Auto Insights Newsletter | June 2022

Young and Mobile

With June being Youth Month we take a look at what South Africa’s under 35s are doing in terms of their major asset purchases – homes and vehicles. Lightstone’s data reveals that under 35s are increasingly opting for Sectional Title properties and Crossover vehicles.

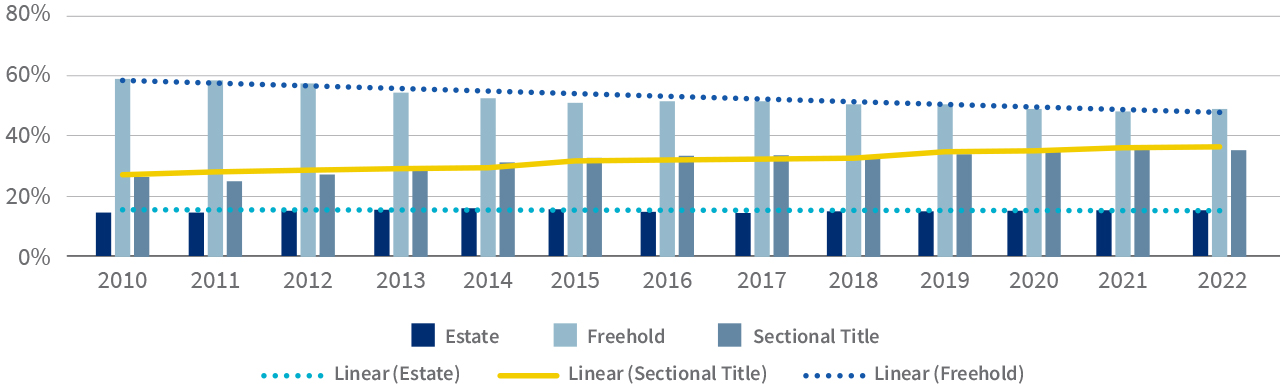

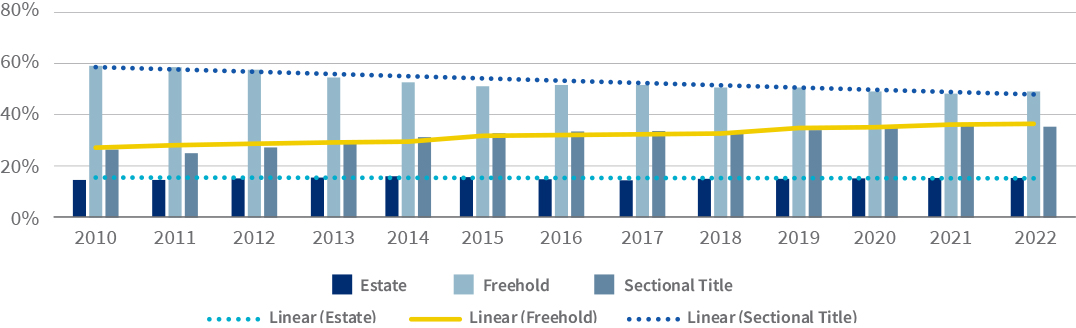

While Freehold properties still account for the most sold to this age group, its share of market has fallen from 59% in 2010 to 48% in 2021, while Sectional Title’s share of market has grown from 27% in 2010 to 36% in 2021.

Young buyers’ share of the Estate market has crept up from 15% to 16%, and the combined growth of Estates and Sectional Title suggests younger people want the “lock-up-and-go” safety and freedom features which both offer.

What do young buyers prefer to buy?

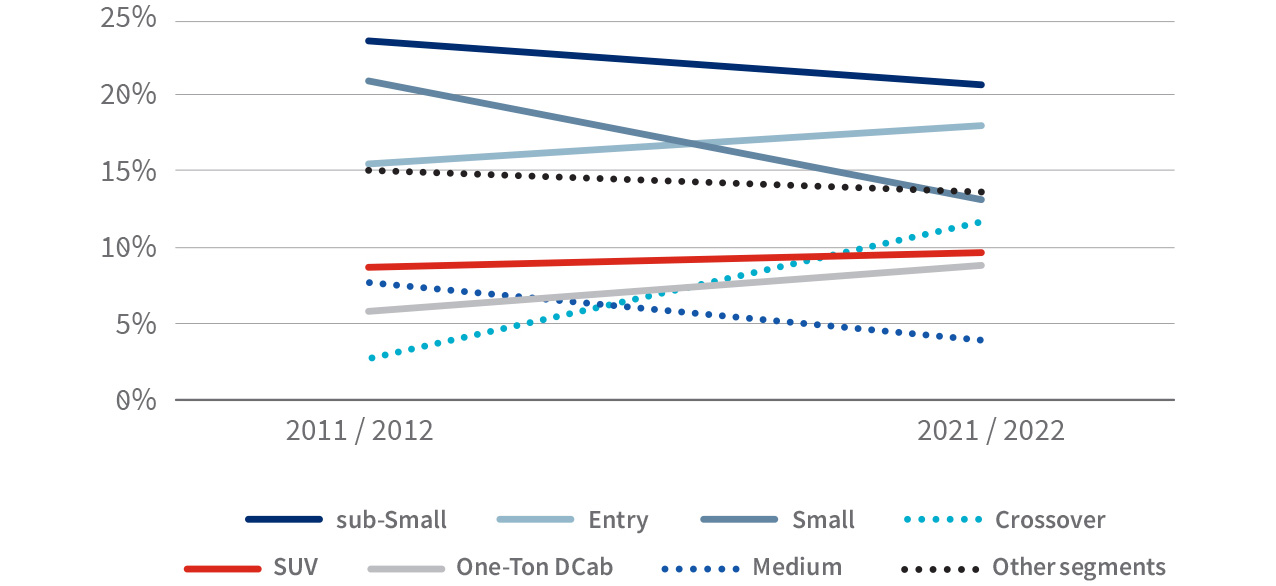

When it comes to motor vehicles, younger buyers are switching to Crossover vehicles in significant numbers. While ranked fourth most popular choice for under 35s, their share of market has risen signifi cantly in a decade, from 3% in 2011/2012 to 12% in 2021/2022. They are now just 1% behind Small vehicles which have been the biggest losers in the period – they have seen their share of market plunge from 21% in 2011/2012 to 13% in 2021/2022.

Segments preferred by under 35s

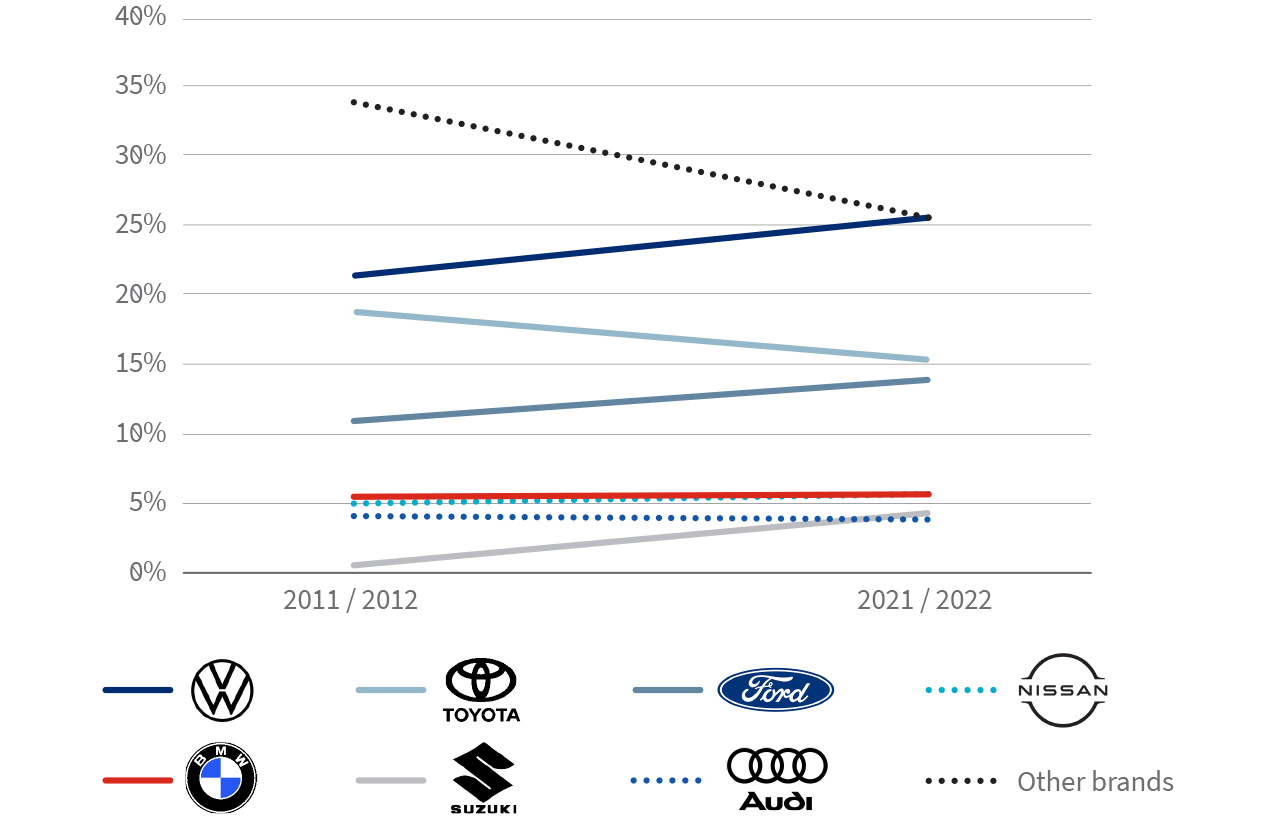

Volkswagen has recorded the largest increase, from 21% to 26%, and is the dominant vehicle brand for under 35s, while Ford and Suzuki have both increased their share of market by 3% – Ford from 11% to 14%, and Suzuki from 1% to 4%. Toyota has been the big loser in this category, while BMW, Nissan and Audi have held steady.

Brands preferred by under 35s

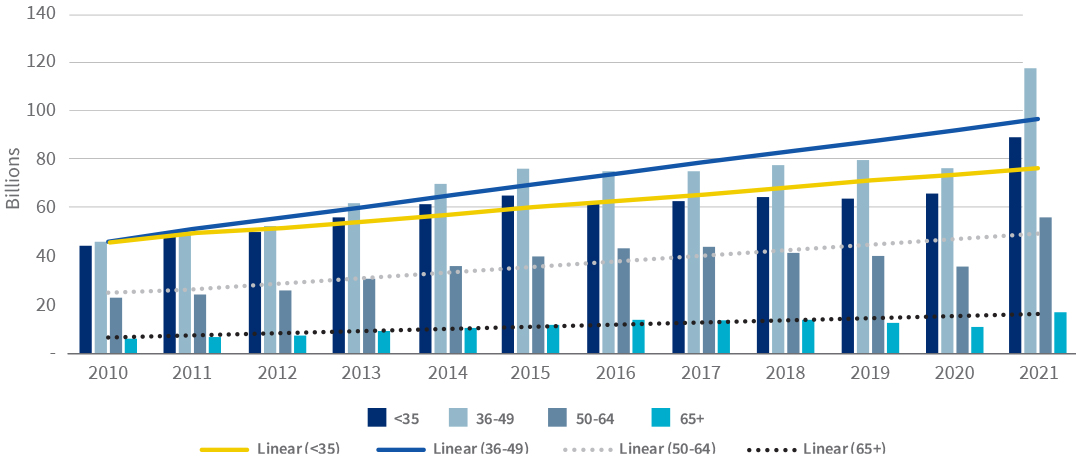

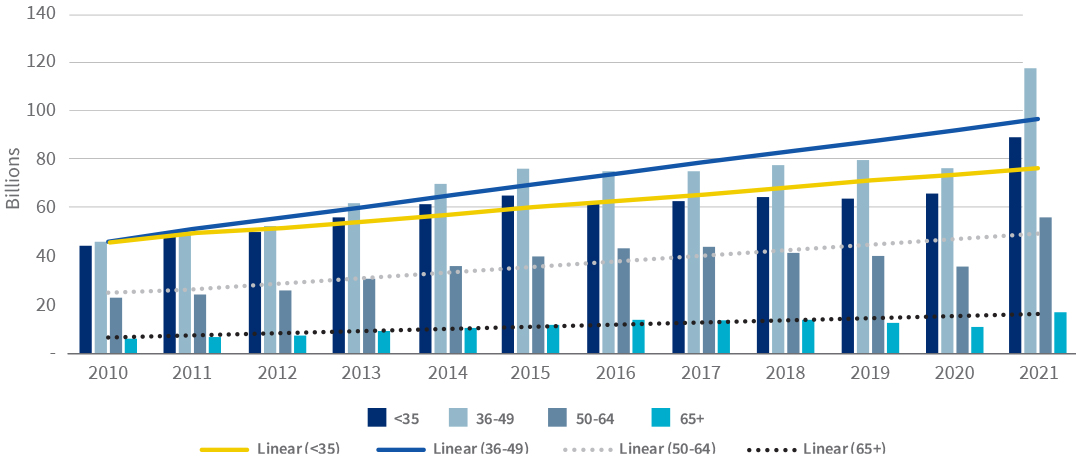

While tastes are changing in both the vehicle and property markets, the number of under 35s buying property has fallen from 38% of all buyers in 2010 to 34% in 2021, while the 36-49 age group has risen from 36% to 39% over the same period. The 50-64 age group and the 65+ age group have ended the period where they began – on 20% and 7% respectively.

Average age of buyers

While accounting for 34% of buyers, the under 35s spent R88 848 921 780 (R89 billion) on properties in 2021, 32% of the total.

Total value of residential transfers

The Mid Value band accounted for 41% of the R89 billion in 2021, with the High Value band making up 39% and Luxury buyers accounting for 13%. Interestingly, as the graph below shows, the Affordable market made up just 6% of buyers under 35 – the same number recorded in 2010.

In which value band are young buyers transacting?

.png)

.png)

.png)

.png)