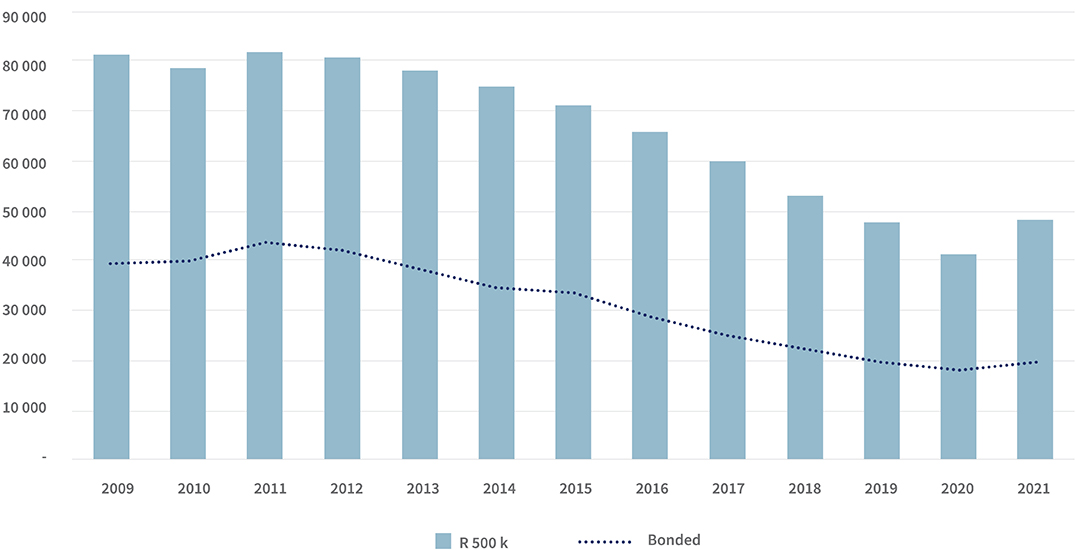

The volume of transfers bonded has fallen from a high of 43 512 in 2011 to 19 562 in 2021 – a drop of more than 50%.

Transfers in the R 500 k and less – band and volume bonded

Covid has made little or no difference to the segment. The increase in transfers in 2021 to around the 2019 level was most likely a result of delayed transfers going through the deeds office.

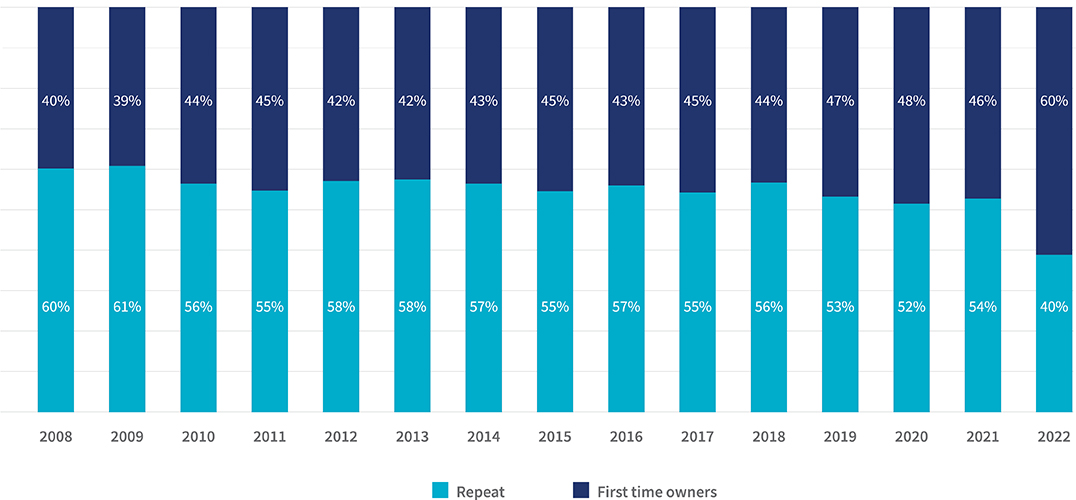

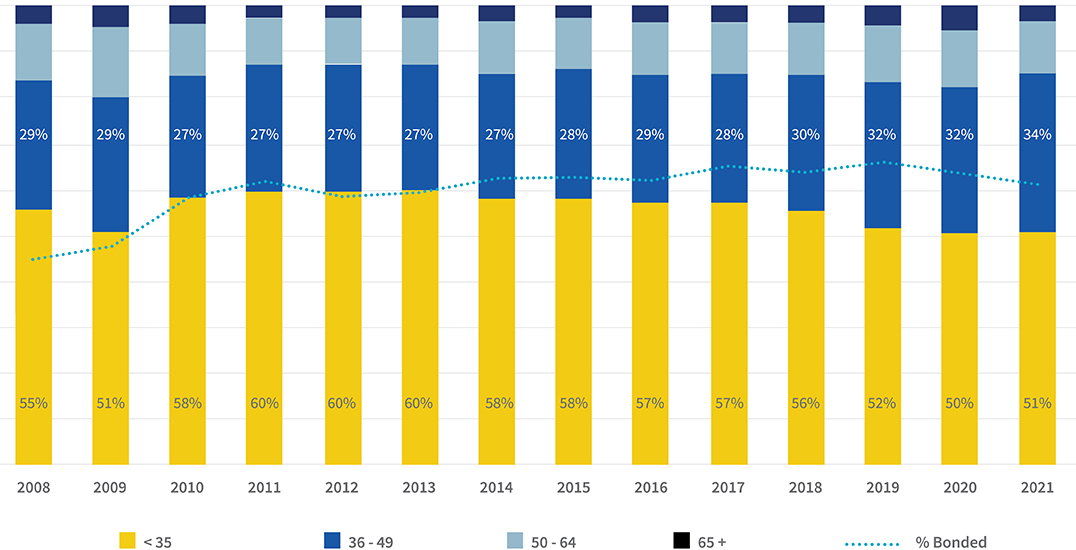

First time buyers accounted for 46% of property transfers valued at below R500k in 2021, up from 39% in 2009. Conversely, repeat buyers are down to 54% in 2021 from 61% in 2009.

Transfers R500k and less - percentage first time and repeat owners

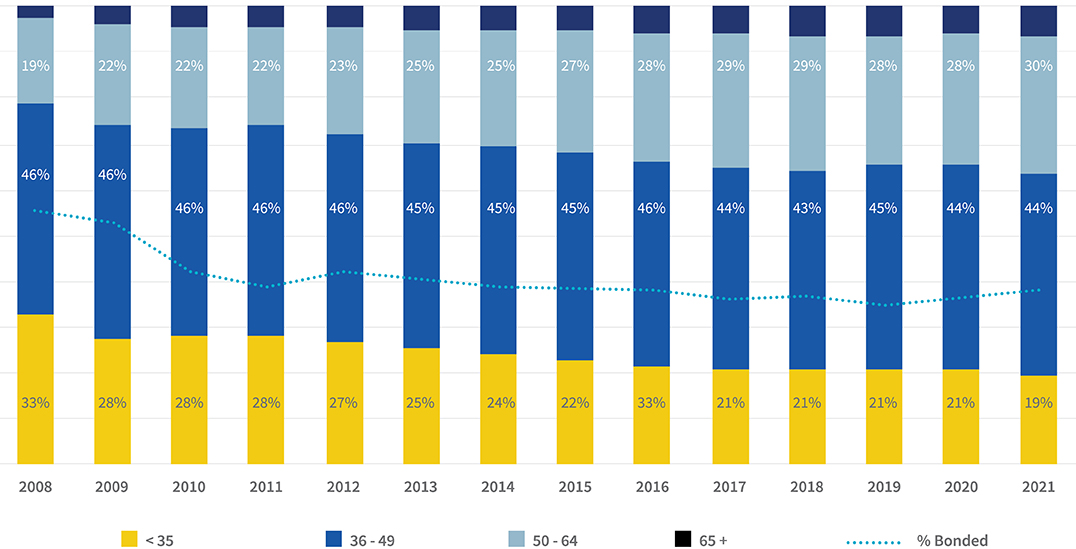

Age band: R 500k and less repeat owners

Buyers under the age of 49 make up 63% of repeat buyer transfers in 2021, compared to 79% in 2008.

Age band: R500k and less first time owners

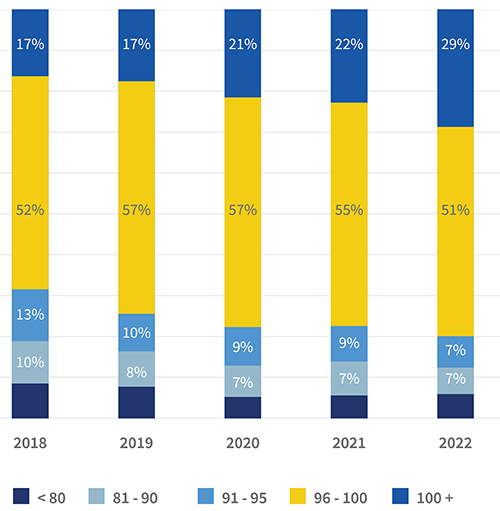

R500k and less purchase band % LTV by bond amount

Most buyers of properties under R500k are heavily bonded – in 2021, 22% secured 100% bonds, 55% between 96-99%, while 9% bought properties with bonds of less than 80%.

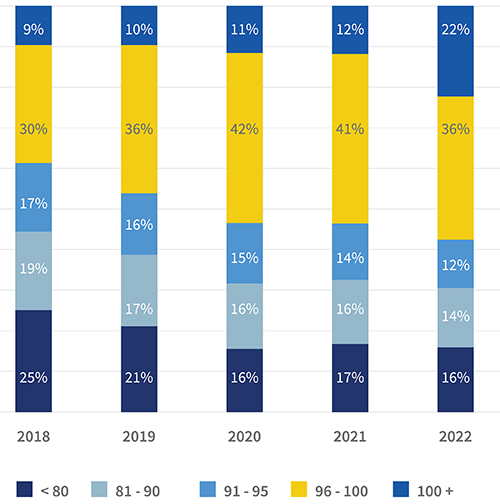

Luxury purchase band - R 1.5 m and above % LTV

By way of comparison, buyers in Lightstone’s Luxury band relied less on bond finance: 12% secured 100% bonds, 41% between 96-99% and 17% under 80%. Interestingly though, this has fallen from 25% in 2018, while Affordable housing has remained more or less consistent.

.png)

.png)

.png)

.png)